The United Kingdom is the best location for wind power in Europe and one of the best in the world. The combination of long coastline, shallow water and strong winds make offshore wind unusually effective.

The economy of the State of New York is reflected in its gross state product in 2022 of $2.053 trillion, ranking third in size behind the larger states of California and Texas. If New York State were an independent nation, it would rank as the 10th largest economy in the world by nominal GDP. However, in 2019, the multi-state, New York City-centered metropolitan statistical area produced a gross metropolitan product (GMP) of $US2.0 trillion, ranking first nationally by a wide margin and would also rank as the 10th largest GDP in the world.

Wind power is a branch of the energy industry that has expanded quickly in the United States over the last several years. From January through December 2023, 425.2 terawatt-hours were generated by wind power, or 10.18% of electricity in the United States. The average wind turbine generates enough electricity in 46 minutes to power the average American home for one month. In 2019, wind power surpassed hydroelectric power as the largest renewable energy source in the U.S.

Wind power generation capacity in India has significantly increased in recent years. As of 31 December 2023, the total installed wind power capacity was 44.736 gigawatts (GW), the fourth largest installed wind power capacity in the world. Wind power capacity is mainly spread across the southern, western, and northwestern states.

Wind power in Texas, a portion of total energy in Texas, consists of over 150 wind farms, which together have a total nameplate capacity of over 30,000 MW. If Texas were a country, it would rank fifth in the world: The installed wind capacity in Texas exceeds installed wind capacity in all countries but China, the United States, Germany and India. Texas produces the most wind power of any U.S. state. According to the Electric Reliability Council of Texas (ERCOT), wind power accounted for at least 15.7% of the electricity generated in Texas during 2017, as wind was 17.4% of electricity generated in ERCOT, which manages 90% of Texas's power. ERCOT set a new wind output record of nearly 19.7 GW at 7:19 pm Central Standard Time on Monday, January 21, 2019.

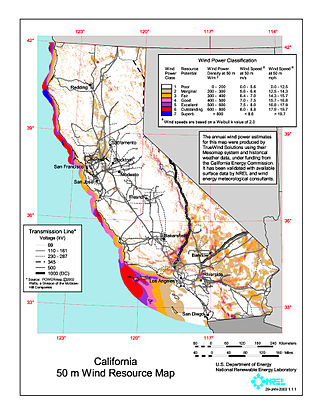

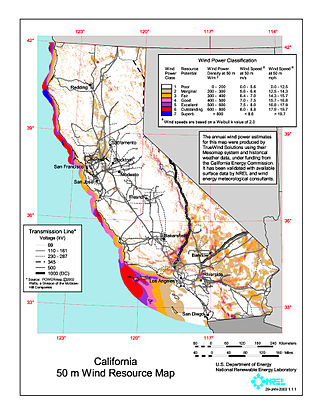

Wind power in California had initiative and early development during Governor Jerry Brown's first two terms in the late 1970s and early 1980s. The state's wind power capacity has grown by nearly 350% since 2001, when it was less than 1,700 MW. In 2016, wind energy supplied about 6.9% of California's total electricity needs, or enough to power more than 1.3 million households. Most of California's wind generation is found in the Tehachapi area of Kern County, California, with some large projects in Solano, Contra Costa and Riverside counties as well. California is among the states with the largest amount of installed wind power capacity. In recent years, California has lagged behind other states when it comes to the installation of wind power. It was ranked 4th overall for wind power electrical generation at the end of 2016 behind Texas, Iowa, and Oklahoma. As of 2019, California had 5,973 megawatts (MW) of wind power generating capacity installed.

The U.S. state of Oregon has large wind energy resources. Many projects have been completed, most of them in rural Eastern Oregon and near the Columbia River Gorge. Wind power accounted for 12.1% of the electricity generated in Oregon in 2016.

Ørsted U.S. Offshore Wind is an offshore wind energy development group that is affiliated with Ørsted, a Danish firm. It is joint headquartered in Boston, Massachusetts and Providence, Rhode Island. As of 2019, it was involved in some of the largest offshore wind farm projects in the United States.

The U.S. state of Massachusetts has vast wind energy resources offshore, as well as significant resources onshore. The 2016 update to the states's Clean Energy and Climate Plan had a goal of reducing 1990 baseline greenhouse gas emissions levels by 25% by 2020. Current goals include installing 3,500 megawatts (MW) of offshore wind power in the state by 2035. However, as of Q4 2021 the state had only 120 MW of wind powered electricity generating capacity, responsible for generating 0.9% of in-state electricity production. The state has awarded contracts to two offshore projects, the 800 MW Vineyard Wind project and 804 MW Mayflower Wind project. Construction began on the Vineyard Wind 1 project on November 18, 2021, after a long fight for approval. Commonwealth Wind was selected for development in 2021, but the developer has attempted to cancel the project due to increased costs. There are eight projects planned for off the southern coast of Massachusetts, though some will deliver power to Rhode Island, Connecticut, and New York.

The US state of Colorado has vast wind energy resources and the installed electricity capacity and generation from wind power in Colorado has been growing significantly in recent years. The growth has been sustained due to a combination of falling costs, continuing federal incentives, and the state's aggressive renewable portfolio standard that requires 30% of the state's electricity to come from renewable sources by 2020.

Modern United States wind energy policy coincided with the beginning of modern wind industry of the United States, which began in the early 1980s with the arrival of utility-scale wind turbines in California at the Altamont Pass wind farm. Since then, the industry has had to endure the financial uncertainties caused by a highly fluctuating tax incentive program. Because these early wind projects were fueled by investment tax credits based on installation rather than performance, they were plagued with issues of low productivity and equipment reliability. Those investment tax credits expired in 1986, which forced investors to focus on improving the reliability and efficiency of their turbines. The 1990s saw rise to a new type of tax credit, the production tax credit, which propelled technological improvements to the wind turbine even further by encouraging investors to focus on electricity output rather than installation.

Wind power in New Jersey is in the early stages of development. New Jersey has just six wind turbines, but the state has plans to develop several major offshore wind projects on the continental shelf of the Atlantic Ocean off the southern Jersey Shore. Legislation has been enacted to support the industry through economic incentives and to permit wind turbines on existing piers.

Energy in the U.S. state of Hawaii is produced from a mixture of fossil fuel and renewable resources. Producing energy is complicated by the state's isolated location and lack of fossil fuel resources. The state relies heavily on imports of petroleum. Hawaii has the highest share of petroleum use in the United States, with about 62% of electricity coming from oil in 2017. As of 2021 renewable energy made up 34.5% on Oahu, Maui and the island of Hawaii.

Wind power in Hawaii is produced by the state's 132 commercial wind turbines, totaling 236 MW in capacity. In 2015, wind turbines produced 6.4% of Hawaii's electricity. In 2012, Hawaii generated 367 million kWh from wind power.

Wind power in Rhode Island is in the early stages of development. There are several small scale wind turbine projects in the state. As of December 2013 there were 11 turbines at 10 sites in the state. In 2014, Rhode Island had 9 MW of installed wind power capacity, which quickly rose to 75 MW in 2019.

Wind power in Maryland, which has land-based and offshore resources, is in the early stages of development. As of 2016, Maryland has 191 megawatts (MW) of wind powered electricity generating capacity, responsible for 1.4% of in-state generated electricity. Two offshore wind farm projects that will supply wind-generated power to the state are underway.

Wind power in North Carolina is found along the coastal areas in the east and mountain regions in the western part of the state. The state has significant offshore wind resources. In 2015, small scale wind turbine projects were found throughout the state. In 2016, North Carolina's first large scale wind project, and the first in the southeastern U.S., was completed near Elizabeth City.

South Fork Wind Farm is a utility-scale offshore wind farm on the Outer Continental Shelf Offshore Rhode Island, providing energy to New York state.

Empire Wind is a proposed utility-scale offshore wind farm on the Outer Continental Shelf Offshore New York. It will be located in Bureau of Ocean Energy Management (BOEM) lease area OCS-A 0512 in the New York Bight about 15 miles (24 km) south of Jones Beach, Long Island.