Swiss Re Ltd is a Swiss reinsurance company founded in 1863 and headquartered in Zürich, Switzerland. It is one of the world's largest reinsurers, as measured by gross premiums written. Swiss Re operates through around 80 offices in 29 countries and employs over 14,000 people. It was ranked 519th on the Forbes Global 2000 list and ranked 316th on the Fortune Global 500 in 2023. Swiss Re is listed on the SIX Swiss Exchange.

Reinsurance is insurance that an insurance company purchases from another insurance company to insulate itself from the risk of a major claims event. With reinsurance, the company passes on ("cedes") some part of its own insurance liabilities to the other insurance company. The company that purchases the reinsurance policy is referred to as the "ceding company" or "cedent". The company issuing the reinsurance policy is referred to as the "reinsurer". In the classic case, reinsurance allows insurance companies to remain solvent after major claims events, such as major disasters like hurricanes or wildfires. In addition to its basic role in risk management, reinsurance is sometimes used to reduce the ceding company's capital requirements, or for tax mitigation or other purposes.

Earthquake insurance is a form of property insurance that pays the policyholder in the event of an earthquake that causes damage to the property. Most ordinary homeowners insurance policies do not cover earthquake damage.

Weather derivatives are financial instruments that can be used by organizations or individuals as part of a risk management strategy to reduce risk associated with adverse or unexpected weather conditions. Weather derivatives are index-based instruments that usually use observed weather data at a weather station to create an index on which a payout can be based. This index could be total rainfall over a relevant period—which may be of relevance for a hydro-generation business—or the number where the minimum temperature falls below zero which might be relevant for a farmer protecting against frost damage.

Crop insurance is insurance purchased by agricultural producers and subsidized by a country's government to protect against either the loss of their crops due to natural disasters, such as hail, drought, and floods, or the loss of revenue due to declines in the prices of agricultural commodities.

Catastrophe modeling is the process of using computer-assisted calculations to estimate the losses that could be sustained due to a catastrophic event such as a hurricane or earthquake. Cat modeling is especially applicable to analyzing risks in the insurance industry and is at the confluence of actuarial science, engineering, meteorology, and seismology.

Parametric insurance is a non-traditional insurance product that offers pre-specified payouts based upon a trigger event. Trigger events depend on the nature of the parametric policy and can include environmental triggers such as wind speed and rainfall measurements, business-related triggers such as foot traffic, and more. Examples of current parametric products include the Caribbean Catastrophe Risk Insurance Facility (CCRIF), the African Risk Capacity (ARC), and the protection of coral reefs in the state of Quintana Roo in Mexico.

Catastrophe bonds are a subset of insurance-linked securities (ILS) that transfer a specified set of risks from a sponsor to investors. They were created and first used in the mid-1990s in the aftermath of Hurricane Andrew and the Northridge earthquake.

The Association for Cooperative Operations Research and Development (ACORD) is a non-profit organization in the insurance industry. ACORD publishes and maintains an archive of standardized forms. ACORD has also developed a comprehensive library of electronic data standards with more than 1200 standardized transaction types to support exchange of insurance data between trading partners. ACORD itself, though, is not an insurance company and does not process claims or provide insurance coverage of any kind.

CRESTA (Catastrophe Risk Evaluation and Standardizing Target Accumulations) is a global natural hazard risk categorization system for insurance and re-insurance companies.

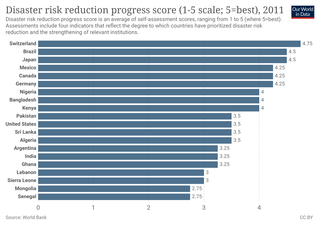

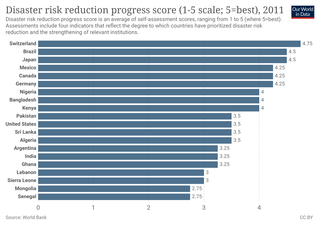

Disaster risk reduction aims to make disasters less likely to happen. The approach, also called DRR or disaster risk management, also aims to make disasters less damaging when they do occur. DRR aims to make communities stronger and better prepared to handle disasters. In technical terms, it aims to make them more resilient or less vulnerable. When DRR is successful, it makes communities less the vulnerable because it mitigates the effects of disasters. This means DRR can make risky events fewer and less severe. Climate change can increase climate hazards. So development efforts often consider DRR and climate change adaptation together.

The Weather Info for All (WIFA) Initiative is a public-private partnership that works to reinforce the capacities and the capabilities of national meteorological services with the goal of supporting local communities worst impacted by climate change through the improvement of weather monitoring. "By bringing together the expertise and resources of different public and private actors, this project may help to save lives and improve the livelihoods of communities in Africa living on the frontlines of climate change." Kofi Annan, President of the Global Humanitarian Forum. The Forum, together with Ericsson, the World Meteorological Organization, National Meteorological Services (NMSs), the Earth Institute at Columbia University, as well as Zain and other mobile phone operators aim to deploy up to 5,000 automatic weather stations (AWSs) at wireless network sites across Africa, where less than 300 are reporting today.

The United Nations Environment Programme Finance Initiative is a partnership between the United Nations Environment Program (UNEP) and the global financial sector to catalyse action across the financial system to align economies with sustainable development. As the UN partner for the finance sector, they convene financial institutions on a voluntary basis to work together with them, and each other, to find practical solutions to overcome the many sustainability challenges facing the world today. UNEP FI does this by providing practical guidance and tools which support institutions in the finance sector to find ways to reshape their businesses and commit to targets for limiting greenhouse gas emissions, protecting nature, promoting a circular economy and supporting financial inclusion to address inequality. The solutions developed effectively form a blueprint for others in the finance sector to tackle similar challenges and evolve their businesses along a sustainable pathway. The creation and adoption of such a blueprint also informs policy makers concerned with sustainability issues about what would constitute appropriate regulation for the finance sector at large. Founded in 1992, UNEP FI was the first organisation to pioneer engagement with the finance sector around sustainability. The Finance Initiative was responsible for incubating the Principles for Responsible Investment and for the development and implementation of UNEP FI's Principles for Responsible Banking and Principles for Sustainable Insurance as well as the UN-convened net-zero alliances. Today, UNEP FI provides sustainability leadership to more than 400 financial institutions, with assets of well over $80 trillion headquartered around the world.

Richard L. Sandor is an American businessman, economist, and entrepreneur. He is chairman and CEO of the American Financial Exchange (AFX) established in 2015, which is an electronic exchange for direct interbank/financial institution lending and borrowing. The AFX flagship product, the AMERIBOR benchmark index, reflects the actual borrowing costs of thousands of regional and community banks across the U.S. and is one of the short-term borrowing rates, along with the Secured Overnight Financing Rate, vying to replace U.S. dollar Libor as a benchmark in the U.S.

Caribbean Catastrophe Risk Insurance Facility Segregated Portfolio Company is an insurance company headquartered in the Cayman Islands. The sixteen original member-countries of CCRIF included participants in CARICOM, and the membership of the Board of Directors is selected by CARICOM and by the Caribbean Development Bank.

Index-based insurance, also known as index-linked insurance, weather-index insurance or, simply, index insurance, is primarily used in agriculture. Because of the high cost of assessing losses, traditional insurance based on paying indemnities for actual losses incurred is usually not viable, particularly for smallholders in developing countries. With index-based insurance, payouts are related to an “index” that is closely correlated to agricultural production losses, such as one based on rainfall, yield or vegetation levels. Payouts are made when the index exceeds a certain threshold, often referred to as a “trigger”. By making payouts according to an index instead of individual claims, providers can circumvent the transaction costs associated with claims assessments. Index-based insurance is therefore not designed to protect farmers against every peril, but only where there is a widespread risk that significantly influences a farmer’s livelihood. Many such indices now make use of satellite imagery.

Climate risk insurance is a type of insurance designed to mitigate the financial and other risk associated with climate change, especially phenomena like extreme weather. The insurance is often treated as a type of insurance needed for improving the climate resilience of poor and developing communities. It provides post-disaster liquidity for relief and reconstruction measures while also preparing for the future measures in order to reduce climate change vulnerability. Insurance is considered an important climate change adaptation measure.

African Risk Capacity Limited or simply ARC Ltd, is an African insurer which provides parametric insurance services for climate change and health risks to the member states of the African Union. ARC Ltd was founded in 2014 as a financial affiliate of the African Risk Capacity (ARC), a specialized agency of the African Union. As of January 2024, ARC Ltd works as a mutual insurance facility comprising 39 African member countries, and its capital contributors including USAID, SDC, FCDO, KFW/BMZ, IFAD, AFDB, WFP and START NETWORK.

The effects of climate change on extreme weather events is requiring the insurance industry in the United States to recalculate risk assessments for various types of insurance. From 1980 to 2005, private and federal government insurers in the United States paid $320 billion in constant 2005 dollars in claims due to weather-related losses while the total amount paid in claims annually generally increased, and 88% of all property insurance losses in the United States from 1980 to 2005 were weather-related. Annual insured natural catastrophe losses in the United States grew 10-fold in inflation-adjusted terms from $49 billion in total from 1959 to 1988 to $98 billion in total from 1989 to 1998, while the ratio of premium revenue to natural catastrophe losses fell six-fold from 1971 to 1999 and natural catastrophe losses were the primary factor in 10% of the approximately 700 U.S. insurance company insolvencies from 1969 to 1999 and possibly a contributing factor in 53%.