The economy of Spain is a highly developed social market economy. It is the world's 15th largest by nominal GDP and the sixth-largest in Europe. Spain is a member of the European Union and the eurozone, as well as the Organization for Economic Co-operation and Development and the World Trade Organization. In 2023, Spain was the 18th-largest exporter in the world. Meanwhile in 2022, Spain was the 15th-largest importer in the world. Spain is listed 27th in the United Nations Human Development Index and 36th in GDP per capita by the World Bank. Some main areas of economic activity are the automotive industry, medical technology, chemicals, shipbuilding, tourism and the textile industry. Among OECD members, Spain has a highly efficient and strong social security system, which comprises roughly 23% of GDP.

The Spanish property bubble is the collapsed overshooting part of a long-term price increase of Spanish real estate prices. This long-term price increase has happened in various stages from 1985 up to 2008. The housing bubble can be clearly divided in three periods: 1985–1991, in which the price nearly tripled; 1992–1996, in which the price remained somewhat stable; and 1996–2008, in which prices grew astonishingly again. Coinciding with the financial crisis of 2007–08, prices began to fall. In 2013, Raj Badiani, an economist at IHS Global Insight in London, estimated that the value of residential real estate has dropped more than 30 percent since 2007 and that house prices would fall at least 50 percent from the peak by 2015. Alcidi and Gros note; “If construction were to continue at the still relatively high rate of today, the process of absorption of the bubble would take more than 30 years”.

In Spain, a savings bank is a financial institution that specializes in accepting savings deposits and granting loans. Spanish banks fall into two categories: Privately owned banks (bancos) and government owned banks. The original aim was to encourage thrift among the very poor, but they evolved to compete with and rival commercial banks.

Ana González Rodríguez, better known as Ana Locking, is a Spanish fashion designer, businesswoman, and photographer. She was born in Toledo and educated in Madrid. Ana is also a judge on Drag Race España.

The 2008–2014 Spanish financial crisis, also known as the Great Recession in Spain or the Great Spanish Depression, began in 2008 during the world 2007–2008 financial crisis. In 2012, it made Spain a late participant in the European sovereign debt crisis when the country was unable to bail out its financial sector and had to apply for a €100 billion rescue package provided by the European Stability Mechanism (ESM).

The 2011 Spanish general election was held on Sunday, 20 November 2011, to elect the 10th Cortes Generales of the Kingdom of Spain. All 350 seats in the Congress of Deputies were up for election, as well as 208 of 266 seats in the Senate. An election had not been due until April 2012 at latest, but a call by Prime Minister José Luis Rodríguez Zapatero for a snap election five months ahead of schedule was announced on 29 July 2011. Zapatero would not be seeking a third term in office, and with political pressure mounting, a deteriorating economic situation and his political project exhausted, an early election was perceived as the only way out.

Caja de Ahorros del Mediterráneo was a Spanish savings bank in Alicante, Valencia.

The Ministry of Housing and Urban Agenda is a department of the Government of Spain responsible for proposing and carrying out the government policy on right to housing, buildings, urban planning, land use and architecture.

In the run up to the 2015 Spanish general election, various organisations carried out opinion polling to gauge voting intention in Spain during the term of the 10th Cortes Generales. Results of such polls are displayed in this article. The date range for these opinion polls is from the previous general election, held on 20 November 2011, to the day the next election was held, on 20 December 2015.

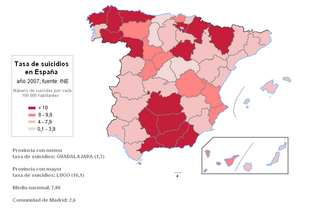

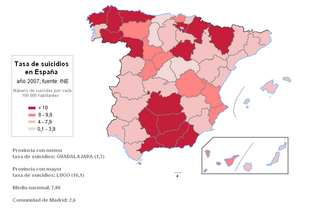

According to WHO's 2016 suicide report, Spain ranked 130th of the 170 countries listed. Spain had an overall suicide rate of 6.1 per 100,000 people, less than most other countries in Europe The reason behind this is unknown; among the many reasons put forward it has been argued that Southern European Mediterranean countries are less prone to suicide for cultural reasons, such as ease of socialisation, deeper religious beliefs that consider suicide as a sin, or just favourable weather conditions rendering less likely seasonal depression. This is consistent with the fact that other southern European countries such as Italy, Greece or Portugal, share a similar low suicidal rate as compared with northern countries. However, exceptions exist since Hungary, a relatively southern country, ranks high in suicidal rates.

Ada Colau Ballano is a Spanish activist and politician who was Mayor of Barcelona between 2015 and 2023. On 13 June 2015 she was elected Mayor of Barcelona, the first woman to hold the office, as part of the citizen municipalist platform, Barcelona En Comú. Colau was one of the founding members and spokespeople of the Plataforma de Afectados por la Hipoteca (PAH), which was set up in Barcelona in 2009 in response to the rise in evictions caused by unpaid mortgage loans and the collapse of the Spanish property market in the wake of the 2008 financial crisis.

The X Party is a political party officially registered with the Spanish Ministry of Interior. The X Party registered towards the end of 2012, and appeared publicly at the beginning of 2013. It was the first party to be founded by a group of people connected to the 15M Movement and other free culture movements. The party supports a model of democracy that is participatory and monitored by everyday citizens, taking advantage of the political potential of tools available for digital communication.

Errekaleor is a neighbourhood on the periphery of Vitoria-Gasteiz, in the Basque Country, Spain. It sits on the plateau created by the Errekaleor river, which is part of the Green Belt of Vitoria-Gasteiz. From 2013 onwards, the area was occupied by squatters and became known as Errekaleor Bizirik. The project is based on the principles of workers' self-management, consensus based decision making, feminism, anti-capitalism and Basque cultural re-invigoration. The neighbourhood is the largest occupied space of its type on the Iberian Peninsula, with over 10 hectares of land and 150 inhabitants. Residents include children, the elderly, blue-collar workers, the unemployed, students, and teachers. The project includes an organic farm of 2 hectares, a bakery, a bar, a social centre, a library, a theatre, a free shop, a recording studio, and other projects.

The first government of José Luis Rodríguez Zapatero was formed on 18 April 2004, following the latter's election as Prime Minister of Spain by the Congress of Deputies on 16 April and his swearing-in on 17 April, as a result of the Spanish Socialist Workers' Party (PSOE) emerging as the largest parliamentary force at the 2004 Spanish general election. It succeeded the second Aznar government and was the Government of Spain from 18 April 2004 to 14 April 2008, a total of 1,457 days, or 3 years, 11 months and 27 days.

Fernando Restoy Lozano is a Spanish economist who has been the Chairman of the Financial Stability Institute of the Bank for International Settlements since early 2017. In his previous position he was Vice Governor of the Bank of Spain from 2012 to 2017, and in parallel Chairman of Fondo de Reestructuración Ordenada Bancaria from 2012 to 2015.

In the run up to the 2023 Spanish general election, various organisations carry out opinion polling to gauge voting intention in Spain during the term of the 14th Cortes Generales. Results of such polls are displayed in this article. The date range for these opinion polls is from the previous general election, held on 10 November 2019, to the present day. This article displays polls conducted between 2019 and 2021.

Luis Arroyo Martínez is a Spanish sociologist and political scientist, advisor to several governments of José Luis Rodríguez Zapatero, and consultant to the World Bank. He chairs the Ateneo de Madrid and the communications consulting firm Asesores de Comunicación Pública. He teaches at some universities in Spain and America and is the author of several essays.

Caja Castilla-La Mancha also known as Caja de Ahorros de Castilla-La Mancha or CCM was a Spanish savings bank headquartered in Cuenca.

Tuition fees in Spain correspond to the amount of money that a student must pay in order to pursue higher education studies in Spain. Although they are generally associated with the cost of matriculation, they may also include other payments, such as enrollment in assessment tests or the issuance of official academic and administrative documents. In the case of fees at public universities, these are called "academic public prices". In turn, private universities can adjust their own prices because they have a financing system that is independent from the government, resulting in substantially higher tuition fees.