A dividend is a distribution of profits by a corporation to its shareholders, after which the stock exchange decreases the price of the stock by the dividend to remove volatility. The market has no control over the stock price on open on the ex-dividend date, though often than not it may open higher. When a corporation earns a profit or surplus, it is able to pay a portion of the profit as a dividend to shareholders. Any amount not distributed is taken to be re-invested in the business. The current year profit as well as the retained earnings of previous years are available for distribution; a corporation is usually prohibited from paying a dividend out of its capital. Distribution to shareholders may be in cash or, if the corporation has a dividend reinvestment plan, the amount can be paid by the issue of further shares or by share repurchase. In some cases, the distribution may be of assets.

In finance, equity is an ownership interest in property that may be offset by debts or other liabilities. Equity is measured for accounting purposes by subtracting liabilities from the value of the assets owned. For example, if someone owns a car worth $24,000 and owes $10,000 on the loan used to buy the car, the difference of $14,000 is equity. Equity can apply to a single asset, such as a car or house, or to an entire business. A business that needs to start up or expand its operations can sell its equity in order to raise cash that does not have to be repaid on a set schedule.

A public company is a company whose ownership is organized via shares of stock which are intended to be freely traded on a stock exchange or in over-the-counter markets. A public company can be listed on a stock exchange, which facilitates the trade of shares, or not. In some jurisdictions, public companies over a certain size must be listed on an exchange. In most cases, public companies are private enterprises in the private sector, and "public" emphasizes their reporting and trading on the public markets.

In finance, a convertible bond, convertible note, or convertible debt is a type of bond that the holder can convert into a specified number of shares of common stock in the issuing company or cash of equal value. It is a hybrid security with debt- and equity-like features. It originated in the mid-19th century, and was used by early speculators such as Jacob Little and Daniel Drew to counter market cornering.

A joint-stock company (JSC) is a business entity in which shares of the company's stock can be bought and sold by shareholders. Each shareholder owns company stock in proportion, evidenced by their shares. Shareholders are able to transfer their shares to others without any effects to the continued existence of the company.

Preferred stock is a component of share capital that may have any combination of features not possessed by common stock, including properties of both an equity and a debt instrument, and is generally considered a hybrid instrument. Preferred stocks are senior to common stock but subordinate to bonds in terms of claim and may have priority over common stock in the payment of dividends and upon liquidation. Terms of the preferred stock are described in the issuing company's articles of association or articles of incorporation.

An investment trust is a form of investment fund found mostly in the United Kingdom and Japan. Investment trusts are constituted as public limited companies and are therefore closed ended since the fund managers cannot redeem or create shares.

Corporate law is the body of law governing the rights, relations, and conduct of persons, companies, organizations and businesses. The term refers to the legal practice of law relating to corporations, or to the theory of corporations. Corporate law often describes the law relating to matters which derive directly from the life-cycle of a corporation. It thus encompasses the formation, funding, governance, and death of a corporation.

Piercing the corporate veil or lifting the corporate veil is a legal decision to treat the rights or duties of a corporation as the rights or liabilities of its shareholders. Usually a corporation is treated as a separate legal person, which is solely responsible for the debts it incurs and the sole beneficiary of the credit it is owed. Common law countries usually uphold this principle of separate personhood, but in exceptional situations may "pierce" or "lift" the corporate veil.

Salomon v A Salomon & Co Ltd[1896] UKHL 1, [1897] AC 22 is a landmark UK company law case. The effect of the House of Lords' unanimous ruling was to uphold firmly the doctrine of corporate personality, as set out in the Companies Act 1862, so that creditors of an insolvent company could not sue the company's shareholders for payment of outstanding debts.

Share repurchase, also known as share buyback or stock buyback, is the reacquisition by a company of its own shares. It represents an alternate and more flexible way of returning money to shareholders. Repurchases allow stockholders to delay taxes which they would have been required to pay on dividends in the year the dividends are paid, to instead pay taxes on the capital gains they receive when they sell the stock, whose price is now proportionally higher because of the smaller number of shares outstanding.

Tag along rights (TARs) comprise a group of clauses in a contract which together have the effect of allowing the minority shareholder(s) in a corporation to also take part in a sale of shares by the majority shareholder to a third party under the same terms and conditions.

The United Kingdom company law regulates corporations formed under the Companies Act 2006. Also governed by the Insolvency Act 1986, the UK Corporate Governance Code, European Union Directives and court cases, the company is the primary legal vehicle to organise and run business. Tracing their modern history to the late Industrial Revolution, public companies now employ more people and generate more of wealth in the United Kingdom economy than any other form of organisation. The United Kingdom was the first country to draft modern corporation statutes, where through a simple registration procedure any investors could incorporate, limit liability to their commercial creditors in the event of business insolvency, and where management was delegated to a centralised board of directors. An influential model within Europe, the Commonwealth and as an international standard setter, UK law has always given people broad freedom to design the internal company rules, so long as the mandatory minimum rights of investors under its legislation are complied with.

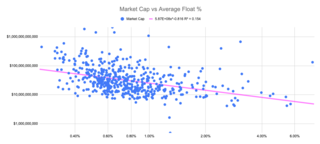

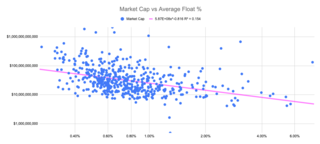

In the context of stock markets, the public float or free float represents the portion of shares of a corporation that are in the hands of public investors as opposed to locked-in shares held by promoters, company officers, controlling-interest investors, or governments. This number is sometimes seen as a better way of calculating market capitalization, because it provides a more accurate reflection of what public investors consider the company to be worth. In this context, the float may refer to all the shares outstanding that can be publicly traded.

Stocks consist of all the shares by which ownership of a corporation or company is divided. A single share of the stock means fractional ownership of the corporation in proportion to the total number of shares. This typically entitles the shareholder (stockholder) to that fraction of the company's earnings, proceeds from liquidation of assets, or voting power, often dividing these up in proportion to the number of like shares each stockholder owns. Not all stock is necessarily equal, as certain classes of stock may be issued, for example, without voting rights, with enhanced voting rights, or with a certain priority to receive profits or liquidation proceeds before or after other classes of shareholders.

Shareholder oppression occurs when the majority shareholders in a corporation take action that unfairly prejudices the minority. It most commonly occurs in non-publicly traded companies, because the lack of a public market for shares leaves minority shareholders particularly vulnerable, since minority shareholders cannot escape mistreatment by selling their stock and exiting the corporation. The majority shareholders may harm the economic interests of the minority by refusing to declare dividends or attempting a squeezeout. The majority may physically lock the minority out of the corporate premises and even deny the minority the right to inspect corporate records and books, making it necessary for the minority to sue every time it wants to look at them. An important concept in law pertaining to shareholder oppression is the "reasonable expectations" of the minority shareholder. The "fair dealing" standard is also sometimes used by courts.

Progress Property Co Ltd v Moorgarth Group Ltd[2010] UKSC 55 is a UK company law case concerning the circumstances by which a transaction at an undervalue would be considered an unauthorised return of capital.

The corporate veil in the United Kingdom is a metaphorical reference used in UK company law for the concept that the rights and duties of a corporation are, as a general principle, the responsibility of that company alone. Just as a natural person cannot be held legally accountable for the conduct or obligations of another person, unless they have expressly or implicitly assumed responsibility, guaranteed or indemnified the other person, as a general principle shareholders, directors and employees cannot be bound by the rights and duties of a corporation. This concept has traditionally been likened to a "veil" of separation between the legal entity of a corporation and the real people who invest their money and labor into a company's operations.

Dividend policy, in financial management and corporate finance, is concerned with the policies regarding dividends; more specifically paying a cash dividend in the present, as opposed to, presumably, paying an increased dividend at a later stage. Practical and theoretical considerations will inform this thinking.

Case Concerning Barcelona Traction, Light, and Power Company, Ltd [1970] ICJ 1 is a public international law case, concerning the abuse of rights.