Related Research Articles

A wealth tax is a tax on an entity's holdings of assets. This includes the total value of personal assets, including cash, bank deposits, real estate, assets in insurance and pension plans, ownership of unincorporated businesses, financial securities, and personal trusts. Typically, liabilities are deducted from an individual's wealth, hence it is sometimes called a net wealth tax.

Sir Anthony Barnes Atkinson was a British economist, Centennial Professor at the London School of Economics, and senior research fellow of Nuffield College, Oxford.

Sir Timothy John Besley, is a British academic economist who is the School Professor of Economics and Political Science and Sir W. Arthur Lewis Professor of Development Economics at the London School of Economics (LSE).

Sir Richard William Blundell CBE FBA is a British economist and econometrician.

Konstantinos "Costas" Meghir is a Greek-British economist. He studied at the University of Manchester where he graduated with a Ph.D. in 1985, following an MA in economics in 1980 and a BA in Economics and Econometrics in 1979. In 1997 he was awarded the Bodosakis foundation prize and in 2000 he was awarded the “Ragnar Frisch Medal” for his article “Estimating Labour Supply Responses using Tax Reforms”.

The Paris School of Economics is a French research institute in the field of economics. It offers MPhil, MSc, and PhD level programmes in various fields of theoretical and applied economics, including macroeconomics, econometrics, political economy and international economics.

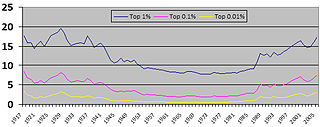

Emmanuel Saez is a French, naturalized American economist who is Professor of Economics at the University of California, Berkeley. His work, done with Thomas Piketty and Gabriel Zucman, includes tracking the incomes of the poor, middle class and rich around the world. Their work shows that top earners in the United States have taken an increasingly larger share of overall income over the last three decades, with almost as much inequality as before the Great Depression. He recommends much higher (marginal) taxes on the rich, up to 70% or 90%. He received the John Bates Clark Medal in 2009, a MacArthur "Genius" Fellowship in 2010, and an honorary degree from Harvard University in 2019.

Thomas Piketty is a French economist who is Professor of Economics at the School for Advanced Studies in the Social Sciences, Associate Chair at the Paris School of Economics and Centennial Professor of Economics in the International Inequalities Institute at the London School of Economics.

The Great Compression refers to "a decade of extraordinary wage compression" in the United States in the early 1940s. During that time, economic inequality as shown by wealth distribution and income distribution between the rich and poor became much smaller than it had been in preceding time periods. The term was reportedly coined by Claudia Goldin and Robert Margo in a 1992 paper, and is a takeoff on the Great Depression, an event during which the Great Compression started.

Adriana Debora Kugler is a Colombian-American economist. She is the U.S. Executive Director at the World Bank, nominated by President Biden and confirmed by the U.S. Senate last April. She is a professor of public policy at Georgetown University and she is currently on leave from her tenured position at Georgetown. She served as the Chief Economist to U.S. Labor Secretary Hilda L. Solis from September 6, 2011 to January 4, 2013.

Emmanuel Farhi was a French economist and professor of economics at Harvard University. His research focused on macroeconomics, taxation and finance. He was a member of the French Economic Analysis Council to the French Prime Minister from 2010 to 2012.

Gabriel Zucman is a French economist who is currently an associate professor of public policy and economics at the University of California, Berkeley‘s Goldman School of Public Policy. The author of The Hidden Wealth of Nations: The Scourge of Tax Havens (2015), Zucman is known for his research on tax havens and corporate tax havens.

Julia Cagé is a French economist specializing in development economics, political economy, and economic history.

Yann Algan is a French economist, Associate Dean of Pre-experience Programs and Professor of Economics at HEC Paris. He was previously and until 2021 a Professor of Economics of Sciences Po, where he was dean of the School of Public Affairs. His research interests include the digital economy, social capital and well-being. In 2009, Yann Algan was awarded the Prize of the Best Young Economist of France for his contributions to economics in France.

Pierre Cahuc is a French economist who currently works as Professor of Economics at Sciences Po. He is Program Director for the IZA Institute of Labor Economics's programme "Labour Markets" and research fellow at CEPR. His research focuses mainly on labour economics and its relationship with macroeconomics. In 2001, he was awarded the Prize of the Best Young Economist of France for his contributions to economic research. He belongs to the most highly cited economists in France and Europe's leading labour economists.

Stéfanie Stantcheva is a Bulgarian-born French economist who is the Nathaniel Ropes Professor of Political Economy at Harvard University. She is a member of the French Council of Economic Analysis. Her research focuses on public finance—in particular questions of optimal taxation. In 2018, she was selected by The Economist as one of the 8 best young economists of the decade. In 2020, she was awarded the Elaine Bennett Research Prize. In 2021, she received the Prix Maurice Allais.

World Inequality Database (WID), previously The World Wealth and Income Database, also known as WID.world, is an extensive, open and accessible database "on the historical evolution of the world distribution of income and wealth, both within countries and between countries".

Henrik Jacobsen Kleven is a Danish economist who is currently a Professor of Economics and Public Affairs at Princeton University. He is also Co-Editor of the American Economic Review. His research lies inside the domain of Public Economics and Inequality, in particular questions about tax policy and welfare programs. He combines economic theory and empirical evidence to show ways of designing more effective public policies. His work has had policy impact in both developed and developing countries.

Jozef (Joep) Konings is a Belgian economist and Professor in Economics at KU Leuven. He is director of research and full professor at the Nazarbayev University Graduate School of Business in Kazakhstan NUGSB, director of the Flemish Institute for Economics and Science (VIVES) at KU Leuven and research fellow of the Center for Economic Policy Research (CEPR) in London. He is a former advisor in economics for the Barroso cabinet in the European Commission, in the Bureau of European Policy Advisers (BEPA).

Paola Giuliano is an economist and currently the Justice Elwood Lui Endowed Term Chair in Management Professor of Management at the University of California, Los Angeles.

References

- ↑ Profile of Camille Landais on the website of LSE. Retrieved May 6th, 2018.

- ↑ Profile of Camille Landais on the website of IZA. Retrieved May 6th, 2018.

- ↑ Le Cercle des économistes (May 23rd, 2016). Camille Landais Prix du meilleur jeune économiste 2016. Le Monde. Retrieved May 6th, 2018.

- ↑ Curriculum vitae of Camille Landais from the website of LSE. Retrieved May 6th, 2018.

- ↑ "Fellows | EEA". www.eeassoc.org. Retrieved 2021-03-24.

- ↑ Profile of Camille Landais on the website of IZA. Retrieved May 6, 2018.

- ↑ Kleven, H.J. et al. (2013). Migration and wage effects of taxing top earners: Evidence from the foreigners' tax scheme in Denmark. Quarterly Journal of Economics, 129(1), pp. 333–378.

- ↑ Kleven, H.J., Landais, C., Saez, E. (2013). Taxation and international migration of superstars: Evidence from the European football market (with Kleven and Saez). American Economic Review, 103(5), pp. 1892–1924.