Lawrence Henry Summers is an American economist, former Vice President of Development Economics and Chief Economist of the World Bank (1991–93), senior U.S. Treasury Department official throughout President Clinton's administration, and former director of the National Economic Council for President Obama (2009–2010). He is a former president of Harvard University (2001–2006), where he is currently a professor and director of the Mossavar-Rahmani Center for Business and Government at Harvard's Kennedy School of Government.

J.P. Morgan Chase Bank, N.A., doing business as Chase Bank, is a national bank headquartered in Manhattan, New York City, that constitutes the consumer and commercial banking subsidiary of the U.S. multinational banking and financial services holding company, JPMorgan Chase & Co. The bank was known as Chase Manhattan Bank until it merged with J.P. Morgan & Co. in 2000. Chase Manhattan Bank was formed by the merger of the Chase National Bank and The Manhattan Company in 1955. The bank has been headquartered in Columbus, Ohio since its merger with Bank One Corporation in 2004. The bank acquired the deposits and most assets of The Washington Mutual.

David M. Cote is an American businessman. Cote previously worked for General Electric and TRW Inc. before he was appointed chairman and chief executive officer (CEO) of Honeywell in 2002, following their acquisition by AlliedSignal. Cote also sat on the JP Morgan Chase risk committee during the period in which the firm lost $6 billion trading credit derivatives. Cote stepped down as CEO at Honeywell at the end of March 2017 and was succeeded by Darius Adamczyk.

Jamie Dimon is an American business executive. He is Chairman and CEO of JPMorgan Chase, the largest of the big four American banks, and previously served on the board of directors of the Federal Reserve Bank of New York. Dimon was included in Time magazine's 2006, 2008, 2009, and 2011 lists of the world's 100 most influential people. He was also on Institutional Investor's lists of best CEOs in the All-America Executive Team surveys from 2008 through 2011.

The Bear Stearns Companies, Inc. was a New York-based global investment bank, securities trading and brokerage firm that failed in 2008 as part of the global financial crisis and recession, and was subsequently sold to JPMorgan Chase. Its main business areas before its failure were capital markets, investment banking, wealth management, and global clearing services, and it was heavily involved in the subprime mortgage crisis.

Jacob Aharon Frenkel is an Israeli economist and the Chairman of JPMorgan Chase International. He served as Governor of the Bank of Israel between 1991 and 2000.

Alan David Schwartz is an American businessman and is the executive chairman of Guggenheim Partners, an investment banking firm based in Chicago and New York. He was previously the last president and chief executive officer of Bear Stearns when the Federal Reserve Bank of New York forced its March 2008 acquisition by JPMorgan Chase & Co..

The JPMorgan Chase Building is an office building in San Francisco, California, 560-584 Mission Street, on the border between South of Market and the Financial District. Designed by architect César Pelli, the building stands 128.02 m (420.0 ft) and has about 655,000 square feet (60,900 m2) of office space. It also has two levels of underground parking and a large plaza. About 400,000 sq ft (37,000 m2) of the building is leased to the major tenant JPMorgan Chase. This is one of many new highrise projects completed or under construction on Mission Street since 2000.

Green shoots is a term used colloquially and propagandistically to indicate signs of economic recovery during an economic downturn. It was first used in this sense by Norman Lamont, the then Chancellor of the Exchequer of the United Kingdom, during the 1991 Recession. At the time, Chancellor Lamont was criticized for "insensitivity". The phrase was used again by Baroness Vadera, former Business Minister of the UK in January, 2009 to refer to signs of economic recovery during the late-2000s recession, again to criticism from the media and opposition politicians. The U.S. media started to use the phrase to describe domestic economic conditions in February 2009 when in New York Times quoted Bruce Kasman, chief economist at JPMorgan Chase as saying, "It's too early to get excited, but I think there are a couple of green shoots that say we're not going down as heavily in the first quarter [of 2009] as we were in the fourth quarter [of 2008]." The Federal Reserve Chairman, Ben Bernanke, made the first public use of the phrase by a Fed official in a March 15, 2009 interview with CBS 60 Minutes. Since February and March 2009, it has been used increasingly in the media to refer to positive economic data and statistics during the late-2000s (decade) recession.

BofA Securities, previously Bank of America Merrill Lynch (BAML), is an American multinational investment bank division under the auspices of Bank of America. Not to be confused with Merrill, the wealth management division of Bank of America, both firms are broker-dealers and engage in prime brokerage.

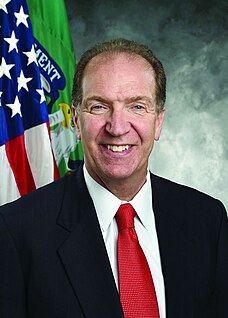

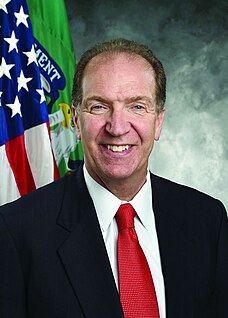

David Robert Malpass is an American economist who currently serves as Under Secretary of the Treasury for International Affairs. He previously served as Deputy Assistant Treasury Secretary under President Ronald Reagan, Deputy Assistant Secretary of State under President George H. W. Bush, and Chief Economist at Bear Stearns for the six years preceding its collapse. During the 2016 U.S. presidential election, Malpass served as an economic advisor to Donald Trump, and in 2017, he was nominated and confirmed as the undersecretary for international affairs in the United States Department of the Treasury.

Blythe Masters is a former executive at JPMorgan Chase. She is the former CEO of Digital Asset Holdings, a financial technology firm developing distributed ledger technology for wholesale financial services. Masters is widely credited as the creator of the credit default swap as a financial instrument. She is also Chairman of the Governing Board of the Linux Foundation’s open source Hyperledger Project, member of the International Advisory Board of Santander Group, and Advisory Board Member of the US Chamber of Digital Commerce.

John Phillip Lipsky is an American economist. He was the acting Managing Director of the International Monetary Fund from May to July 2011. He assumed the post of Acting Managing Director after Dominique Strauss-Kahn was arrested in May 2011 accused of sexual assault. After the appointment of Christine Lagarde he returned to his post as the First Deputy Managing Director of the IMF. He retired from the IMF in November 2011 and is currently a Distinguished Visiting Scholar at Johns Hopkins School of Advanced International Studies (SAIS).

In April and May 2012, large trading losses occurred at JPMorgan's Chief Investment Office, based on transactions booked through its London branch. The unit was run by Chief Investment Officer Ina Drew, who has since stepped down. A series of derivative transactions involving credit default swaps (CDS) were entered, reportedly as part of the bank's "hedging" strategy. Trader Bruno Iksil, nicknamed the London Whale, accumulated outsized CDS positions in the market. An estimated trading loss of US$2 billion was announced, with the actual loss expected to be substantially larger. These events gave rise to a number of investigations to examine the firm's risk management systems and internal controls.

Vittorio Grilli is an Italian economist and academic. He was Italy's economy and finances minister as part of the Monti cabinet from 2012 to 2013.

Barry L. Zubrow is an American business executive and investment banker. Spending most of his career at Goldman Sachs, including in key leadership roles, he subsequently served as the Chief Risk Officer of JPMorgan Chase during the 2008 financial crisis. He was later appointed the Head of Corporate and Regulatory Affairs at that company between January and November 2012.

The forex scandal is a financial scandal that involves the revelation, and subsequent investigation, that banks colluded for at least a decade to manipulate exchange rates for their own financial gain. Market regulators in Asia, Switzerland, the United Kingdom, and the United States began to investigate the $4.7 trillion-a-day foreign exchange market (forex) after Bloomberg News reported in June 2013 that currency dealers said they had been front-running client orders and rigging the foreign exchange benchmark WM/Reuters rates by colluding with counterparts and pushing through trades before and during the 60-second windows when the benchmark rates are set. The behavior occurred daily in the spot foreign-exchange market and went on for at least a decade according to currency traders.

Charles W. Scharf is an American businessman who was the chief executive officer of Visa Inc., the current CEO of BNY Mellon and a member of the Microsoft board of directors.

Frank J. Bisignano is an American businessman, and the Chairman and CEO of First Data. Based in New York City, Bisignano started his career as VP of both Shearson Lehman Brothers and First Fidelity Bank. Starting in 1994 he held a number of executive positions at Citigroup, with American Banker writing that "he got his payments industry bona fides at Citi by running its massive global transaction services unit." In 2004 the publication Treasury and Risk named him one of the "100 most influential people in finance."