An accountant is a practitioner of accounting or accountancy. Accountants who have demonstrated competency through their professional associations' certification exams are certified to use titles such as Chartered Accountant, Chartered Certified Accountant or Certified Public Accountant, or Registered Public Accountant. Such professionals are granted certain responsibilities by statute, such as the ability to certify an organization's financial statements, and may be held liable for professional misconduct. Non-qualified accountants may be employed by a qualified accountant, or may work independently without statutory privileges and obligations.

The Institute of Chartered Accountants of Scotland (ICAS) is the world's first professional body of Chartered Accountants (CAs).

Chartered accountants were the first accountants to form a professional accounting body, initially established in Scotland in 1854. The Edinburgh Society of Accountants (1854), the Glasgow Institute of Accountants and Actuaries (1854) and the Aberdeen Society of Accountants (1867) were each granted a royal charter almost from their inception. The title is an internationally recognised professional designation; the certified public accountant designation is generally equivalent to it. Women were able to become chartered accountants only following the Sex Disqualification (Removal) Act 1919 after which, in 1920, Mary Harris Smith was recognised by the Institute of Chartered Accountants in England and Wales and became the first woman chartered accountant in the world.

Founded in 1904, the Association of Chartered Certified Accountants (ACCA) is the global professional accounting body offering the Chartered Certified Accountant qualification (ACCA). It has 240,952 members and 541,930 future members worldwide. ACCA's headquarters are in London with principal administrative office in Glasgow. ACCA works through a network of over 110 offices and centres in 51 countries - with 346 Approved Learning Partners (ALP) and more than 7,600 Approved Employers worldwide, who provide employee development.

Institute of Chartered Accountants of India (ICAI) is India's largest professional accounting body under the administrative control of Ministry of Corporate Affairs, Government of India. It was established on 1 July 1949 as a statutory body under the Chartered Accountants Act, 1949 enacted by the Parliament for promotion, development and regulation of the profession of Chartered Accountancy in India.

The Institute of Financial Analysts of India (IFAI) was established in 1984 as a non-profit educational society in Hyderabad, Telangana, India. The institution has been offering education to students across India through its various programs in the field of higher education. The institution was founded by N. J. Yasaswy, Besant C. Raj and Dr. Prasanna Chandra, the Director of Centre for Financial Management.

The School of Accounting and Finance (SAF) at University of Waterloo is a professional school within the Faculty of Arts. The School was established in 1980 under the name 'School of Accountancy'. Its name was changed in 2008 to better reflect its program offering. Today, more than 1,600 students are enrolled in the School's programs. In September 2009, a new 52,000 square feet (5,000 m2) building was officially opened to house the School.

The Institute of Cost Accountants of India (ICMAI), which was previously known as The Institute of Cost & Works Accountants of India (ICWAI) is a professional accountancy body in India. It is under the ownership of the Ministry of Corporate Affairs of the Government of India. It has as its prime responsibility to contribute to the cost and management accounting profession at the global level.

Following is a partial list of professional certifications in financial services, with an overview of the educational and continuing requirements for each; see Professional certification § Accountancy, auditing and finance and Category:Professional certification in finance for all articles. As the field of finance has increased in complexity in recent years, the number of available designations has grown, and, correspondingly, some will have more recognition than others. Note that in the US, many state securities and insurance regulators do not allow financial professionals to use a designation — in particular a "senior" designation — unless it has been accredited by either the American National Standards Institute or the National Commission for Certifying Agencies.

The Association of International Accountants (AIA) is a professional accountancy body. It was founded in the UK in 1928 and since that date has promoted the concept of ‘international accounting’ to create a global network of accountants in over 85 countries worldwide.

The Pakistan Institute of Public Finance Accountants (PIPFA) is an autonomous body recognized mainly in the government sector and established under license from the Securities and Exchange Commission of Pakistan by the authority given under section 42 of the Companies Ordinance, 1984.

Institute of Corporate Secretaries of Pakistan (ICSP) was established on 22 November 1973 as a company limited by guarantee, under the then Indian Companies Act 1913, later substituted by the Companies Ordinance 1984. Since incorporation, the ICSP is functioning as the only recognized professional body of corporate secretaries which is imparting professional education and prudence in the areas of secretarial practice. Besides, equipping the students with knowledge for meeting challenges of modern corporate and financial world, the ICSP is also providing commands in the subjects of corporate & business laws, corporate governance, accounting, administration, management, human resource, business ethics and information technology. As a matter of fact the Corporate Secretaries should have caliber to chart a course of action or take decisions in accordance with regulations, legislations, precedents, traditions, best practices and to oversee that the operations of the organization are moving effectively/efficiently towards its objectives and goals.

Accounting Technicians Ireland is an organisation providing accounting education in Ireland. They have over 10,000 members and students in the Republic of Ireland and in Northern Ireland.

The actuarial credentialing and exam process usually requires passing a rigorous series of professional examinations, most often taking several years in total, before one can become recognized as a credentialed actuary. In some countries, such as Denmark, most study takes place in a university setting. In others, such as the U.S., most study takes place during employment through a series of examinations. In the UK, and countries based on its process, there is a hybrid university-exam structure.

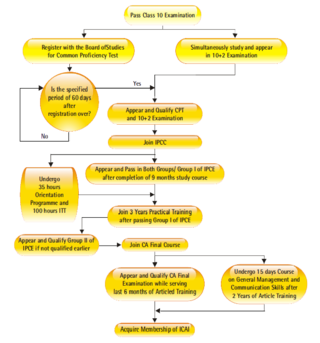

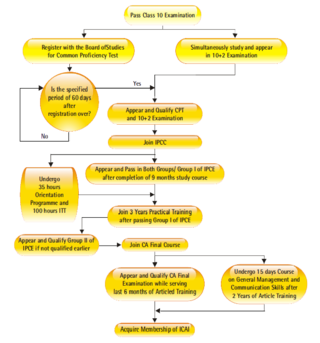

The CPT or Common Proficiency Test was the first level of Chartered Accountancy examinations in India which has been changed to CA Foundation according to ICAI's revised scheme.

Western India Regional Council, abbreviated as WIRC of ICAI is one of the five Regional Councils of Institute of Chartered Accountants of India (ICAI) and the largest among them. It is located in Mumbai and serves a membership of more than 85000 Chartered Accountants and circa 225000 CA students, in a network of 32 branches in the three states of Maharashtra, Gujarat, Goa and two Union Territories of Daman and Diu and Dadra and Nagar Haveli.

The Institute of Certified Management Accountants of Sri Lanka, is a professional body offering qualification in management accountancy in Sri Lanka.

Chartered Professional Accountants of Canada is the national organization representing the Canadian accounting profession through the unification of the three largest accounting organizations: the Canadian Institute of Chartered Accountants (CICA), the Society of Management Accountants of Canada and Certified General Accountants of Canada (CGA-Canada), as well as the 40 national and provincial accounting bodies. It is one of the largest organizations of its type in the world, with over 217,000 Chartered Professional Accountants in Canada and around the world.

The CA Foundation Course is the entrance level for the chartered accountancy course offered by the Institute of Chartered Accountants of India (ICAI). Earlier, it was known as the Common Proficiency Test. CA Foundation contains 5 series of papers. The CA Foundation exam replaced the CA-CPT exam and now is conducted by the Institute of Chartered Accountants of India (ICAI) thrice a year. After the CA Foundation exam, students need to complete the Intermediate and Final levels as well to become a chartered accountant

In India, a Chartered Accountant is a qualified accountant of the Institute of Chartered Accountants of India. Chartered Accountant is one of most respectful profession in commerce stream. They have knowledge of various subjects like accounting, auditing, corporate laws, costing and various aspects of direct and indirect taxation.