Oman is a country situated in Southwest Asia, bordering the Arabian Sea, Gulf of Oman, and Persian Gulf, between Yemen and the United Arab Emirates (UAE).

The Abu Dhabi Investment Authority (ADIA) is a sovereign wealth fund owned by Emirate of Abu Dhabi founded for the purpose of investing funds on behalf of the Government of the Emirate of Abu Dhabi. It manages the Emirate’s excess oil reserves, estimated to be as much as $875 billion. Its portfolio grows at an annual rate of about 10% compounded. The fund is a member of the International Forum of Sovereign Wealth Funds and is therefore signed up to the Santiago Principles on best practice in managing sovereign wealth funds.

The Kuwait Investment Authority (KIA) is Kuwait's sovereign wealth fund, managing body, specializing in local and foreign investment. It is the 5th largest sovereign wealth fund in the world with assets exceeding $592 billion. It is a member of the International Forum of Sovereign Wealth Funds and has signed up to the Santiago Principles on best practice in managing sovereign wealth funds.

Duqm is a port town on the Arabian Sea in Al Wusta Governorate in central-eastern Oman. The town is currently experiencing significant development, growing from about 5,100 in 2008 to over 11,200 people in 2010, and the Oman Tourism Development Company is looking to develop it into a resort, aiming to increase its population to 100,000 by 2020.

The Honorable Salaam Said Al Shaksy is a member of the Council of State of Oman where he serves as deputy head of the Economic Committee, and the CEO of alizz islamic bank. Al Shaksy is also currently the Chairman of Oman’s Investment Stabilization Fund, Chairman of The Shaksy Group, member of the Board of Directors; member of the Board of Executive Committee and Chairman of the Tender Committee of Al Rafd Fund ; and a Board member & Chairman of the Audit Committee of Oman Oil Company and an Advisory Council Member in the Sultan Qaboos University (SQU’s) College of Economics & Political Science. Mr. Al-Shaksy is also a committee member of the Government-Private Sector PPP program, and supervisory committee member of the Government of Oman leadership development program.

A sovereign wealth fund (SWF) or sovereign investment fund is a state-owned investment fund that invests in real and financial assets such as stocks, bonds, real estate, precious metals, or in alternative investments such as private equity fund or hedge funds. Sovereign wealth funds invest globally. Most SWFs are funded by revenues from commodity exports or from foreign-exchange reserves held by the central bank. By historic convention, the United States' Social Security Trust Fund, with US$2.8 trillion of assets in 2014, and similar vehicles like Japan Post Bank's JP¥200 trillion of holdings, are not considered sovereign wealth funds.

Oman is a country on the Arabian Peninsula. Tourism in Oman grew considerably during the 2000s, and a 2013 report predicted that it would become one of the largest industries in the nation.

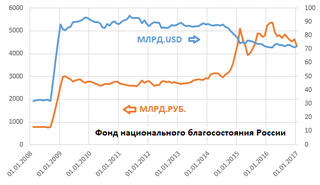

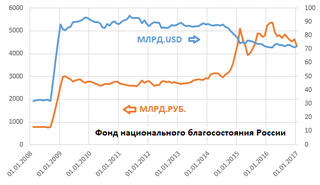

The Russian National Wealth Fund is Russia's sovereign wealth fund. It was created after the Stabilization Fund of the Russian Federation was split into two separate investment funds on 30 January 2008. The two funds are the Reserve Fund, which is invested abroad in low-yield securities and used when oil and gas incomes fall, and the National Wealth Fund, which invests in riskier, higher return vehicles, as well as federal budget expenditures. The Reserve Fund was given $125 billion and the National Wealth Fund was given $32 billion. The fund is controlled by the Ministry of Finance. One of the fund's main responsibilities is to support the Russian pension system.

The Qatar Investment Authority (QIA) is Qatar's state-owned holding company that can be characterised as a National Wealth Fund. It specialises in domestic and foreign investment. The QIA was founded by the State of Qatar in 2005 to strengthen the country's economy by diversifying into new asset classes. The fund is a member of the International Forum of Sovereign Wealth Funds, and is therefore a signatory of the Santiago Principles on best practice in managing sovereign wealth funds.

The Sharqiya Sands is a region of desert in Oman, The region was named for the Bani Wahiba tribe. divided between the northern and southern governorates in the Eastern Region. The area is defined by a boundary of 180 kilometers (110 mi) north to south and 80 kilometers (50 mi) east to west, with an area of 12,500 square kilometers (4,800 sq mi). The desert has been of scientific interest since a 1986 expedition by the Royal Geographical Society documented the diversity of the terrain, the flora and fauna, noting 16,000 invertebrates as well as 200 species of other wildlife, including avifauna. They also documented 150 species of native flora.

The Ministry of Foreign Affairs is the government body in the Sultanate of Oman responsible for Oman's relations with the rest of the world.

Oman Tourism Development Company (Omran) is a Government owned company mandated to drive the investment, growth and development of the tourism sector in the Sultanate of Oman. Established in 1964, they are the master developers of major tourism, heritage and urban developments.

The Abu Dhabi Fund for Development (ADFD) is an foreign aid agency established by the government of Abu Dhabi in 1971. The fund provides concessionary loans to fund economic and social development projects. The fund also invests in order to expand and strengthen the private sector economies of its clients.

Old Muscat is the original historic city of Muscat, the capital of Oman, on the coast in the Gulf of Oman.

The Batinah Expressway is a 256 km 8-lane highway in Oman that connects the Muscat Expressway at Halban with the United Arab Emirates border at Khatmat Malaha.

OppenheimerFunds is a global asset manager. The firm, with its subsidiaries, manages more than $213 billion in assets for over 13 million investor accounts, including sub-accounts, as of Dec 31, 2018.