Related Research Articles

Bausch & Lomb is an American-Canadian eye health products company based in Vaughan, Ontario, Canada. It is one of the world's largest suppliers of contact lenses, lens care products, pharmaceuticals, intraocular lenses, and other eye surgery products. The company was founded in Rochester, New York, in 1853 by optician John Bausch and cabinet maker turned financial backer Henry Lomb. Until its sale in 2013, Bausch + Lomb was one of the oldest continually operating companies in the United States.

Carl Celian Icahn is an American businessman, investor, and philanthropist. He is the founder and controlling shareholder of Icahn Enterprises, a public company and diversified conglomerate holding company based in Sunny Isles Beach, Florida. Icahn's business model is to take large stakes in companies that he believes will appreciate from changes to corporate policy. Subsequently, Icahn then pressures management to make the changes that he believes will benefit shareholders, and him. Widely regarded as one of the most successful hedge fund managers of all time and one of the greatest investors on Wall Street, he was one of the first activist shareholders and is credited with making that investment strategy mainstream for hedge funds.

Marc Lowell Andreessen is an American businessman and former software engineer. He is the co-author of Mosaic, the first widely used web browser with a graphical user interface; co-founder of Netscape; and co-founder and general partner of Silicon Valley venture capital firm Andreessen Horowitz. He co-founded and later sold the software company Opsware to Hewlett-Packard. Andreessen is also a co-founder of Ning, a company that provides a platform for social networking websites and an inductee in the World Wide Web Hall of Fame. Andreessen's net-worth is estimated at $1.7 billion.

Steven A. Cohen is an American hedge-fund manager and owner of the New York Mets of Major League Baseball since September 14, 2020, owning just over 97% of the team. He is the founder of hedge fund Point72 Asset Management and S.A.C. Capital Advisors, which closed after pleading guilty to insider trading and other financial crimes.

Bausch Health Companies Inc. is an American-Canadian multinational specialty pharmaceutical company based in Laval, Quebec, Canada. It develops, manufactures and markets pharmaceutical products and branded generic drugs, primarily for skin diseases, gastrointestinal disorders, eye health and neurology. Bausch Health owns Bausch & Lomb, a supplier of eye health products. Bausch Health's business model is primarily focused on acquiring small pharmaceutical companies and then sharply increasing the prices of the drugs these companies sell.

Icahn Enterprises L.P. is an American publicly traded master limited partnership and conglomerate headquartered at Milton Tower in Sunny Isles Beach, Florida. The company has investments in various industries including energy, automotive, food packaging, metals, real estate and home fashion. The company is controlled by Carl Icahn, who owns 86 percent of it.

Bridgewater Associates, LP is an American investment management firm founded by Ray Dalio in 1975. The firm serves institutional clients including pension funds, endowments, foundations, foreign governments, and central banks. As of 2022, Bridgewater has posted the second highest gains of any hedge fund since its inception in 1975. The firm began as an institutional investment advisory service, graduated to institutional investing, and pioneered the risk parity investment approach in 1996.

Daniel Seth Loeb is an American investor, hedge fund manager, and philanthropist. He is the founder and chief executive of Third Point, a New York-based hedge fund focused on event-driven, value-oriented investing with $4 billion in assets under management, as of December 2023. New York magazine noted that Loeb's "preferred strategy" is to buy into troubled companies, which "is the key to his success." Regarding his active involvement in the companies in which he invests, Loeb was described as "one of the most successful activists" in 2014.

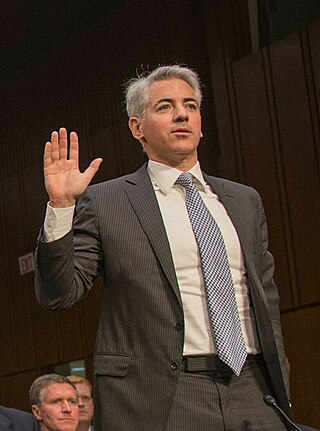

William Albert Ackman is an American billionaire hedge fund manager, who is the founder and chief executive officer of Pershing Square Capital Management, a hedge fund management company. His investment approach has made him an activist investor. As of June 2024, Ackman's net worth was estimated at $9.3 billion by Forbes.

Seth Andrew Klarman is an American billionaire investor, hedge fund manager, and author. He is a proponent of value investing. He is the chief executive and portfolio manager of the Baupost Group, a Boston-based private investment partnership he founded in 1982.

John Alfred Paulson is an American billionaire hedge fund manager. He leads Paulson & Co., a New York–based investment management firm he founded in 1994. He has been called "one of the most prominent names in high finance", and "a man who made one of the biggest fortunes in Wall Street history."

Pershing Square Capital Management is an American hedge fund management company founded and run by Bill Ackman, headquartered in New York City.

Ole Andreas Halvorsen is a Norwegian billionaire hedge fund manager. He is the CEO and a co-founder of the Connecticut-based hedge fund, Viking Global Investors. Viking had $24 billion under management as of October, 2017. Halvorsen has consistently ranked among the top earning hedge fund managers, placing 11th in Forbes' 2012 rankings and 9th in 2015, according to Institutional Investor's Alpha.

Glenview Capital Management is a hedge fund founded in 2000 with approximately $7.7 billion of capital under management as of March 2019. Glenview manages capital for investors through a series of private investment funds. The firm was founded by Larry Robbins, the firm's CEO and portfolio manager, and is based in New York.

Xu Xiang is a former Chinese private placement investor who served as General Manager of Zexi Investment (泽熙投资), a Chinese investment company. He has been variously called "China's Carl Icahn", "China's Warren Buffett", and "Big Man of Private Placement" (私募一哥) by fellow Chinese investors. On November 1, 2015, Xu Xiang was arrested by the police for insider trading.

Barry S. Rosenstein is an American hedge fund manager and billionaire. He is the founder and managing partner of JANA Partners LLC, an activist hedge fund firm. He made $300 million over the merger of Whole Foods with Amazon in April–July 2017.

MHR Fund Management is a private equity firm focusing on leveraged buyout and distressed securities transactions in the United States. The firm specializes in turnaround, buyouts and undervalued middle-market companies, most notably in the entertainment, communications and energy sectors.

Daniel A. Ninivaggi is an American automobile executive who Formerly served as the executive chairman of Lordstown Motors until its bankruptcy, and formerly its CEO. He is also the chairman of Garrett Motion, and was formerly the CEO of Icahn Enterprises as well as co-chairman, co-CEO of Federal-Mogul.

Brent Saunders is an American biopharma executive and entrepreneur who is the chairman and CEO of the health company Bausch & Lomb. He helped lead various mergers and acquisitions, including the mergers between Merck and Schering-Plough, the acquisition of Bausch + Lomb by Valeant Pharmaceuticals, and the $63 billion acquisition of Allergan by Abbvie. He is the founder of special-purpose acquisition company (SPAC) Vesper Healthcare Acquisition. Saunders is also executive chairman of medical aesthetics companies The Beauty Health Company and Hugel America.

Anchorage Capital Group is an American investment management firm based in New York City. The firm is known as one of the world's most prominent vulture funds, funds that invest in distressed securities.

References

- 1 2 Miles Weiss, Carl Icahn Hands Son Brett $3 Billion to Prove His Mettle, Bloomberg BusinessWeek , August 13, 2012

- 1 2 3 Betty Jin, Brett Icahn On The Possibility He Might Soon Take Over His Dad's Company: Nepotism Doesn't Exist At Icahn, Business Insider, July 12, 2010

- 1 2 3 Sam Jones, Dan McCrum, Icahn’s son hones skills with $3bn fund, The Financial Times , August 14, 2012

- 1 2 3 4 Janet Morrissey, The Raider in Winter: Carl Icahn at 75, The New York Times , April 16, 2011

- 1 2 Vardi, Nathan (March 5, 2015). "Brett Icahn Stands To Make $183 Million At Dad's Investment Company". Forbes. Retrieved October 19, 2015.

- ↑ Courtney Comstock, 31-Year Old Brett Icahn's Hedge Fund Returned 50% Last Year, Business Insider , April 19, 2011

- ↑ "Bausch + Lomb (BLCO) Announces Brett Icahn and Gary Hu Have Been Appointed to its Board of Directors". www.streetinsider.com. Retrieved 2022-06-25.

- ↑ "Bausch Health Announces Agreement With Carl C. Icahn". ir.bauschhealth.com. Retrieved 2022-06-25.

- ↑ Worden, Nat (July 10, 2010). "Brett Icahn Takes High-Profile Role in Lions Gate Negotiations". Wall Street Journal.