Related Research Articles

An accountant is a practitioner of accounting or accountancy. Accountants who have demonstrated competency through their professional associations' certification exams are certified to use titles such as Chartered Accountant, Chartered Certified Accountant or Certified Public Accountant, or Registered Public Accountant. Such professionals are granted certain responsibilities by statute, such as the ability to certify an organization's financial statements, and may be held liable for professional misconduct. Non-qualified accountants may be employed by a qualified accountant, or may work independently without statutory privileges and obligations.

A patent attorney is an attorney who has the specialized qualifications necessary for representing clients in obtaining patents and acting in all matters and procedures relating to patent law and practice, such as filing patent applications and oppositions to granted patents.

Chartered accountants were the first accountants to form a professional accounting body, initially established in Scotland in 1854. The Edinburgh Society of Accountants (1854), the Glasgow Institute of Accountants and Actuaries (1854) and the Aberdeen Society of Accountants (1867) were each granted a royal charter almost from their inception. The title is an internationally recognised professional designation; the certified public accountant designation is generally equivalent to it. Women were able to become chartered accountants only following the Sex Disqualification (Removal) Act 1919 after which, in 1920, Mary Harris Smith was recognised by the Institute of Chartered Accountants in England and Wales and became the first woman chartered accountant in the world.

Founded in 1904, the Association of Chartered Certified Accountants (ACCA) is the global professional accounting body offering the Chartered Certified Accountant qualification (ACCA). It has 240,952 members and 541,930 future members worldwide. ACCA's headquarters are in London with principal administrative office in Glasgow. ACCA works through a network of over 110 offices and centres in 51 countries - with 346 Approved Learning Partners (ALP) and more than 7,600 Approved Employers worldwide, who provide employee development.

Institute of Chartered Accountants of India (ICAI) is India's largest professional accounting body under the administrative control of Ministry of Corporate Affairs, Government of India. It was established on 1 July 1949 as a statutory body under the Chartered Accountants Act, 1949 enacted by the Parliament for promotion, development and regulation of the profession of Chartered Accountancy in India.

The Institute of Financial Analysts of India (IFAI) was established in 1984 as a non-profit educational society in Hyderabad, Telangana, India. The institution has been offering education to students across India through its various programs in the field of higher education. The institution was founded by N. J. Yasaswy, Besant C. Raj and Dr. Prasanna Chandra, the Director of Centre for Financial Management.

West Bengal Joint Entrance Examination (WBJEE) is a state-government controlled centralized test, conducted by the West Bengal Joint Entrance Examinations Board for admission into Undergraduate Courses in Engineering/Technology, Pharmacy and Architecture of different Universities, Government Colleges as well as Self Financing, Private Institutes in the State of West Bengal.

The Civil Services Examination (CSE) is a standardized test in India conducted by the Union Public Service Commission for recruitment to higher civil services in the Government of India, such as the All India Services and Central Civil Services.

Primary School Achievement Test, also known as Ujian Pencapaian Sekolah Rendah, was a national examination taken by all students in Malaysia at the end of their sixth year in primary school before they leave for secondary school. It is prepared and examined by the Malaysian Examinations Syndicate, an agency that constitutes the Ministry of Education.

The Institute of Chartered Accountants of Pakistan is a professional accountancy body in Pakistan. It has over 10,000 members working locally and globally. The institute was established on July 1, 1961 to regulate the profession of accountancy in Pakistan. It is a statutory autonomous body established under the Chartered Accountants Ordinance, 1961. With the significant growth in the profession, the CA Ordinance and By-Laws were revised in 1983.

The State Entrance Examination - Uttar Pradesh Technical University(SEE-UPTU) is an annual college entrance examination in Uttar Pradesh for engineering, architecture, pharmacy and management courses. All institutions affiliated to Dr. A.P.J. Abdul Kalam Technical University admit students through centralized counselling of SEE-UPTU. The private institutions may, however, admit 15% of the total intake directly. The exam is conducted by Dr. A.P.J. Abdul Kalam Technical University. It is one of the highly reputed exams of India.

The Association of International Accountants (AIA) is a professional accountancy body. It was founded in the UK in 1928 and since that date has promoted the concept of ‘international accounting’ to create a global network of accountants in over 85 countries worldwide.

Institute of Corporate Secretaries of Pakistan (ICSP) was established on 22 November 1973 as a company limited by guarantee, under the then Indian Companies Act 1913, later substituted by the Companies Ordinance 1984. Since incorporation, the ICSP is functioning as the only recognized professional body of corporate secretaries which is imparting professional education and prudence in the areas of secretarial practice. Besides, equipping the students with knowledge for meeting challenges of modern corporate and financial world, the ICSP is also providing commands in the subjects of corporate & business laws, corporate governance, accounting, administration, management, human resource, business ethics and information technology. As a matter of fact the Corporate Secretaries should have caliber to chart a course of action or take decisions in accordance with regulations, legislations, precedents, traditions, best practices and to oversee that the operations of the organization are moving effectively/efficiently towards its objectives and goals.

Before 2021, Rajasthan Pre-Engineering Test (RPET) was the state-level entrance examination for undergraduate engineering programs in Rajasthan State, India.

The Central Board of Secondary Education (CBSE) is a national level board of education in India for public and private schools, controlled and managed by the Government of India. Established in 1929 by a resolution of the government, the Board was an experiment towards inter-state integration and cooperation in the sphere of secondary education. There are more than 27,000 schools in India and 240 schools in 28 foreign countries affiliated to the CBSE. All schools affiliated to CBSE follow the NCERT curriculum especially from class 9 to 12. The current Chairperson of CBSE is Rahul Singh, IAS.

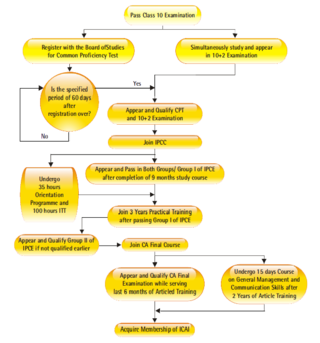

The CPT or Common Proficiency Test was the first level of Chartered Accountancy examinations in India which has been changed to CA Foundation according to ICAI's revised scheme.

The CA Foundation Course is the entrance level for the chartered accountancy course offered by the Institute of Chartered Accountants of India (ICAI). Earlier, it was known as the Common Proficiency Test. CA Foundation contains 5 series of papers. The CA Foundation exam replaced the CA-CPT exam and now is conducted by the Institute of Chartered Accountants of India (ICAI) thrice a year. After the CA Foundation exam, students need to complete the Intermediate and Final levels as well to become a chartered accountant

CA Intermediate is the second level exam, of a course in India, Chartered Accountancy. It has six subjects and over 7000 pages of study material that a student is expected to cover in the nine months study period allotted to them.

In India, a Chartered Accountant is a qualified accountant of the Institute of Chartered Accountants of India. Chartered Accountant is one of most respectful profession in commerce stream. They have knowledge of various subjects like accounting, auditing, corporate laws, costing and various aspects of direct and indirect taxation.

A Company Secretary in India is a qualified secretary of the Institute of Company Secretaries of India (ICSI). Prerequisites for membership are successful completions of the ISCI’s theory and practical training exams. Company Secretaries are required for every Indian Company listing on the stock exchange, public or private, with share capitals of Rs 10 crores or higher. As a qualified professional, a company secretary is required to perform the duties enumerated by the ICSI for organisations engaged in manufacturing or service for ensuring proper compliance with legal and taxation-related controls to be followed through the course of its operations. These policies clear any ambiguities for the organisations in the maintenance of their book of accounts. The ICSI has +70000 Company Secretaries. Their roles include facilitating meetings of the Board of Directors, providing guidance on formation, mergers and liquidations and representing the company in arbitration or the Company Law Board, among other tasks.

References

- ↑ Kachhap, Avik (20 July 2024). "CA FINAL - INFORMATION AND GUIDANCE FOR APPLICANTS" (PDF).

- ↑ Kachhap, Ian (20 July 2024). "CA Final Exam" (PDF).

- ↑ Kachhap, Avik (20 July 2024). "ICAI prospectus" (PDF).