Related Research Articles

SoftBank Group Corp. is a Japanese multinational investment holding company headquartered in Minato, Tokyo that focuses on investment management. The group primarily invests in companies operating in technology that offer goods and services to customers in a multitude of markets and industries ranging from the internet to automation. With over $100 billion in capital at its onset, SoftBank's Vision Fund is the world's largest technology-focused venture capital fund. Fund investors included sovereign wealth funds from countries in the Middle East.

Masayoshi Son is a Japanese billionaire technology entrepreneur, investor and philanthropist. A third-generation Zainichi Korean, he naturalized as a Japanese citizen in 1990. He is the founder, representative director, corporate officer, chairman and CEO of SoftBank Group Corp. (SBG), a technology-focused investment holding company, as well as chairman of UK-based Arm Holdings.

CVC Capital Partners plc is a Jersey-based private equity and investment advisory firm with approximately €186 billion of assets under management and approximately €157 billion in secured commitments since inception across American, European, and Asian private equity, secondaries, credit funds and infrastructure. As of 31 December 2021, the funds managed or advised by CVC are invested in more than 100 companies worldwide, employing over 450,000 people in numerous countries. CVC was founded in 1981 and, as of 31 March 2022, has over 850 employees working across its network of 25 offices throughout EMEA, Asia and the Americas.

Khosla Ventures is a private American venture capital firm based in Menlo Park, California. It was founded by entrepreneur Vinod Khosla in 2004.

Adyen is a Dutch payment company with the status of an acquiring bank that allows businesses to accept e-commerce, mobile, and point-of-sale payments. It is listed on the stock exchange Euronext Amsterdam.

Highland Capital Partners is a global venture capital firm with offices in Boston, Silicon Valley, and San Francisco. Highland has raised over $4 billion in committed capital and invested in more than 280 companies, with 47 IPOs and 134 acquisitions.

Eduardo Luiz Saverin is a Brazilian billionaire entrepreneur and angel investor, known for having co-founded Facebook. In 2012, he owned about 2% of Facebook shares, valued at approximately $2 billion at the time. Based in Singapore, he is the co-founder and co-CEO of the venture capital firm B Capital, and has also invested in early-stage startups such as Qwiki and Jumio. Saverin is the wealthiest Brazilian, with an estimated net worth of US$32.6 billion as of 30 December 2024, according to Forbes, and the 52nd richest individual in the world.

Zuora, Inc. is an American enterprise software company headquartered in Redwood City, California that creates and provides software for businesses to launch and manage their subscription-based services. Zuora's applications are designed to automate recurring billing, collections, quoting, revenue recognition, and subscription metrics. Tien Tzuo, a co-founder of the company, has served as its CEO since 2007.

WeWork Inc. is a provider of coworking spaces, including physical and virtual shared spaces, headquartered in New York City. As of December 31, 2022, the company operated 43.9 million square feet (4,080,000 m2) of space, including 18.3 million square feet (1,700,000 m2) in the United States and Canada, in 779 locations in 39 countries, and had 547,000 members, with a weighted average commitment term of 19 months.

WeTransfer B.V. is a Dutch internet-based computer file transfer service company that was founded in 2009 and based in Amsterdam. In 2024, the company was acquired by Bending Spoons.

Paytm is an Indian multinational financial technology company, that specializes in digital payments and financial services, based in Noida, India. Paytm was founded in 2010 by Vijay Shekhar Sharma under One97 Communications. The company offers mobile payment services to consumers and enables merchants to receive payments through QR code payment, Soundbox, Android-based-payment terminal, and online payment gateway. In partnership with financial institutions, Paytm also offers financial services such as microcredit and buy now, pay later to its consumers and merchants.

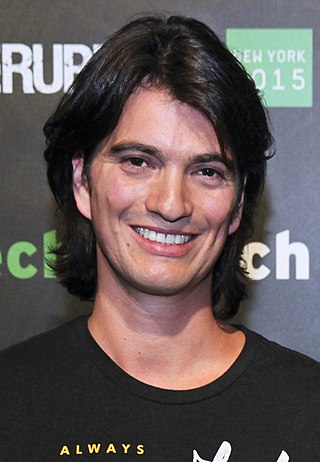

Adam Neumann is an Israeli-American billionaire businessman and investor. In 2010, he co-founded WeWork with Miguel McKelvey, where he was CEO from 2010 to 2019. In 2019, he co-founded a family office dubbed 166 2nd Financial Services with his wife, Rebekah Neumann, to manage their personal wealth, investing over a billion dollars in real estate and venture startups.

Nium is a Singapore-headquartered cross-border payments company. Initially founded by Prajit Nanu and Michael Bermingham, and launched as a consumer-remittance platform Instarem in 2014. In 2016, the company introduced its B2B payments platform and rebranded as Nium in 2019, subsequently elevating Pratik Gandhi to co-founder in 2021. However, Gandhi left Nium in October 2023, around the time Nium's Chief Product Officer also left the company and Nium announced a layoff of over 10% of its global staff.

Brian Armstrong is an American business executive, billionaire, and investor who is CEO of cryptocurrency platform Coinbase. He received media attention for his policy of keeping the workplace free of political activism.

Baiju Prafulkumar Bhatt is an American entrepreneur of Indian descent. He is the founder of Aetherflux, a space-based solar energy company, and the co-founder and former co-chief executive officer of Robinhood, a US-based financial services company.

Pieter van der Does is a Dutch billionaire Internet entrepreneur, and the co-founder and chief executive officer (CEO) of Adyen. As of September 2024, his net worth was estimated at US$1.8 billion, and he owns 3% of the company.

Tony Xu is a Chinese American billionaire businessman and the co-founder and CEO of DoorDash. Xu was born in Nanjing and immigrated to the United States with his parents at the age of four. He earned degrees from the University of California, Berkeley and the Stanford Graduate School of Business. Early in his career, Xu interned at Square, Inc., and worked for McKinsey & Company, eBay, and PayPal. He was included in Fortune's 40 Under 40 in 2020.

Apoorva Mehta is a billionaire Canadian-American businessman and the founder of Instacart and Cloud Health Systems. As of September 2023 he had a net worth of $1.3 billion, owing to his 10% ownership share of Instacart and his stake in Cloud Health Systems.

ICONIQ Capital, LLC is an American investment management firm headquartered in San Francisco, California. It functions as a hybrid family office providing specialized financial advisory, private equity, venture capital, real estate, and philanthropic services to its clientele. ICONIQ Capital primarily serves ultra-high-net-worth clients working in technology, high finance, and entertainment. The firm operates in-house venture capital, growth equity, and charitable giving funds for its clients.

References

- 1 2 van de Belt, Bastian (14 December 2023). "Alles over Arnout Schuijff" [All about Arnout Schuijff]. Quote (in Dutch).

- 1 2 "Executive Profile: Arnout Schuijff". Bloomberg LP. Retrieved 23 July 2018.

- 1 2 "Adyen Co-Founder Now a Billionaire as European Tech IPO Soars" . Retrieved 23 July 2018.

- 1 2 "Forbes profile: Arnout Schuijff". Forbes. Retrieved 26 May 2020.

- ↑ Prakash, Prarthana (15 October 2024). "Cofounder of $50 billion European fintech giant Adyen raises funding for an employee-owned payments company". Fortune .

- ↑ Sterling, Toby (15 October 2024). "Adyen co-founder's new firm Tebi raises $22 mln to expand". Reuters.

- ↑ Schouten, Vian (17 May 2024). "WeTicket breekt markt open met geld oprichter Adyen: 'Er heerst een graaicultuur in ticketingwereld'" [WeTicket Disrupts the Market with Founder of Adyen’s Funding: ‘There’s a Culture of Greed in the Ticketing Industry’]. De Telegraaf (in Dutch). Retrieved 2 January 2025.