A nonprofit organization (NPO), also known as a nonbusiness entity, nonprofit institution, or simply a nonprofit, is a legal entity organized and operated for a collective, public or social benefit, as opposed to an entity that operates as a business aiming to generate a profit for its owners. A nonprofit organization is subject to the non-distribution constraint: any revenues that exceed expenses must be committed to the organization's purpose, not taken by private parties. Depending on the local laws, charities are regularly organized as non-profits. A host of organizations may be nonprofit, including some political organizations, schools, hospitals, business associations, churches, foundations, social clubs, and consumer cooperatives. Nonprofit entities may seek approval from governments to be tax-exempt, and some may also qualify to receive tax-deductible contributions, but an entity may incorporate as a nonprofit entity without having tax-exempt status.

United States non-profit laws relate to taxation, the special problems of an organization which does not have profit as its primary motivation, and prevention of charitable fraud. Some non-profit organizations can broadly be described as "charities" — like the American Red Cross. Some are strictly for the private benefit of the members — like country clubs, or condominium associations. Others fall somewhere in between — like labor unions, chambers of commerce, or cooperative electric companies. Each presents unique legal issues.

Maximus Inc. is an American government services company, with global operations in countries including the United States, Australia, Canada, and the United Kingdom. The company contracts with government agencies to provide services to manage and administer government-sponsored programs. Maximus provides administration and other services for Medicaid, Medicare, health care reform, welfare-to-work, and student loan servicing among other government programs. The company is based in Tysons, Virginia, has 39,600 employees and a reported annual revenue of $4.9 billion in fiscal year 2023.

The Administration for Children and Families (ACF) is a division of the United States Department of Health and Human Services (HHS). It is headed by the assistant secretary of health and human services for children and families. It has a $49 billion budget for 60 programs that target children, youth and families. These programs include assistance with welfare, child support enforcement, adoption assistance, foster care, child care, and child abuse. The agency employs approximately 1,700 staff, including 1,200 federal employees and 500 contractors, where 60% are based in Washington, DC, with the remaining in regional offices located in Boston, New York City, Philadelphia, Atlanta, Chicago, Dallas, Kansas City (Missouri), Denver, San Francisco, and Seattle.

A 501(c) organization is a nonprofit organization in the federal law of the United States according to Internal Revenue Code. Such organizations are exempt from some federal income taxes. Sections 503 through 505 set out the requirements for obtaining such exemptions. Many states refer to Section 501(c) for definitions of organizations exempt from state taxation as well. 501(c) organizations can receive unlimited contributions from individuals, corporations, and unions.

Free Geek is a technology related non-profit organization based in Portland, Oregon, launched on April 22, 2000. It started as a public event at Pioneer Courthouse Square. In September 2000, it opened a permanent facility as a drop off site for electronic waste. In January 2001, local newspaper The Oregonian ran an article advertising their free computer program for volunteers, which became so successful that they had to start a waiting list. They currently have over 2,000 active volunteers per year.

NatureServe, Inc. is a non-profit organization based in Arlington County, Virginia, US, that provides proprietary wildlife conservation-related data, tools, and services to private and government clients, partner organizations, and the public. NatureServe reports being "headquartered in Arlington, Virginia, with regional offices in four U.S. locations and in Canada." In calendar year 2011 they reported having 86 employees, 6 volunteers, and 15 independent officers.

A 501(c)(3) organization is a United States corporation, trust, unincorporated association or other type of organization exempt from federal income tax under section 501(c)(3) of Title 26 of the United States Code. It is one of the 29 types of 501(c) nonprofit organizations in the US.

A religious corporation is a type of religious non-profit organization, which has been incorporated under the law. Often these types of corporations are recognized under the law on a subnational level, for instance by a state or province government. The government agency responsible for regulating such corporations is usually the official holder of records, for instance, the Secretary of State. In the United States, religious corporations are formed like all other nonprofit corporations by filing articles of incorporation with the state. Religious corporation articles need to have the standard tax-exempt language the IRS requires. Religious corporations are permitted to designate a person to act in the capacity of corporation sole. This is a person who acts as the official holder of the title on the property, etc.

The Connelly Foundation is a Philadelphia philanthropic organization based in West Conshohocken, Pennsylvania. The organization was founded in 1955 by businessman and entrepreneur John F. Connelly. Connelly headed the foundation until his death in 1990, and his wife Josephine led until her death in 1999.

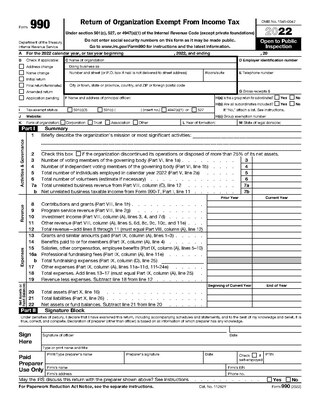

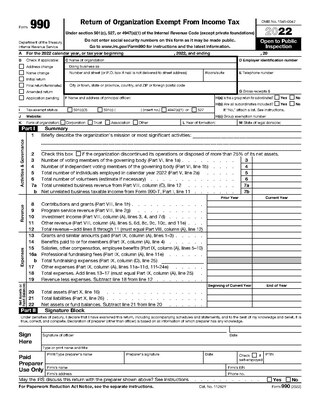

Form 990 is a United States Internal Revenue Service (IRS) form that provides the public with information about a nonprofit organization. It is also used by government agencies to prevent organizations from abusing their tax-exempt status. Some nonprofits, such as hospitals and other healthcare organizations, have more comprehensive reporting requirements.

The Senior Community Service Employment Program (SCSEP) is a program of the United States Department of Labor, its Employment and Training Administration, to help more senior citizens get back into or remain active in the labor workforce. It is a community service and work-based training program. It does this through job skill training and employment assistance with an emphasis on getting a ready job with a suitable and cooperating company or organisation. In such a setting, the worker is paid the United States minimum wage, or the highest of Federal, State or local minimum wage, or the prevailing wage, for an average of 20 hours per week, and experiences on-the-job learning and newly acquired skills use. The intention is that through these community jobs, the older worker will gain a permanent job, not subsidized by federal government funds.

Candid is an information service specializing in reporting on U.S. nonprofit companies. In 2016, its database provided information on 2.5 million organizations. It is the product of the February 2019 merger of GuideStar with Foundation Center.

A nonpartisan organization, in American politics, is a non-profit organization organized United States Internal Revenue Code that qualifies certain non-profit organizations for tax-exempt status because they refrain from engaging in certain political activities prohibited for them. The designation "nonpartisan" usually reflects a claim made by organizations about themselves, or by commentators, and not an official category per American law. Rather, certain types of nonprofit organizations are under varying requirements to refrain from election-related political activities, or may be taxed to the extent they engage in electoral politics, so the word affirms a legal requirement. In this context, "nonpartisan" means that the organization, by US tax law, is prohibited from supporting or opposing political candidates, parties, and in some cases other votes like propositions, directly or indirectly, but does not mean that the organization cannot take positions on political issues.

Voices for America's Children(Voices) was a 501(c)(3) non-profit organization located in Washington, DC. Voices was a U.S. nonpartisan, national organization that advocated for the well-being of children at the federal, state and local levels of government. It addressed areas such as early childhood education, health, juvenile justice, child welfare, tax and budget decisions. It was known as National Association of Child Advocates prior to 2003.

The Institute for Nonprofit News (INN) is a non-profit consortium of nonprofit journalism organizations. The organization promotes nonprofit investigative and public service journalism. INN facilitates collaborations between member organizations, provides training in best-practices and fundraising, and provides back-office services.

Assets for Independence (AFI) is a federal program that distributes discretionary grants to help the impoverished achieve one of three goals: (1) homeownership; (2) business ownership; and (3) post-secondary education. AFI was created by the Assets for Independence Act.

A 501(h) election or Conable election is a procedure in United States tax law that allows a 501(c)(3) non-profit organization to participate in lobbying limited only by the financial expenditure on that lobbying, regardless of its overall extent. This allows organizations taking the 501(h) election to potentially perform a large amount of lobbying if it is done using volunteer labor or through inexpensive means. The 501(h) election is available to most types of 501(c)(3) organizations that are not churches or private foundations. It was introduced by Representative Barber Conable as part of the Tax Reform Act of 1976 and codified as 26 U.S.C. § 501(h), and the corresponding Internal Revenue Service (IRS) regulations were finalized in 1990.

LibreTexts is a 501(c)(3) nonprofit online educational resource project. The project provides open access to its content on its website, and the site is built on the proprietary Mindtouch platform. LibreTexts was started in 2008 by Professor Delmar Larsen at the University of California Davis and has since expanded to 400 texts in 154 courses, making it one of the largest and most visited online educational resources. LibreTexts currently has 13 library disciplines.

Early childhood education in the United States relates to the teaching of children from birth up to the age of eight. The education services are delivered via preschools and kindergartens.