The ATR.1 Certificate is a customs document used in trade between European Union members and Turkey, to benefit from cheaper rates of duty. The legal basis for the use of the certificate is the EU-Turkey Customs Union. Products not included in the customs union are steel, coal and some agricultural products. Many of these are instead included in the EU-Turkey FTA.

The ATR.1 certificate is a status certificate, not a certificate of origin, and certifies that the product has been put in free circulation either in the European Union or in Turkey, having been imported in either country.

A customs union is generally defined as a type of trade bloc which is composed of a free trade area with a common external tariff.

Customs is an authority or agency in a country responsible for collecting tariffs and for controlling the flow of goods, including animals, transports, personal effects, and hazardous items, into and out of a country. Traditionally, customs has been considered as the fiscal subject that charges customs duties and other taxes on import and export. In recent decades, the views on the functions of customs have considerably expanded and now covers three basic issues: taxation, security, and trade facilitation.

Three European Union schemes of geographical indications and traditional specialties, known as protected designation of origin (PDO), protected geographical indication (PGI), and traditional speciality guaranteed (TSG), promote and protect names of agricultural products and foodstuffs, wines and spirits. Products registered under one of the three schemes may be marked with the logo for that scheme to help identify those products. The schemes are based on the legal framework provided by the EU Regulation No 1151/2012 of the European Parliament and of the Council of 21 November 2012 on quality schemes for agricultural products and foodstuffs. This regulation applies within the EU as well as in Northern Ireland. Protection of the registered products is gradually expanded internationally via bilateral agreements between the EU and non-EU countries. It ensures that only products genuinely originating in that region are allowed to be identified as such in commerce. The legislation first came into force in 1992. The purpose of the law is to protect the reputation of the regional foods, promote rural and agricultural activity, help producers obtain a premium price for their authentic products, and eliminate the unfair competition and misleading of consumers by non-genuine products, which may be of inferior quality or of a different flavour. Critics argue that many of the names, sought for protection by the EU, have become commonplace in trade and should not be protected.

This is a list of international trade topics.

The presence of the logo on commercial products indicates that the manufacturer or importer affirms the goods' conformity with European health, safety, and environmental protection standards. It is not a quality indicator or a certification mark. The CE marking is required for goods sold in the European Economic Area (EEA); goods sold elsewhere may also carry the mark.

The European Union–Turkey Customs Union is a trade agreement between the European Union (EU) and Turkey. The agreement came into effect on 31 December 1995, following a 6 March 1995 decision of the European Community–Turkey Association Council to implement a customs union between the two parties. Goods may travel between the two entities without any customs restrictions. The Customs Union does not cover essential economic areas such as agriculture, services or public procurement.

A duty-free shop or store is a retail outlet whose goods are exempt from the payment of certain local or national taxes and duties, on the requirement that the goods will be sold to travelers who will take them out of the country, who will then pay duties and taxes in their destination country. Which products can be sold duty-free vary by jurisdiction, as well as how they can be sold, and the process of calculating the duty or refunding the duty component.

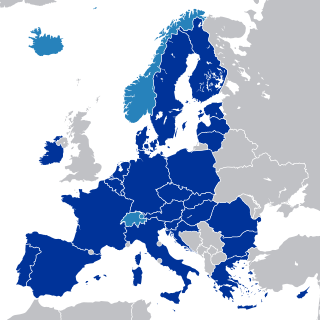

The European single market, also known as the European internal market or the European common market, is the single market comprising mainly the 27 member states of the European Union (EU). With certain exceptions, it also comprises Iceland, Liechtenstein, Norway, and Switzerland. The single market seeks to guarantee the free movement of goods, capital, services, and people, known collectively as the "four freedoms". This is achieved through common rules and standards that all participating states are legally committed to follow.

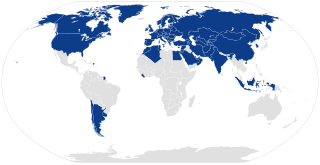

The Convention on International Transport of Goods Under Cover of TIR Carnets is a multilateral treaty that was concluded at Geneva on 14 November 1975 to simplify and harmonise the administrative formalities of international road transport. The 1975 convention replaced the TIR Convention of 1959, which itself replaced the 1949 TIR Agreement between a number of European countries. The conventions were adopted under the auspices of the United Nations Economic Commission for Europe (UNECE). As of December 2020, there are 77 parties to the Convention, including 76 states and the European Union.

The European Union-Mediterranean Free Trade Area, also called the Euro-Mediterranean Free Trade Area or Euromed FTA, is based on the Barcelona Process and European Neighbourhood Policy (ENP). The Barcelona Process, developed after the Barcelona Conference in successive annual meetings, is a set of goals designed to lead to a free trade area in the Mediterranean Region and the Middle East by 2010.

A Certificate of Origin or Declaration of Origin is a document widely used in international trade transactions which attests that the product listed therein has met certain criteria to be considered as originating in a particular country. A certificate of origin / declaration of origin is generally prepared and completed by the exporter or the manufacturer, and may be subject to official certification by an authorized third party. It is often submitted to a customs authority of the importing country to justify the product's eligibility for entry and/or its entitlement to preferential treatment. Guidelines for issuance of Certificates of Origin by chambers of commerce globally are issued by the International Chamber of Commerce.

The ATA Carnet, often referred to as the "Passport for goods", is an international customs document that permits the tax-free and duty-free temporary export and import of nonperishable goods for up to one year. It consists of unified customs declaration forms which are prepared ready to use at every border crossing point. It is a globally accepted guarantee for customs duties and taxes which can replace the security deposit required by each customs authority. It can be used in multiple countries in multiple trips up to its one-year validity. The acronym ATA is a combination of French and English terms "Admission Temporaire/Temporary Admission". The ATA carnet is now the document most widely used by the business community for international operations involving temporary admission of goods.

The EUR.1 movement certificate is a form used in international commodity traffic. The EUR.1 is most importantly recognized as a certificate of origin in the external trade in legal sense, especially within the framework of several bi- and multilateral agreements of the Pan-European preference system.

The European Union Customs Union (EUCU), formally known as the Community Customs Union, is a customs union which consists of all the member states of the European Union (EU), Monaco, and the British Overseas Territory of Akrotiri and Dhekelia. Some detached territories of EU states do not participate in the customs union, usually as a result of their geographic separation. In addition to the EUCU, the EU is in customs unions with Andorra, San Marino and Turkey, through separate bilateral agreements.

The Trade Control and Expert System (TRACES), is a web-based veterinarian certification tool used by the European Union for controlling the import and export of live animals and animal products within and without its borders. Its network falls under the responsibility of the European Commission. TRACES constitutes a key element of how the European Union facilitates trade and improves health protection for the consumer, as laid down in the First Pillar principle. Other countries use computer networks to provide veterinary certification, but TRACES is the only supranational network working at a continental scale of 28 countries and almost 500 million people.

The Customs Union of the Eurasian Economic Union or EAEU Customs Union is a customs union of 5 post-Soviet states consisting of all the member states of the Eurasian Economic Union which initially became effective on January 1, 2010 at the date of implementation of the common external tariff (CET) as the Customs Union of the Eurasian Economic Community or Customs Union of Russia, Belarus and Kazakhstan. It was inherited from the Eurasian Economic Community and is now regulated by Part Two of the Treaty on the Eurasian Economic Union, EAEU Customs Code, other international agreements and by decisions of supranational bodies as Supreme Eurasian Economic Council, Intergovernmental Council and Eurasian Economic Commission.

Made in France is a merchandise mark indicating that a product is planned, manufactured and packed in France.

A customs declaration is a form that lists the details of goods that are being imported or exported when a citizen or visitor enters a customs territory. Most countries require travellers to complete a customs declaration form when bringing notified goods across international borders. Posting items via international mail also requires the sending party to complete a customs declaration form.

The EU Digital COVID Certificate (EUDCC), best known in Italy as the Green Pass and in France as the Sanitary Pass or Health Pass, was a digital certificate that a person has been vaccinated against COVID-19, tested for infection with SARS-CoV-2, or recovered from COVID-19 created by the European Union (EU) and valid in all member states.

Diagonal cumulation is a rules of origin (RoO) provision in international trade whereby products from one country of origin can have value added to it in another as if it were native to that country. It includes the provisions from bilateral cumulation and exists between countries with identical cumulation provisions, even if they are in separate free trade agreements (FTAs).