Related Research Articles

A societas Europaea is a public company registered in accordance with the corporate law of the European Union (EU), introduced in 2004 with the Council Regulation on the Statute for a European Company. Such a company may more easily transfer to or merge with companies in other member states.

Council Directive 93/98/EEC of 29 October 1993 harmonising the term of protection of copyright and certain related rights is a European Union directive in the field of EU copyright law, made under the internal market provisions of the Treaty of Rome. It was replaced by the 2006 Copyright Term Directive (2006/116/EC).

European Union law is a system of rules operating within the member states of the European Union. Since the founding of the Coal and Steel Community after World War II, the EU has developed the aim to "promote peace, its values and the well-being of its peoples". The EU has political institutions, social and economic policies, which transcend nation states for the purpose of cooperation and human development. According to its Court of Justice the EU represents "a new legal order of international law".

A subsidiary, subsidiary company or daughter company is a company that is owned or controlled by another company, which is called the parent company, parent, or holding company. The subsidiary can be a company, corporation, or limited liability company. In some cases it is a government or state-owned enterprise.

Corporate law is the body of law governing the rights, relations, and conduct of persons, companies, organizations and businesses. The term refers to the legal practice of law relating to corporations, or to the theory of corporations. Corporate law often describes the law relating to matters which derive directly from the life-cycle of a corporation. It thus encompasses the formation, funding, governance, and death of a corporation.

The European Single Market, Internal Market or Common Market is a single market comprising the 27 member states of the European Union (EU) as well as – with certain exceptions – Iceland, Liechtenstein and Norway through the Agreement on the European Economic Area, Switzerland through bilateral treaties, and the United Kingdom during the Brexit transition period, as outlined in the Brexit withdrawal agreement. It seeks to guarantee the free movement of goods, capital, services, and labour, known collectively as the "four freedoms".

Directive 2014/65/EU is a legal act of the European Union. Together with Regulation (EU) No 600/2014 it provides a legal framework for securities markets, investment intermediaries and trading venues. The directive provides harmonised regulation for investment services of the member states of the European Economic Area - the EU member states plus Iceland, Norway, and Liechtenstein; the United Kingdom will continue to implement the directive during the transition period. Its main objectives are to increase competition and investor protection, and level the playing field for market participants in investment services. It repeals Directive 2004/39/EC.

Directive 92/100/EEC is a European Union directive in the field of copyright law, made under the internal market provisions of the Treaty of Rome. It creates a "rental and lending right" as a part of copyright protection, and sets out minimum standards of protection for the related rights of performers, phonogram and film producers and broadcasting organisations.

A société à responsabilité limitée is a form of private company that exists mainly in French-speaking countries, such as France, Luxembourg, Monaco, Algeria, Morocco, Tunisia, Madagascar, Lebanon, Switzerland, and Belgium. The primary purpose of a SARL is to conduct commercial activity.

The Companies Act 2006 is an Act of the Parliament of the United Kingdom which forms the primary source of UK company law. It had the distinction of being the longest Act in British Parliamentary history: with 1,300 sections and covering nearly 700 pages, and containing 16 schedules but it has since been surpassed, in that respect, by the Corporation Tax Act 2009.

The United Kingdom company law regulates corporations formed under the Companies Act 2006. Also governed by the Insolvency Act 1986, the UK Corporate Governance Code, European Union Directives and court cases, the company is the primary legal vehicle to organise and run business. Tracing their modern history to the late Industrial Revolution, public companies now employ more people and generate more of wealth in the United Kingdom economy than any other form of organisation. The United Kingdom was the first country to draft modern corporation statutes, where through a simple registration procedure any investors could incorporate, limit liability to their commercial creditors in the event of business insolvency, and where management was delegated to a centralised board of directors. An influential model within Europe, the Commonwealth and as an international standard setter, UK law has always given people broad freedom to design the internal company rules, so long as the mandatory minimum rights of investors under its legislation are complied with.

Francovich v Italy (1991) C-6/90 was a decision of the European Court of Justice which established that European Union member states could be liable to pay compensation to individuals who suffered a loss by reason of the member state's failure to transpose an EU directive into national law. This principle is sometimes known as the principle of state liability or "the rule in Francovich" in European Union law.

Mergers and acquisitions in United Kingdom law refers to a body of law that covers companies, labour, and competition, which is engaged when firms restructure their affairs in the course of business.

The European Union value-added tax is a value added tax on goods and services within the European Union (EU). The EU's institutions do not collect the tax, but EU member states are each required to adopt a value added tax that complies with the EU VAT code. Different rates of VAT apply in different EU member states, ranging from 17% in Luxembourg to 27% in Hungary. The total VAT collected by member states is used as part of the calculation to determine what each state contributes to the EU's budget.

Kamer van Koophandel en Fabrieken voor Amsterdam v Inspire Art Ltd (2003) C-167/01 is a leading corporate law case, concerning the EU law of freedom of establishment for companies.

European labour law regulates basic transnational standards of employment and partnership at work in the European Union and countries adhering to the European Convention on Human Rights. In setting regulatory floors to competition to for job-creating investment within the Union, and in promoting a degree of employee consultation in the workplace, European labour law is viewed as a pillar of the "European social model". Despite wide variation in employment protection and related welfare provision between member states, a contrast is typically drawn with conditions in the United States.

European corporate law is a part of European Union law, which concerns the formation, operation and insolvency of corporations in the European Union. There is no substantive European company law as such, although a host of minimum standards are applicable to companies throughout the European Union. All member states continue to operate separate companies acts, which are amended from time to time to comply with EU Directives and Regulations. There is, however, also the option of businesses to incorporate as a Societas Europaea (SE), which allows a company to operate across all member states.

The Institutions for Occupational Retirement Provision Directive2016/2341 is a European Union Directive designed to create an internal market for occupational retirement provision. It lays down minimum standards on funding pension schemes, the types of investments pensions may make and permits cross-border management of pension plans.

The Takeover Directive2004/25/EC is an EU Directive dealing with European company law's treatment of mergers and acquisitions. It concerns the standards takeover bidders must comply with in how long a bid stays open to, who they offer to, and the information companies must give to the public about the bid. The most controversial provision, which eventually was made optional, was the requirement of the board of directors of a target company to be neutral in the bid process.

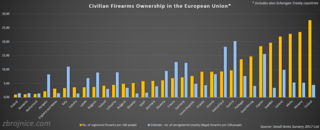

The European Firearms Directive is a law of the European Union which sets minimum standards regarding civilian firearms acquisition and possession that EU member states must implement into their national legal systems.