Related Research Articles

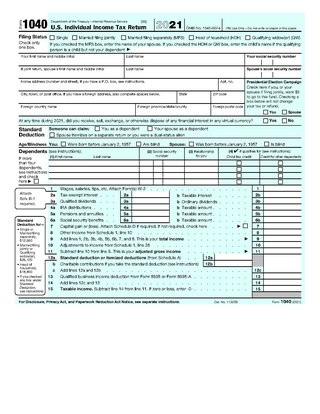

Form 1040, officially, the U.S. Individual Income Tax Return, is an IRS tax form used for personal federal income tax returns filed by United States residents. The form calculates the total taxable income of the taxpayer and determines how much is to be paid to or refunded by the government.

Three key types of withholding tax are imposed at various levels in the United States:

A tax refund or tax rebate is a payment to the taxpayer due to the taxpayer having paid more tax than they owed.

Form W-2 is an Internal Revenue Service (IRS) tax form used in the United States to report wages paid to employees and the taxes withheld from them. Employers must complete a Form W-2 for each employee to whom they pay a salary, wage, or other compensation as part of the employment relationship. An employer must mail out the Form W-2 to employees on or before January 31 of any year in which an employment relationship existed and which was not contractually independent. This deadline gives these taxpayers about 2 months to prepare their returns before the April 15 income tax due date. The form is also used to report FICA taxes to the Social Security Administration. Form W-2 along with Form W-3 generally must be filed by the employer with the Social Security Administration by the end of February following employment the previous year. Relevant amounts on Form W-2 are reported by the Social Security Administration to the Internal Revenue Service. In US territories, the W-2 is issued with a two letter territory code, such as W-2GU for Guam. Corrections can be filed using Form W-2c.

Form 1099 is one of several IRS tax forms used in the United States to prepare and file an information return to report various types of income other than wages, salaries, and tips. The term information return is used in contrast to the term tax return although the latter term is sometimes used colloquially to describe both kinds of returns.

The "Slave Reparations Act" is a tax fraud related to the concept of reparations for slavery. The scam claims that filers can receive $5,000 or increased social security payouts for African-Americans born in the United States between 1911 and 1926.

A tax protester, in the United States, is a person who denies that he or she owes a tax based on the belief that the Constitution of the United States, statutes, or regulations do not empower the government to impose, assess or collect the tax. The tax protester may have no dispute with how the government spends its revenue. This differentiates a tax protester from a tax resister, who seeks to avoid paying a tax because the tax is being used for purposes with which the resister takes issue.

Form W-4 is an Internal Revenue Service (IRS) tax form completed by an employee in the United States to indicate his or her tax situation to the employer. The W-4 form tells the employer the correct amount of federal tax to withhold from an employee's paycheck.

Taxpayers in the United States may face various penalties for failures related to Federal, state, and local tax matters. The Internal Revenue Service (IRS) is primarily responsible for charging these penalties at the Federal level. The IRS can assert only those penalties specified imposed under Federal tax law. State and local rules vary widely, are administered by state and local authorities, and are not discussed herein.

Eddie Ray Kahn is an American tax protester. Kahn is currently in prison for tax crimes, with a tentative release date of 2026. Kahn founded the group American Rights Litigators and ran the for-profit businesses "Guiding Light of God Ministries" and "Eddie Kahn and Associates." According to the U.S. Justice Department, all three organizations are or were illegal tax evasion operations.

The United States Internal Revenue Service uses forms for taxpayers and tax-exempt organizations to report financial information, such as to report income, calculate taxes to be paid to the federal government, and disclose other information as required by the Internal Revenue Code (IRC). There are over 800 various forms and schedules. Other tax forms in the United States are filed with state and local governments.

The redemption movement is a debt-resistance movement and fraud scheme which is primarily active in the United States and Canada. The group alleges that a secret fund is created for every citizen at birth and that a procedure exists to "redeem" or reclaim this fund to pay bills, forming a foundational section of the pseudolaw movement. Common redemption schemes include acceptance for value (A4V), 'Treasury Direct Accounts' (TDA) and secured party creditor "kits," collections of pseudolegal tactics sold to participants despite a complete lack of any actual legal basis. Such tactics are sometimes called "money for nothing" schemes, as their aim is ultimately to extract money from the government by using secret methods. The name of the A4V scheme in particular has become synonymous with the movement as a whole.

A tax protester is someone who refuses to pay a tax claiming that the tax laws are unconstitutional or otherwise invalid. Tax protesters are different from tax resisters, who refuse to pay taxes as a protest against a government or its policies, or a moral opposition to taxation in general, not out of a belief that the tax law itself is invalid. The United States has a large and organized culture of people who espouse such theories. Tax protesters also exist in other countries.

Sean David Morton is a self-described psychic, ufologist and alleged remote viewer who has referred to himself as "America's Prophet." Until legal troubles led to his incarceration in a federal prison, he also hosted radio shows, authored books, and made documentary films about the paranormal. In 2010, Morton and his wife were charged with civil securities fraud. The director of the New York regional office of the U.S. Securities and Exchange Commission (SEC) stated that "Morton's self-proclaimed psychic powers were nothing more than a scam to attract investors and steal their money." In 2016, Morton and his wife were indicted on Federal tax-related charges, and were found guilty in April 2017. He served a Federal prison sentence.

In the United States, Form 1099-MISC is a variant of Form 1099 used to report miscellaneous income. One notable use of Form 1099-MISC was to report amounts paid by a business to a non-corporate US resident independent contractor for services, but starting tax year 2020, this use was moved to the separate Form 1099-NEC. The ubiquity of the form has also led to use of the phrase "1099 workers" or "the 1099 economy" to refer to the independent contractors themselves. Other uses of Form 1099-MISC include rental income, royalties, and Native American gaming profits.

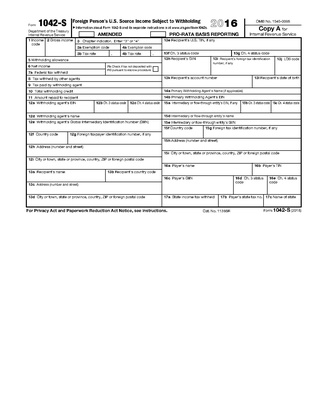

Forms 1042, 1042-S and 1042-T are United States Internal Revenue Service tax forms dealing with payments to foreign persons, including non-resident aliens, foreign partnerships, foreign corporations, foreign estates, and foreign trusts.

An IRS impersonation scam is a class of telecommunications fraud and scam which targets American taxpayers by masquerading as Internal Revenue Service (IRS) collection officers. The scammers operate by placing disturbing official-sounding calls to unsuspecting citizens, threatening them with arrest and frozen assets if thousands of dollars are not paid immediately, usually via gift cards or money orders. According to the IRS, over 1,029,601 Americans have received threatening calls, and $29,100,604 has been reported lost to these call scams as of March 2016. The problem has been assigned to the Treasury Inspector General for Tax Administration.

In the United States, a Form 1099-OID is a tax form intended to be submitted to the Internal Revenue Service by the holder of debt instruments which were discounted at purchase to report the taxable difference between the instruments' actual value and the discounted purchase price. Like other 1099 forms, it is normally filled out by a payer of income — for example, the issuer or seller of a discounted bond — and sent both to tax authorities and the recipient of the income.

An Internal Revenue Service investigation nicknamed Operation Slam Dunk began in 1994 surrounding untaxed income of at least 43 National Basketball Association referees regarding downgraded first-class or full-fare coach plane tickets that were paid for by the NBA with the cost difference being pocketed by the referees without reporting that income on their tax returns.

The Employee Retention Credit (ERC) is a U.S. federal tax credit that was available to certain employers, most recently during the COVID-19 pandemic. It was originally designed to help employers who were not eligible for a Paycheck Protection Program loan, but it was later amended so employers who received Paycheck Protection Program loan forgivess were often still eligible for the Employee Retention Credit. Although it ended on December 31, 2021, eligible employers may still be able to claim the tax credit by filing amended forms with the Internal Revenue Service. Due to a substantial number of improper claims, processing of amended forms claiming the Employee Retention Credit has been temporarily suspended as of September 14, 2023.

References

- ↑ See generally "Common Fraud Schemes," Federal Bureau of Investigation, U.S. Dep't of Justice, at

- ↑ "Form 1099-OID" (PDF). irs.gov. Internal Revenue Service. Retrieved 21 October 2016.

- ↑ "Publication 1212 - Main Content". irs.gov. Internal Revenue Service. Retrieved 21 October 2016.

- ↑ Peter J. Reilly (18 August 2016). "The OID Fraud And Criminal Gullibility". Forbes.com. Retrieved 21 October 2016.

- ↑ "IRS Releases the Dirty Dozen Tax Scams for 2012". US Internal Revenue Service - Feb. 16, 2012. Retrieved 2012-06-27.

- ↑ Chang, Andrea; Hsu, Tiffany (March 17, 2012). "Orange County man convicted of tax fraud". Los Angeles Times . Archived from the original on April 19, 2012.

- ↑ "American convicted in cross-border scam". CBC News. Associated Press. March 17, 2012. Retrieved March 14, 2017.