Rail transport is a means of transport using wheeled vehicles running in tracks, which usually consist of two parallel steel rails. Rail transport is one of the two primary means of land transport, next to road transport. It is used for about 8% of passenger and freight transport globally, thanks to its energy efficiency and potentially high speed.

A financial market is a market in which people trade financial securities and derivatives at low transaction costs. Some of the securities include stocks and bonds, raw materials and precious metals, which are known in the financial markets as commodities.

Barings Bank was a British merchant bank based in London, and one of England's oldest merchant banks after Berenberg Bank, Barings' close collaborator and German representative. It was founded in 1762 by Francis Baring, a British-born member of the German–British Baring family of merchants and bankers.

John Pierpont Morgan Sr. was an American financier and investment banker who dominated corporate finance on Wall Street throughout the Gilded Age and Progressive Era. As the head of the banking firm that ultimately became known as J.P. Morgan and Co., he was a driving force behind the wave of industrial consolidations in the United States at the turn of the twentieth century.

The Panic of 1873 was a financial crisis that triggered an economic depression in Europe and North America that lasted from 1873 to 1877 or 1879 in France and in Britain. In Britain, the Panic started two decades of stagnation known as the "Long Depression" that weakened the country's economic leadership. In the United States, the Panic was known as the "Great Depression" until the events of 1929 and the early 1930s set a new standard.

The history of rail transport began before the beginning of the common era. It can be divided into several discrete periods defined by the principal means of track material and motive power used.

The Second Industrial Revolution, also known as the Technological Revolution, was a phase of rapid scientific discovery, standardisation, mass production and industrialisation from the late 19th century into the early 20th century. The First Industrial Revolution, which ended in the middle of the 19th century, was punctuated by a slowdown in important inventions before the Second Industrial Revolution in 1870. Though a number of its events can be traced to earlier innovations in manufacturing, such as the establishment of a machine tool industry, the development of methods for manufacturing interchangeable parts, as well as the invention of the Bessemer process and open hearth furnace to produce steel, later developments heralded the Second Industrial Revolution, which is generally dated between 1870 and 1914.

Railroads played a large role in the development of the United States from the Industrial Revolution in the Northeast (1820s–1850s) to the settlement of the West (1850s–1890s). The American railroad mania began with the founding of the first passenger and freight line in the country, the Baltimore and Ohio Railroad, in 1827, and the "Laying of the First Stone" ceremonies and the beginning of its long construction heading westward over the obstacles of the Appalachian Mountains eastern chain in the next year. It flourished with continuous railway building projects for the next 45 years until the financial Panic of 1873, followed by a major economic depression, that bankrupted many companies and temporarily stymied and ended growth.

The Long Depression was a worldwide price and economic recession, beginning in 1873 and running either through March 1879, or 1899, depending on the metrics used. It was most severe in Europe and the United States, which had been experiencing strong economic growth fueled by the Second Industrial Revolution in the decade following the American Civil War. The episode was labeled the "Great Depression" at the time, and it held that designation until the Great Depression of the 1930s. Though it marked a period of general deflation and a general contraction, it did not have the severe economic retrogression of the later Great Depression.

The economic history of the United States spans the colonial era through the 21st century. The initial settlements depended on agriculture and hunting/trapping, later adding international trade, manufacturing, and finally, services, to the point where agriculture represented less than 2% of GDP. Until the end of the Civil War, slavery was a significant factor in the agricultural economy of the South. The US was the world's largest economy for decades, possibly surpassed in the 21st century.

Around 500 BC, the Mahajanapadas minted punch-marked silver coins. The period was marked by intensive trade activity and urban development. By 300 BC, the Maurya Empire had united most of the Indian subcontinent except Tamilakam, which was ruled by the Three Crowned Kings. The resulting political unity and military security allowed for a common economic system and enhanced trade and commerce, with increased agricultural productivity.

The economic history of the Ottoman Empire covers the period 1299–1923. Trade, agriculture, transportation, and religion make up the Ottoman Empire's economy.

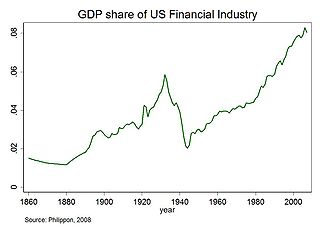

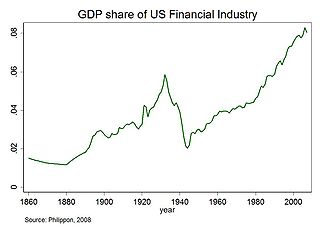

Financialization is a term sometimes used to describe the development of financial capitalism during the period from 1980 to present, in which debt-to-equity ratios increased and financial services accounted for an increasing share of national income relative to other sectors.

The role and scale of British imperial policy during the British Raj on India's relative decline in global GDP remains a topic of debate among economists, historians, and politicians. Some commentators argue that the effect of British rule was negative, and that Britain engaged in a policy of deindustrialisation in India for the benefit of British exporters, which left Indians relatively poorer than before British rule. Others argue that Britain's impact on India was either broadly neutral or positive, and that India's declining share of global GDP was due to other factors, such as new mass production technologies or internal ethnic conflict.

The historical origins of globalization are the subject of ongoing debate. Though many scholars situate the origins of globalization in the modern era, others regard it as a phenomenon with a long history, dating back thousands of years. The period in the history of globalization roughly spanning the years between 1600 and 1800 is in turn known as the proto-globalization.

The financial history of the Dutch Republic involves the interrelated development of financial institutions in the Dutch Republic. The rapid economic development of the country after the Dutch Revolt in the years 1585–1620 accompanied by an equally rapid accumulation of a large fund of savings, created the need to invest those savings profitably. The Dutch financial sector, both in its public and private components, came to provide a wide range of modern investment products beside the possibility of (re-)investment in trade and industry, and in infrastructure projects. Such products were the public bonds, floated by the Dutch governments on a national, provincial, and municipal level; acceptance credit and commission trade; marine and other insurance products; and shares of publicly traded companies like the Dutch East India Company (VOC), and their derivatives. Institutions like the Amsterdam Stock Exchange, the Bank of Amsterdam, and the merchant bankers helped to mediate this investment. In the course of time the invested capital stock generated its own income stream that caused the capital stock to assume enormous proportions. As by the end of the 17th century structural problems in the Dutch economy precluded profitable investment of this capital in domestic Dutch sectors, the stream of investments was redirected more and more to investment abroad, both in sovereign debt and foreign stocks, bonds and infrastructure. The Netherlands came to dominate the international capital market up to the crises of the end of the 18th century that caused the demise of the Dutch Republic.

The Ascent of Money: A Financial History of the World is a 2008 book by then-Harvard professor Niall Ferguson, and an adapted television documentary for Channel 4 (UK) and PBS (US), which in 2009 won an International Emmy Award. It examines the long history of money, credit, and banking.

This article covers the Economic history of Europe from about 1000 AD to the present. For the context, see History of Europe.

Philadelphia financier Jay Cooke established the first modern American investment bank during the Civil War era. However, private banks had been providing investment banking functions since the beginning of the 19th century and many of these evolved into investment banks in the post-bellum era. However, the evolution of firms into investment banks did not follow a single trajectory. For example, some currency brokers such as Prime, Ward & King and John E. Thayer and Brother moved from foreign exchange operations to become private banks, taking on some investment bank functions. Other investment banks evolved from mercantile firms such as Thomas Biddle and Co. and Alexander Brothers.

The economic history of the United Kingdom relates the economic development in the British state from the absorption of Wales into the Kingdom of England after 1535 to the modern United Kingdom of Great Britain and Northern Ireland of the early 21st century.