| |

| Agency overview | |

|---|---|

| Formed | 1985 |

| Type | Executive agency |

| Jurisdiction | Scotland |

| Headquarters | 1 Pennyburn Road, Kilwinning, KA13 6SA |

| Employees | 121 [1] |

| Minister responsible | |

| Agency executives |

|

| Parent department | Scottish Government |

| Website | www |

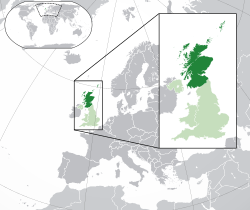

| Map | |

Scotland in the UK and Europe | |

The Accountant in Bankruptcy (AiB) is the Scottish government agency responsible for administering the process of personal bankruptcy and corporate insolvency, administering the Debt Arrangement Scheme (DAS), [2] and implementing, monitoring and reviewing government policy in these and related areas, for example protected trust deeds and diligence.

Contents

It reports to the Scottish Government's Minister for Business, Fair Work and Skills [ citation needed ], who is Jamie Hepburn MSP . The agency is based in Pennyburn Road, Kilwinning, Ayrshire.