A tax is a mandatory financial charge or levy imposed on a taxpayer by a governmental organization to support government spending and public expenditures collectively or to regulate and reduce negative externalities. Tax compliance refers to policy actions and individual behavior aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax relief. The first known taxation occurred in Ancient Egypt around 3000–2800 BC. Taxes consist of direct or indirect taxes and may be paid in money or as labor equivalent.

A flat tax is a tax with a single rate on the taxable amount, after accounting for any deductions or exemptions from the tax base. It is not necessarily a fully proportional tax. Implementations are often progressive due to exemptions, or regressive in case of a maximum taxable amount. There are various tax systems that are labeled "flat tax" even though they are significantly different. The defining characteristic is the existence of only one tax rate other than zero, as opposed to multiple non-zero rates that vary depending on the amount subject to taxation.

Supply-side economics is a macroeconomic theory postulating that economic growth can be most effectively fostered by lowering taxes, decreasing regulation, and allowing free trade. According to supply-side economics theory, consumers will benefit from greater supply of goods and services at lower prices, and employment will increase. Supply-side fiscal policies are designed to increase aggregate supply, as opposed to aggregate demand, thereby expanding output and employment while lowering prices. Such policies are of several general varieties:

- Investments in human capital, such as education, healthcare, and encouraging the transfer of technologies and business processes, to improve productivity. Encouraging globalized free trade via containerization is a major recent example.

- Tax reduction, to provide incentives to work, invest and take risks. Lowering income tax rates and eliminating or lowering tariffs are examples of such policies.

- Investments in new capital equipment and research and development (R&D), to further improve productivity. Allowing businesses to depreciate capital equipment more rapidly gives them an immediate financial incentive to invest in such equipment.

- Reduction in government regulations, to encourage business formation and expansion.

Benjamin Jeremy Stein is an American writer, lawyer, actor, comedian, and commentator on political and economic issues. He began his career as a speechwriter for U.S. presidents Richard Nixon and Gerald Ford before entering the entertainment field as an actor, comedian, and game show host. He is best known on screen as the economics teacher in Ferris Bueller's Day Off, as the host of Win Ben Stein's Money, and as Dr. Arthur Neuman in The Mask and Son of the Mask. Stein also co-wrote and starred in the controversial 2008 film Expelled which was widely criticized for promoting pseudoscientific intelligent design creationist claims of persecution. Stein is the son of economist and writer Herbert Stein, who worked at the White House under President Nixon. As a character actor he is well known for his droning, monotonous delivery. In comedy, he is known for his deadpan delivery.

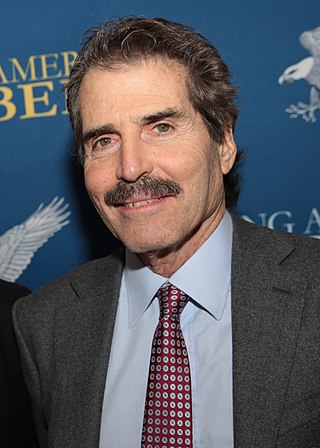

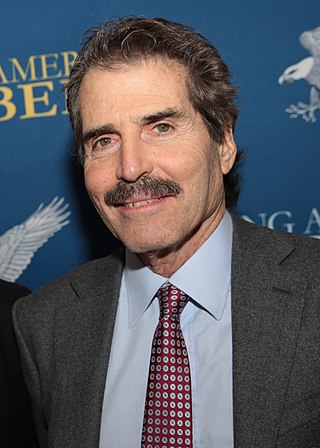

John Frank Stossel is an American libertarian television presenter, author, consumer journalist, political activist, and pundit. He is known for his career as a host on ABC News, Fox Business Network, and Reason TV.

The United States federal government and most state governments impose an income tax. They are determined by applying a tax rate, which may increase as income increases, to taxable income, which is the total income less allowable deductions. Income is broadly defined. Individuals and corporations are directly taxable, and estates and trusts may be taxable on undistributed income. Partnerships are not taxed, but their partners are taxed on their shares of partnership income. Residents and citizens are taxed on worldwide income, while nonresidents are taxed only on income within the jurisdiction. Several types of credits reduce tax, and some types of credits may exceed tax before credits. Most business expenses are deductible. Individuals may deduct certain personal expenses, including home mortgage interest, state taxes, contributions to charity, and some other items. Some deductions are subject to limits, and an Alternative Minimum Tax (AMT) applies at the federal and some state levels.

Tax shelters are any method of reducing taxable income resulting in a reduction of the payments to tax collecting entities, including state and federal governments. The methodology can vary depending on local and international tax laws.

An Inconvenient Truth is a 2006 American documentary film directed by Davis Guggenheim about former vice president of the United States Al Gore's campaign to educate people about global warming. The film features a slide show that, by Gore's own estimate, he has presented over 1,000 times to audiences worldwide.

Film finance is an aspect of film production that occurs during the development stage prior to pre-production, and is concerned with determining the potential value of a proposed film.

The Canadian federal budget for the fiscal year 2006–07, was presented to the House of Commons of Canada by Finance Minister Jim Flaherty on May 2, 2006. Among the most notable elements of the federal budget were its reduction of the Goods and Services Tax by one percentage point, income tax cuts for middle-income earners, and $1,200-per-child childcare payment for Canadian parents.

America: Freedom to Fascism is a 2006 American film by filmmaker and activist Aaron Russo, covering a variety of subjects that Russo contends are detrimental to Americans. Topics include the Internal Revenue Service (IRS), the income tax, Federal Reserve System, national ID cards, human-implanted RFID tags, Diebold electronic voting machines, globalization, Big Brother, taser weapons abuse, and the use of terrorism by the government as a means to diminish the citizens' rights.

Tax policy refers to the guidelines and principles established by a government for the imposition and collection of taxes. It encompasses both microeconomic and macroeconomic aspects, with the former focusing on issues of fairness and efficiency in tax collection, and the latter focusing on the overall quantity of taxes to be collected and its impact on economic activity. The tax framework of a country is considered a crucial instrument for influencing the country's economy.

Optimal tax theory or the theory of optimal taxation is the study of designing and implementing a tax that maximises a social welfare function subject to economic constraints. The social welfare function used is typically a function of individuals' utilities, most commonly some form of utilitarian function, so the tax system is chosen to maximise the aggregate of individual utilities. Tax revenue is required to fund the provision of public goods and other government services, as well as for redistribution from rich to poor individuals. However, most taxes distort individual behavior, because the activity that is taxed becomes relatively less desirable; for instance, taxes on labour income reduce the incentive to work. The optimization problem involves minimizing the distortions caused by taxation, while achieving desired levels of redistribution and revenue. Some taxes are thought to be less distorting, such as lump-sum taxes and Pigouvian taxes, where the market consumption of a good is inefficient, and a tax brings consumption closer to the efficient level.

Corporate tax is imposed in the United States at the federal, most state, and some local levels on the income of entities treated for tax purposes as corporations. Since January 1, 2018, the nominal federal corporate tax rate in the United States of America is a flat 21% following the passage of the Tax Cuts and Jobs Act of 2017. State and local taxes and rules vary by jurisdiction, though many are based on federal concepts and definitions. Taxable income may differ from book income both as to timing of income and tax deductions and as to what is taxable. The corporate Alternative Minimum Tax was also eliminated by the 2017 reform, but some states have alternative taxes. Like individuals, corporations must file tax returns every year. They must make quarterly estimated tax payments. Groups of corporations controlled by the same owners may file a consolidated return.

Economic theory evaluates how taxes are able to provide the government with required amount of the financial resources and what are the impacts of this tax system on overall economic efficiency. If tax efficiency needs to be assessed, tax cost must be taken into account, including administrative costs and excessive tax burden also known as the dead weight loss of taxation (DWL). Direct administrative costs include state administration costs for the organisation of the tax system, for the evidence of taxpayers, tax collection and control. Indirect administrative costs can include time spent filling out tax returns or money spent on paying tax advisors.

Life Is My Movie Entertainment is a documentary studio founded on January 1, 2011 by Vincent Vittorio based in Los Angeles and Atlanta. The company specializes in developing, producing, acquiring, and distributing non-fiction films.

In economics, the Laffer curve illustrates a theoretical relationship between rates of taxation and the resulting levels of the government's tax revenue. The Laffer curve assumes that no tax revenue is raised at the extreme tax rates of 0% and 100%, meaning that there is a tax rate between 0% and 100% that maximizes government tax revenue.

Stossel is a weekly American television talk show, hosted by John Stossel, highlighting current consumer issues, with a libertarian viewpoint. It was broadcast between 2009 and 2016. The program debuted on December 10, 2009, on the Fox Business Network and aired on Fridays—originally at 8:00 pm EST, but was moved to 9:00 pm EST. In 2013, Fox News Channel began to replay the show occasionally on weekends.

Film production incentives are tax incentives offered on a state-by-state basis throughout the United States to encourage in-state film production. Since the 1990s, states have offered increasingly competitive incentives to lure productions away from other states. The structure, type, and size of the incentives vary from state to state. Many include tax credits and exemptions, and other incentive packages include cash grants, fee-free locations, or other perks.

Inequality for All is a 2013 documentary film directed by Jacob Kornbluth and narrated by American economist, author and professor Robert Reich. Based on Reich's 2010 book Aftershock: The Next Economy and America's Future, the film examines widening income inequality in the United States. Reich publicly argued about the issue for decades, and producing a film of his viewpoints was a "final frontier" for him. In addition to being a social issue documentary, Inequality for All is also partially a biopic regarding Reich's early life and his time as Secretary of Labor under Bill Clinton's presidency. Warren Buffett and Nick Hanauer, two entrepreneurs and investors in the top 1%, are interviewed in the film, supporting Reich's belief in an economy that benefits all citizens, including those of the middle and lower classes.