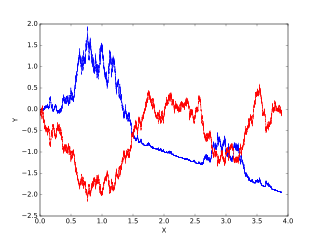

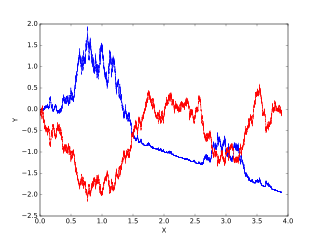

In mathematics, the Wiener process is a real-valued continuous-time stochastic process named in honor of American mathematician Norbert Wiener for his investigations on the mathematical properties of the one-dimensional Brownian motion. It is often also called Brownian motion due to its historical connection with the physical process of the same name originally observed by Scottish botanist Robert Brown. It is one of the best known Lévy processes and occurs frequently in pure and applied mathematics, economics, quantitative finance, evolutionary biology, and physics.

Stochastic calculus is a branch of mathematics that operates on stochastic processes. It allows a consistent theory of integration to be defined for integrals of stochastic processes with respect to stochastic processes. This field was created and started by the Japanese mathematician Kiyosi Itô during World War II.

The fundamental theorems of asset pricing, in both financial economics and mathematical finance, provide necessary and sufficient conditions for a market to be arbitrage-free, and for a market to be complete. An arbitrage opportunity is a way of making money with no initial investment without any possibility of loss. Though arbitrage opportunities do exist briefly in real life, it has been said that any sensible market model must avoid this type of profit. The first theorem is important in that it ensures a fundamental property of market models. Completeness is a common property of market models. A complete market is one in which every contingent claim can be replicated. Though this property is common in models, it is not always considered desirable or realistic.

In probability theory, a Lévy process, named after the French mathematician Paul Lévy, is a stochastic process with independent, stationary increments: it represents the motion of a point whose successive displacements are random, in which displacements in pairwise disjoint time intervals are independent, and displacements in different time intervals of the same length have identical probability distributions. A Lévy process may thus be viewed as the continuous-time analog of a random walk.

A stochastic differential equation (SDE) is a differential equation in which one or more of the terms is a stochastic process, resulting in a solution which is also a stochastic process. SDEs have many applications throughout pure mathematics and are used to model various behaviours of stochastic models such as stock prices, random growth models or physical systems that are subjected to thermal fluctuations.

Itô calculus, named after Kiyosi Itô, extends the methods of calculus to stochastic processes such as Brownian motion. It has important applications in mathematical finance and stochastic differential equations.

In mathematics, a local martingale is a type of stochastic process, satisfying the localized version of the martingale property. Every martingale is a local martingale; every bounded local martingale is a martingale; in particular, every local martingale that is bounded from below is a supermartingale, and every local martingale that is bounded from above is a submartingale; however, in general a local martingale is not a martingale, because its expectation can be distorted by large values of small probability. In particular, a driftless diffusion process is a local martingale, but not necessarily a martingale.

In probability theory, a real valued stochastic process X is called a semimartingale if it can be decomposed as the sum of a local martingale and a càdlàg adapted finite-variation process. Semimartingales are "good integrators", forming the largest class of processes with respect to which the Itô integral and the Stratonovich integral can be defined.

In mathematics – specifically, in the theory of stochastic processes – Doob's martingale convergence theorems are a collection of results on the limits of supermartingales, named after the American mathematician Joseph L. Doob. Informally, the martingale convergence theorem typically refers to the result that any supermartingale satisfying a certain boundedness condition must converge. One may think of supermartingales as the random variable analogues of non-increasing sequences; from this perspective, the martingale convergence theorem is a random variable analogue of the monotone convergence theorem, which states that any bounded monotone sequence converges. There are symmetric results for submartingales, which are analogous to non-decreasing sequences.

In probability theory, the optional stopping theorem says that, under certain conditions, the expected value of a martingale at a stopping time is equal to its initial expected value. Since martingales can be used to model the wealth of a gambler participating in a fair game, the optional stopping theorem says that, on average, nothing can be gained by stopping play based on the information obtainable so far. Certain conditions are necessary for this result to hold true. In particular, the theorem applies to doubling strategies.

The Brownian motion models for financial markets are based on the work of Robert C. Merton and Paul A. Samuelson, as extensions to the one-period market models of Harold Markowitz and William F. Sharpe, and are concerned with defining the concepts of financial assets and markets, portfolios, gains and wealth in terms of continuous-time stochastic processes.

In financial mathematics, a self-financing portfolio is a portfolio having the feature that, if there is no exogenous infusion or withdrawal of money, the purchase of a new asset must be financed by the sale of an old one. This concept is used to define for example admissible strategies and replicating portfolios, the latter being fundamental for arbitrage-free derivative pricing.

No free lunch with vanishing risk (NFLVR) is a concept used in mathematical finance as a strengthening of the no-arbitrage condition. In continuous time finance the existence of an equivalent martingale measure (EMM) is no more equivalent to the no-arbitrage-condition, but is instead equivalent to the NFLVR-condition. This is known as the first fundamental theorem of asset pricing.

In mathematics and information theory of probability, a sigma-martingale is a semimartingale with an integral representation. Sigma-martingales were introduced by C.S. Chou and M. Emery in 1977 and 1978. In financial mathematics, sigma-martingales appear in the fundamental theorem of asset pricing as an equivalent condition to no free lunch with vanishing risk.

In stochastic analysis, a rough path is a generalization of the notion of smooth path allowing to construct a robust solution theory for controlled differential equations driven by classically irregular signals, for example a Wiener process. The theory was developed in the 1990s by Terry Lyons. Several accounts of the theory are available.

Stochastic portfolio theory (SPT) is a mathematical theory for analyzing stock market structure and portfolio behavior introduced by E. Robert Fernholz in 2002. It is descriptive as opposed to normative, and is consistent with the observed behavior of actual markets. Normative assumptions, which serve as a basis for earlier theories like modern portfolio theory (MPT) and the capital asset pricing model (CAPM), are absent from SPT.

Monotone comparative statics is a sub-field of comparative statics that focuses on the conditions under which endogenous variables undergo monotone changes when there is a change in the exogenous parameters. Traditionally, comparative results in economics are obtained using the Implicit Function Theorem, an approach that requires the concavity and differentiability of the objective function as well as the interiority and uniqueness of the optimal solution. The methods of monotone comparative statics typically dispense with these assumptions. It focuses on the main property underpinning monotone comparative statics, which is a form of complementarity between the endogenous variable and exogenous parameter. Roughly speaking, a maximization problem displays complementarity if a higher value of the exogenous parameter increases the marginal return of the endogenous variable. This guarantees that the set of solutions to the optimization problem is increasing with respect to the exogenous parameter.

An additive process, in probability theory, is a cadlag, continuous in probability stochastic process with independent increments. An additive process is the generalization of a Lévy process. An example of an additive process that is not a Lévy process is a Brownian motion with a time-dependent drift. The additive process was introduced by Paul Lévy in 1937.

In mathematics, stochastic analysis on manifolds or stochastic differential geometry is the study of stochastic analysis over smooth manifolds. It is therefore a synthesis of stochastic analysis and differential geometry.

In probability theory, Kramkov's optional decomposition theorem is a mathematical theorem on the decomposition of a positive supermartingale with respect to a family of equivalent martingale measures into the form