Related Research Articles

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to protect against the risk of a contingent or uncertain loss.

Life insurance is a contract between an insurance policy holder and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person. Depending on the contract, other events such as terminal illness or critical illness can also trigger payment. The policyholder typically pays a premium, either regularly or as one lump sum. The benefits may include other expenses, such as funeral expenses.

Variable universal life insurance is a type of life insurance that builds a cash value. In a VUL, the cash value can be invested in a wide variety of separate accounts, similar to mutual funds, and the choice of which of the available separate accounts to use is entirely up to the contract owner. The 'variable' component in the name refers to this ability to invest in separate accounts whose values vary—they vary because they are invested in stock and/or bond markets. The 'universal' component in the name refers to the flexibility the owner has in making premium payments. The premiums can vary from nothing in a given month up to maximums defined by the Internal Revenue Code for life insurance. This flexibility is in contrast to whole life insurance that has fixed premium payments that typically cannot be missed without lapsing the policy.

Term life insurance or term assurance is life insurance that provides coverage at a fixed rate of payments for a limited period of time, the relevant term. After that period expires, coverage at the previous rate of premiums is no longer guaranteed and the client must either forgo coverage or potentially obtain further coverage with different payments or conditions. If the life insured dies during the term, the death benefit will be paid to the beneficiary. Term insurance is typically the least expensive way to purchase a substantial death benefit on a coverage amount per premium dollar basis over a specific period of time.

Universal life insurance is a type of cash value life insurance, sold primarily in the United States. Under the terms of the policy, the excess of premium payments above the current cost of insurance is credited to the cash value of the policy, which is credited each month with interest. The policy is debited each month by a cost of insurance (COI) charge as well as any other policy charges and fees drawn from the cash value, even if no premium payment is made that month. Interest credited to the account is determined by the insurer but has a contractual minimum rate. When an earnings rate is pegged to a financial index such as a stock, bond or other interest rate index, the policy is an "Indexed universal life" contract. Such policies offer the advantage of guaranteed level premiums throughout the insured's lifetime at a substantially lower premium cost than an equivalent whole life policy at first. The cost of insurance always increases, as is found on the cost index table. That not only allows for easy comparison of costs between carriers but also works well in irrevocable life insurance trusts (ILITs) since cash is of no consequence.

Property insurance provides protection against most risks to property, such as fire, theft and some weather damage. This includes specialized forms of insurance such as fire insurance, flood insurance, earthquake insurance, home insurance, or boiler insurance. Property is insured in two main ways—open perils and named perils.

Whole life insurance, or whole of life assurance, sometimes called "straight life" or "ordinary life", is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date. As a life insurance policy it represents a contract between the insured and insurer that as long as the contract terms are met, the insurer will pay the death benefit of the policy to the policy's beneficiaries when the insured dies. Because whole life policies are guaranteed to remain in force as long as the required premiums are paid, the premiums are typically much higher than those of term life insurance where the premium is fixed only for a limited term. Whole life premiums are fixed, based on the age of issue, and usually do not increase with age. The insured party normally pays premiums until death, except for limited pay policies which may be paid up in 10 years, 20 years, or at age 65. Whole life insurance belongs to the cash value category of life insurance, which also includes universal life, variable life, and endowment policies.

A fidelity bond or fidelity guarantee is a form of insurance protection that covers policyholders for losses that they incur as a result of fraudulent acts by specified individuals. It usually insures a business for losses caused by the dishonest acts of its employees.

Ronald Clark O'Bryan, nicknamed The Candy Man and The Man Who Killed Halloween, was an American man convicted of killing his eight-year-old son Timothy on Halloween 1974 with a potassium cyanide-laced Pixy Stix that was ostensibly collected during a trick or treat outing. O'Bryan poisoned his son in order to claim life insurance money to ease his own financial troubles, as he was $100,000 in debt. O'Bryan also distributed poisoned candy to his daughter and three other children in an attempt to cover up his crime; however, neither his daughter nor the other children ate the poisoned candy. He was convicted of capital murder in June 1975 and sentenced to death. He was executed by lethal injection in March 1984.

Key person insurance, also called keyman insurance, is an important form of business insurance. There is no legal definition of "key person insurance". In general, it can be described as an insurance policy taken out by a business to compensate that business for financial losses that would arise from the death or extended incapacity of an important member of the business. To put it simply, key person insurance is a standard life insurance or trauma insurance policy that is used for business succession or business protection purposes. The policy's term does not extend beyond the period of the key person’s usefulness to the business. Key person policies are usually owned by the business and the aim is to compensate the business for losses incurred with the loss of a key income generator and facilitate business continuity. Key person insurance does not indemnify the actual losses incurred but compensates with a fixed monetary sum as specified in the insurance policy.

In the United States, an annuity is a financial product which offers tax-deferred growth and which usually offers benefits such as an income for life. Typically these are offered as structured (insurance) products that each state approves and regulates in which case they are designed using a mortality table and mainly guaranteed by a life insurer. There are many different varieties of annuities sold by carriers. In a typical scenario, an investor will make a single cash premium to own an annuity. After the policy is issued the owner may elect to annuitize the contract for a chosen period of time. This process is called annuitization and can also provide a predictable, guaranteed stream of future income during retirement until the death of the annuitant. Alternatively, an investor can defer annuitizing their contract to get larger payments later, hedge long-term care cost increases, or maximize a lump sum death benefit for a named beneficiary.

In insurance practice, an insurable interest exists when an insured person derives a financial or other kind of benefit from the continuous existence, without repairment or damage, of the insured object. An "interested person" has an insurable interest in something when loss of or damage to that thing would cause the person to suffer a financial or other kind of loss. Normally, insurable interest is established by ownership, possession, or direct relationship. For example, people have insurable interests in their own homes and vehicles, but not in their neighbors' homes and vehicles, and almost certainly not those of strangers.

The Philadelphia poison ring was a murder for hire gang led by Italian immigrant cousins, Herman and Paul Petrillo, in 1930s Philadelphia, where the Italian community had more than doubled in 20 years from 76,734 in 1910 to over 155,000 by 1930 - just before the murder ring began operations. The activities of the ring came to light in 1938 and the cousins were ultimately convicted of first degree murder and executed by electric chair in 1941.

Longevity insurance, describes the process of mitigating against Longevity risk. Such risk mitigation is often achieved using a longevity annuity or Tontine, qualifying longevity annuity contract (QLAC), deferred income annuity, is an annuity contract designed to provide to the policyholder payments for life starting at a pre-established future age, e.g., 85, and purchased many years before reaching that age.

Stranger-originated life insurance ("STOLI") generally means any act, practice, or arrangement, at or prior to policy issuance, to initiate or facilitate the issuance of a life insurance policy for the intended benefit of a person who, at the time of policy origination, does not have an insurable interest in the life of the insured under the laws of the applicable state. This includes the purchase of life insurance with resources or guarantees from or through a person that, at the time of policy initiation, could not lawfully initiate the policy; an arrangement or other agreement to transfer ownership of the policy or the policy benefits to another person; or a trust or similar arrangement that is used directly or indirectly for the purpose of purchasing one or more policies for the intended benefit of another person in a manner that violates the insurable interest laws of the state. The main characteristic of a STOLI transaction is that the insurance is purchased solely as an investment vehicle, rather than for the benefit of the policy owner's beneficiaries. STOLI arrangements are typically promoted to consumers between the age of 65 and 85.

Juvenile life insurance is permanent life insurance that insures the life of a child. It is a financial planning tool that provides a tax advantaged savings vehicle with potential for a lifetime of benefits. Juvenile life insurance, or child life insurance, is usually purchased to protect a family against the sudden and unexpected costs of a funeral and burial with much lower face values. Should the juvenile survive to their college years it can then take on the form of a financial planning tool.

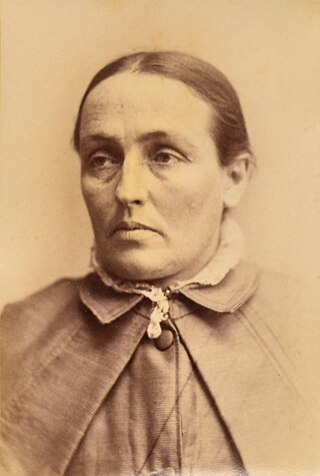

Louisa Collins 11 August 1847 – 8 January 1889) was an Australian convicted murderer. She lived in the Sydney suburb of Botany and married twice, with both husbands dying of arsenic poisoning under suspicious circumstances. Collins was tried for murder on four separate occasions, with the first three juries failing to reach a verdict. At the fourth trial the jury delivered a guilty verdict for the murder of her second husband and she was sentenced to death. Louisa Collins was hanged at Darlinghurst Gaol on the morning of 8 January 1889. She was the first woman hanged in Sydney and the last woman to be executed in New South Wales.

Athelstan Braxton Hicks was a coroner in London and Surrey for two decades at the end of the 19th century. He was given the nickname "The Children's Coroner" for his conscientiousness in investigating the suspicious deaths of children, and especially baby farming and the dangers of child life insurance. He would later publish a study on infanticide.

The Deptford Poisoning Cases were a series of notorious murder cases that occurred in 1889 in Deptford, United Kingdom.

Sarah Jane Whiteling, known as The Wholesale Poisoner, was a German-born American serial killer who poisoned her husband and two children in the span of three months in 1888. She was sentenced to death and executed for her crimes, becoming the first woman to have been executed in Philadelphia County.

References

- ↑ "Child Life Insurance Information and Quotes". www.netquote.com. 11 July 2017.

- ↑ "Child Life Insurance | CompuQuotes.com". Archived from the original on 2010-10-20. Retrieved 2010-11-05.

- ↑ "Life Insurance for Children – The Gerber Life Grow-Up® Plan". Gerber Life Insurance Company.

- ↑ "Gerber Life College Plan | Saving for College - Gerber Life". Archived from the original on 2010-12-03. Retrieved 2010-11-05.

- ↑ "Globe Life Insurance - Life, Accident, & Supplemental Health Insurance | Globe Life".

- ↑ "Gerber Life Insurance Company | Adult and Child Life Insurance". Archived from the original on 2010-11-01. Retrieved 2010-11-05.

- ↑ "Juvenile Life Insurance Foundation - What is Juvenile Life Insurance?". Archived from the original on 2011-03-01. Retrieved 2010-11-28.

- ↑ Zelizer, Viviana A. (1981). "The Price and Value of Children: The Case of Children's Insurance". American Journal of Sociology. 86 (5): 1036–1056. doi:10.1086/227353. ISSN 0002-9602. PMID 11611105. S2CID 39176004.

- ↑ "CHILD LIFE INSURANCE". The New York Times. January 4, 1891.

- ↑ "Infantile Insurance". Times [London, England]. 14 Feb 1889. p. 13 – via The Times Digital Archive.

- ↑ "Amelia Winters' Ambitious Plan to Murder Relatives Interrupted After 5 Successes, Deptford, England - 1889". The Unknown History of MISANDRY. 22 September 2011.