The Federal Old-Age and Survivors Insurance Trust Fund and Federal Disability Insurance Trust Fund are trust funds that provide for payment of Social Security benefits administered by the United States Social Security Administration.

The government budget balance, also referred to as the general government balance, public budget balance, or public fiscal balance, is the difference between government revenues and spending. For a government that uses accrual accounting the budget balance is calculated using only spending on current operations, with expenditure on new capital assets excluded. A positive balance is called a government budget surplus, and a negative balance is a government budget deficit. A government budget presents the government's proposed revenues and spending for a financial year.

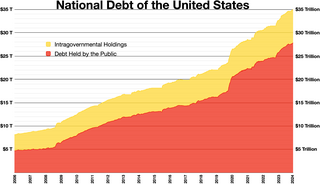

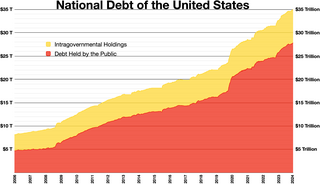

The national debt of the United States is the total national debt owed by the federal government of the United States to Treasury security holders. The national debt at any point in time is the face value of the then-outstanding Treasury securities that have been issued by the Treasury and other federal agencies. The terms "national deficit" and "national surplus" usually refer to the federal government budget balance from year to year, not the cumulative amount of debt. In a deficit year the national debt increases as the government needs to borrow funds to finance the deficit, while in a surplus year the debt decreases as more money is received than spent, enabling the government to reduce the debt by buying back Treasury securities. In general, government debt increases as a result of government spending and decreases from tax or other receipts, both of which fluctuate during the course of a fiscal year. There are two components of gross national debt:

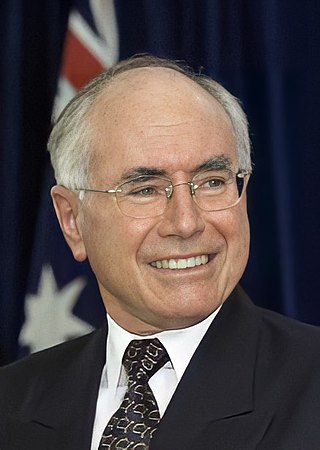

Peter Howard Costello is an Australian businessman, lawyer and former politician who served as the treasurer of Australia in government of John Howard from 1996 to 2007. He is the longest-serving treasurer in Australia's history. Costello was a member of parliament (MP) of the Australian House of Representatives from 1990 to 2009, representing the Division of Higgins. He also served as the Deputy Leader of the Liberal Party from 1994 to 2007.

Goods and Services Tax (GST) in Australia is a value added tax of 10% on most goods and services sales, with some exemptions and concessions. GST is levied on most transactions in the production process, but is in many cases refunded to all parties in the chain of production other than the final consumer.

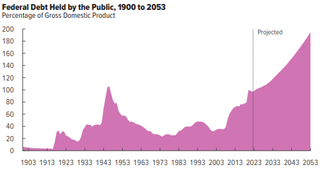

Fiscal policy is any changes the government makes to the national budget to influence a nation's economy. "An essential purpose of this Financial Report is to help American citizens understand the current fiscal policy and the importance and magnitude of policy reforms essential to make it sustainable. A sustainable fiscal policy is explained as the debt held by the public to Gross Domestic Product which is either stable or declining over the long term". The approach to economic policy in the United States was rather laissez-faire until the Great Depression. The government tried to stay away from economic matters as much as possible and hoped that a balanced budget would be maintained. Prior to the Great Depression, the economy did have economic downturns and some were quite severe. However, the economy tended to self-correct so the laissez faire approach to the economy tended to work.

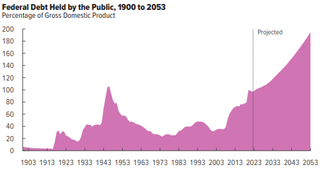

The United States budget comprises the spending and revenues of the U.S. federal government. The budget is the financial representation of the priorities of the government, reflecting historical debates and competing economic philosophies. The government primarily spends on healthcare, retirement, and defense programs. The non-partisan Congressional Budget Office provides extensive analysis of the budget and its economic effects. CBO estimated in February 2024 that Federal debt held by the public is projected to rise from 99 percent of GDP in 2024 to 116 percent in 2034 and would continue to grow if current laws generally remained unchanged. Over that period, the growth of interest costs and mandatory spending outpaces the growth of revenues and the economy, driving up debt. Those factors persist beyond 2034, pushing federal debt higher still, to 172 percent of GDP in 2054.

The State Treasurer of Oklahoma is the chief custodian of Oklahoma's cash deposits, monies from bond sales, and other securities and collateral and directs the investments of those assets. The treasurer provides for the safe and efficient operation of state government through effective banking, investment, and cash management. The state treasurer has the powers of a typical chief financial officer for a corporation.

The history of the United States public debt began with federal government debt incurred during the American Revolutionary War by the first U.S treasurer, Michael Hillegas, after the country's formation in 1776. The United States has continuously experienced fluctuating public debt, except for about a year during 1835–1836. To facilitate comparisons over time, public debt is often expressed as a ratio to gross domestic product (GDP). Historically, the United States public debt as a share of GDP has increased during wars and recessions, and subsequently declined.

The Howard government refers to the federal executive government of Australia led by Prime Minister John Howard between 11 March 1996 and 3 December 2007. It was made up of members of the Liberal–National Coalition, which won a majority of seats in the House of Representatives at four successive elections. The Howard government commenced following victory over the Keating government at the 1996 federal election. It concluded with its defeat at the 2007 federal election by the Australian Labor Party, whose leader Kevin Rudd then formed the first Rudd government. It was the second-longest government under a single prime minister, with the longest having been the second Menzies government (1949–1966).

The 2009 Australian federal budget for the Australian financial year ended 30 June 2010 was presented on 12 May 2009 by the Treasurer of Australia, Wayne Swan, the second federal budget presented by Swan, and the second budget of the first Rudd government. Swan commented that the budget would be tougher than in previous years. "Projected government revenue has fallen by $200 billion since the last budget because of the global economic crisis."

The Australian government debt is the amount owed by the Australian federal government. The Australian Office of Financial Management, which is part of the Treasury Portfolio, is the agency which manages the government debt and does all the borrowing on behalf of the Australian government. Australian government borrowings are subject to limits and regulation by the Loan Council, unless the borrowing is for defence purposes or is a 'temporary' borrowing. Government debt and borrowings have national macroeconomic implications, and are also used as one of the tools available to the national government in the macroeconomic management of the national economy, enabling the government to create or dampen liquidity in financial markets, with flow on effects on the wider economy.

The 2010 Australian federal budget for the Australian financial year ended 30 June 2011 was presented on 11 May 2010 by the Treasurer of Australia, Wayne Swan, the third federal budget presented by Swan, and the third and final budget of the first Rudd government.

The 2012 Australian federal budget for the Australian financial year ended 30 June 2013 was presented on 8 May 2012 by the Treasurer of Australia, Wayne Swan, the fifth federal budget presented by Swan, and the second budget of the Gillard government. The budget was described as a "battlers" budget with benefits geared towards families and low income earners. It forecast a surplus of $1.5 billion in the financial year ended 30 June 2013.

The early 1990s recession saw a period of economic downturn affect much of the world in the late 1980s and early 1990s. The economy of Australia suffered its worst recession since the Great Depression.

The 2013 Australian federal budget for the Australian financial year ended 30 June 2014 was presented on 14 May 2013 by the Treasurer of Australia, Wayne Swan, the sixth federal budget presented by Swan. The 2013 budget estimated total revenue of A$387.7 billion and spending of A$398.3 billion, a deficit of A$18 billion, with a return to surplus expected in the 2015 Australian federal budget. Some of the measures in the budget had been announced by various Ministers before the budget.

James Edward Chalmers is an Australian politician. He has been Treasurer of Australia in the Albanese government since May 2022. He is a member of the Australian Labor Party (ALP) and has served as a member of parliament for the division of Rankin since 2013.

The 2019 Australian federal budget was the federal budget to fund government services and operations for the 2019–20 financial year. The budget was presented to the House of Representatives by Treasurer Josh Frydenberg on 2 April 2019. It was the sixth budget to be handed down by the Liberal/National Coalition since their election to government at the 2013 federal election, and the first budget to be handed down by Frydenberg and the Morrison government. All of the figures below are estimates published in the 2019-20 budget documents.

The October 2022 Australian federal budget was the federal budget to fund government services and operations. The budget was presented to the House of Representatives by Treasurer Jim Chalmers on 25 October 2022. It was the first budget to be handed down by the Australian Labor Party since their election to government at the 2022 federal election. It was the second budget to be handed down in 2022, with the preceding budget being delivered in March by the prior government.

The 2024 Australian federal budget was delivered on budget night at 7:30pm on Tuesday, 14 May 2024 by Treasurer Jim Chalmers. The budget will dictate how the Australian Government will allocate an estimated A$715 billion across the federal government, and to state and territory governments. It is the third federal budget handed down by the Labor Party since their victory in 2022. The consultation period described the budget as focused on support for Australians and creating a "stronger, more inclusive and more sustainable economy".