Related Research Articles

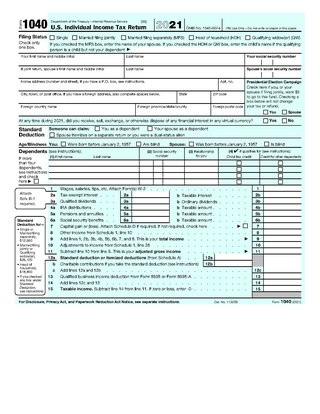

Form 1040, officially, the U.S. Individual Income Tax Return, is an IRS tax form used for personal federal income tax returns filed by United States residents. The form calculates the total taxable income of the taxpayer and determines how much is to be paid to or refunded by the government.

The United States has separate federal, state, and local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, capital gains, dividends, imports, estates and gifts, as well as various fees. In 2020, taxes collected by federal, state, and local governments amounted to 25.5% of GDP, below the OECD average of 33.5% of GDP.

Under United States tax law, itemized deductions are eligible expenses that individual taxpayers can claim on federal income tax returns and which decrease their taxable income, and are claimable in place of a standard deduction, if available.

Tax returns in the United States are reports filed with the Internal Revenue Service (IRS) or with the state or local tax collection agency containing information used to calculate income tax or other taxes. Tax returns are generally prepared using forms prescribed by the IRS or other applicable taxing authority.

A tax refund or tax rebate is a payment to the taxpayer due to the taxpayer having paid more tax than they owed.

Tax break also known as tax preferences, tax concession, and tax relief, are a method of reduction to the tax liability of taxpayers. Government usually applies them to stimulate the economy and increase the solvency of the population. By this fiscal policy act, government favourable behaving of population sample or general behaving. By announcing a new tax break state budget possibly deprecate some of their revenues from collecting taxes. On the other hand, a new tax break stimulates the economy of subjects in the state, which could possibly strengthen the increase of outcomes that will be taxed. Every tax break must go through the Legislative system to be accepted by authorized institutions to become valid. Most of the countries pledge this position to the Ministry of finance, which approves new tax breaks as tax law. Whether for validation is needed an agreement with other constitutional officials depends on state legislative. However, in the same manner, could the tax break be annulled. In many cases tax break is announced with a limitation factor, which restricts the maximum use of this tax break. For example, a tax credit is given for purchases of electric cars. The tax credit should deprecate 10% from purchases, but the limiting factor is 500$, which can’t be exceeded.

For households and individuals, gross income is the sum of all wages, salaries, profits, interest payments, rents, and other forms of earnings, before any deductions or taxes. It is opposed to net income, defined as the gross income minus taxes and other deductions.

The United States federal government and most state governments impose an income tax. They are determined by applying a tax rate, which may increase as income increases, to taxable income, which is the total income less allowable deductions. Income is broadly defined. Individuals and corporations are directly taxable, and estates and trusts may be taxable on undistributed income. Partnerships are not taxed, but their partners are taxed on their shares of partnership income. Residents and citizens are taxed on worldwide income, while nonresidents are taxed only on income within the jurisdiction. Several types of credits reduce tax, and some types of credits may exceed tax before credits. Most business expenses are deductible. Individuals may deduct certain personal expenses, including home mortgage interest, state taxes, contributions to charity, and some other items. Some deductions are subject to limits, and an Alternative Minimum Tax (AMT) applies at the federal and some state levels.

Salaries tax is a type of income tax that is levied in Hong Kong, chargeable on income from any office, employment and pension for a year of assessment arising in or derived from the territory. For purposes of calculating liability, the period of assessment is from April 1 to March 31 of the following year.

The United States Internal Revenue Service (IRS) uses forms for taxpayers and tax-exempt organizations to report financial information, such as to report income, calculate taxes to be paid to the federal government, and disclose other information as required by the Internal Revenue Code (IRC). There are over 800 various forms and schedules. Other tax forms in the United States are filed with state and local governments.

Taxpayers in the United States may have tax consequences when debt is cancelled. This is commonly known as cancellation-of-debt (COD) income. According to the Internal Revenue Code, the discharge of indebtedness must be included in a taxpayer's gross income. There are exceptions to this rule, however, so a careful examination of one's COD income is important to determine any potential tax consequences.

North American Oil Consolidated v. Burnet, 286 U.S. 417 (1932), was a landmark decision by the United States Supreme Court that established the claim of right doctrine.

Commissioner v. Indianapolis Power & Light Company, 493 U.S. 203 (1990), was a United States Supreme Court case in which the Court addressed whether customer deposits constituted taxable income to a public utility company.

Realization, for U.S. Federal income tax purposes, is a requirement in determining what must be included as income subject to taxation. It should not be confused with the separate concept of Recognition (tax).

Taxation of illegal income in the United States arises from the provisions of the Internal Revenue Code, enacted by the U.S. Congress in part for the purpose of taxing net income. As such, a person's taxable income will generally be subject to the same federal income tax rules, regardless of whether the income was obtained legally or illegally.

Haverly v. United States, 513 F.2d 224 is a United States income tax case.

Dobson v. Commissioner, 320 U.S. 489 (1943), was a United States Supreme Court case related to income tax.

The alternative minimum tax (AMT) is a tax imposed by the United States federal government in addition to the regular income tax for certain individuals, estates, and trusts. As of tax year 2018, the AMT raises about $5.2 billion, or 0.4% of all federal income tax revenue, affecting 0.1% of taxpayers, mostly in the upper income ranges.

Taxes in Germany are levied by the federal government, the states (Länder) as well as the municipalities (Städte/Gemeinden). Many direct and indirect taxes exist in Germany; income tax and VAT are the most significant.

A tax return is the completion of documentation that calculates an entity or individual's income earned and the amount of taxes to be paid to the government or government organizations or, potentially, back to the taxpayer.

References

- ↑ Clark v. Commissioner, 40B.T.A.333 (1939).

- ↑ Klein, William A.; Bankman, Joseph; Shaviro, Daniel N.; Stark, Kirk J. Federal Income Taxation . ISBN 978-0735578098.

- 1 2 40 B.T.A. at 335.

- ↑ Commissioner v. Glenshaw Glass Co. , 348U.S.426 (1955).