Related Research Articles

Actuarial science is the discipline that applies mathematical and statistical methods to assess risk in insurance, pension, finance, investment and other industries and professions.

Life insurance is a contract between an insurance policy holder and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person. Depending on the contract, other events such as terminal illness or critical illness can also trigger payment. The policyholder typically pays a premium, either regularly or as one lump sum. The benefits may include other expenses, such as funeral expenses.

The Independent Order of Foresters, operating as Foresters Financial, is a fraternal benefit society headquartered in Toronto, Ontario, Canada, that provides life insurance and other financial solutions in Canada, the United Kingdom, and the United States. As of 2022, Louis Gagnon has served as the company's president and CEO.

Knights of the Maccabees was a fraternal organization formed in 1878 in London, Ontario, Canada. Most active in the U.S. state of Michigan, the group's fraternal aspects took a backseat to providing low-cost insurance to members. In the society's early years it also provided other final-expense related benefits such as society cemeteries.

The Knights of Honor, was a fraternal order and secret society in the United States in the late 19th and early 20th century. The Knights were one of the most successful fraternal beneficiary societies of its time.

The Brotherhood of Locomotive Firemen and Enginemen was a North American railroad fraternal benefit society and trade union in the 19th and 20th centuries. The organization began in 1873 as the Brotherhood of Locomotive Firemen, a mutual benefit society for workers employed as firemen for steam locomotives, before expanding its name in 1907 in acknowledgement that many of its members had been promoted to the job of railroad engineer. Gradually taking on the functions of a trade union over time, in 1969 the B of LF&E merged with three other railway labor organizations to form the United Transportation Union.

The Canadian Institute of Actuaries (CIA) is the national organization of the actuarial profession in Canada. It was incorporated March 18, 1965. The FCIA designation stands for Fellow of the Canadian Institute of Actuaries. As the national organization of the Canadian actuarial profession, the CIA serves the public through the provision by the profession of actuarial services and advice by: representing the Canadian actuarial profession in the formulation of public policy; promoting the advancement of actuarial science; educating and qualifying CIA members; ensuring that actuarial services provided by its members meet accepted professional standards; and assisting actuaries in Canada in the discharge of their professional responsibilities.

A benefit society, fraternal benefit society, fraternal benefit order, friendly society, or mutual aid organization is a voluntary association formed to provide mutual aid, benefit, for instance insurance for relief from sundry difficulties. Such organizations may be formally organized with charters and established customs or may arise ad hoc to meet the unique needs of a particular time and place.

The Order of Scottish Clans was a fraternal and benevolent society The dual purpose of the Order was to provide life and disability insurance to Scottish immigrants and their descendants, and also to preserve the culture and traditions of Scotland among Americans of Scottish ancestry.

Catholic Financial Life (CFL) is a Milwaukee-based life insurer and fraternal organization. It is one of the largest Roman Catholic not-for-profit financial services organizations in the United States, second only to the Knights of Columbus. Fraternal benefits societies are nonprofit membership organizations that designate a portion of their income for charity.

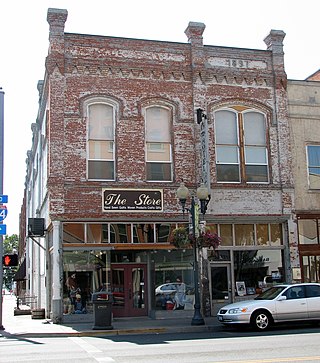

The Ancient Order of United Workmen (AOUW) was a fraternal organization in the United States and Canada, providing mutual social and financial support after the American Civil War. It was the first of the "fraternal benefit societies", organizations that would offer insurance as well as sickness, accident, death and burial policies. It dissolved in 1952.

The Supreme Council of the Royal Arcanum, commonly known simply as the Royal Arcanum, is a fraternal benefit society founded in 1877 in Boston, Massachusetts by John A. Cummings and Darius Wilson, who had previously been among the founders of the Knights of Honor, a similar organization, in Kentucky. The Royal Arcanum home office is located in Boston, Massachusetts.

The American Legion of Honor was a fraternal benefit order that was active in the late 19th century and early 20th century. In its heyday, it was one of the best known benefit societies.

The Order of Chosen Friends was a fraternal benefit order that existed in North America in the late nineteenth and early twentieth centuries. The group suffered a number of splits during its lifetime, leading scholar Alan Axelrod to call it "almost a parody" of fraternal benefit societies of the time.

United Commercial Travellers or UCT is a non-profit organization that supports communities and causes across the United States and Canada. The organization is headquartered in Columbus, Ohio, and Grandview Heights.

Teachers Life Insurance Society (Fraternal), operating as Teachers Life, is a Canadian fraternal benefit society which provides life insurance and disability insurance to members in Alberta, British Columbia and Ontario.

The National Fraternal Society of the Deaf was an organization of deaf people in the United States and Canada modeled on ethnic fraternal orders that were popular at the beginning of the twentieth century.

Brotherhood of American Yeomen was a coeducational North American secret fraternal benefit society organized in 1897. In 1932, the organization was changed to a mutual, legal reserve, level premium company.

References

- 1 2 3 4 5 6 7 8 9 Preuss, Arthur (1924). "Canadian Order of Chosen Friends". A Dictionary of Secret and Other Societies ... B. Herder Book Company. pp. 85–87. Retrieved 14 October 2024.

This article incorporates text from this source, which is in the public domain .

This article incorporates text from this source, which is in the public domain . - ↑ Thorold and Beaverdams Historical Society (1898). Jubilee History of Thorold, Township and Town, from the Time of the Red Man to the Present. Thorold Post Print. and Publishing Company. pp. 182–83. Retrieved 14 October 2024.

This article incorporates text from this source, which is in the public domain .

This article incorporates text from this source, which is in the public domain . - 1 2 "Name Changed". The Expositor. 22 July 1943. p. 6. Retrieved 14 October 2024– via Newspapers.com.

- 1 2 Landis, Abb (1906). Analyses of Fraternal Societies: And Illustrations of Premium Computations. The author. p. 46. Retrieved 14 October 2024.

This article incorporates text from this source, which is in the public domain .

This article incorporates text from this source, which is in the public domain . - ↑ Langford, H. E. (29 December 1964). "Trust companies close '64 on a high note". The Hamilton Spectator. p. 36. Retrieved 14 October 2024– via Newspapers.com.

- ↑ "Reliable Life Insurance Company History". reliablelifeinsurance.com. Retrieved 30 January 2015.

- ↑ "ROYGBIV". The Kingston Whig-Standard. 26 January 1991. p. 123. Retrieved 14 October 2024– via Newspapers.com.