Related Research Articles

Coin collecting is the collecting of coins or other forms of minted legal tender.

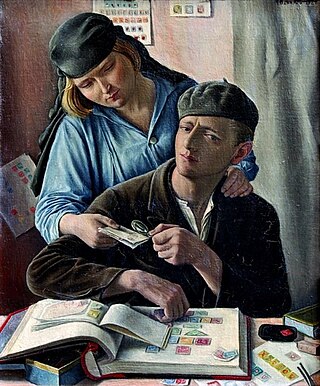

Stamp collecting is the collecting of postage stamps and related objects. It is an area of philately, which is the study of stamps. It has been one of the world's most popular hobbies since the late nineteenth century with the rapid growth of the postal service, as a never-ending stream of new stamps was produced by countries that sought to advertise their distinctiveness through their stamps.

A collectable is any object regarded as being of value or interest to a collector. Collectable items are not necessarily monetarily valuable or uncommon. There are numerous types of collectables and terms to denote those types. An antique is a collectable that is old. A curio is something deemed unique, uncommon, or weird, such as a decorative item. A manufactured collectable is an item made specifically for people to collect.

Philatelic investment is investment in collectible postage stamps for the purpose of realizing a profit. Philatelic investment was popular during the 1970s but then fell out of favour following a speculative bubble and prices of rare stamps took many years to recover.

A tangible investment is something physical that you can touch. It is an investment in a tangible, hard or real asset or personal property. This contrasts with financial investments such as stocks, bonds, mutual funds and other financial instruments.

Linn's Stamp News is an American weekly magazine for stamp collectors. It is published by Amos Media Co., which also publishes the Scott Standard Postage Stamp Catalogue, the Scott Specialized Catalogue of United States Stamps and Covers, and the Scott Classic Specialized Catalogue of Stamps and Covers 1840–1940. Linn's was founded in 1928 by George W. Linn as Linn's Weekly Stamp News.

A vintage car is, in the most general sense, an old automobile, and in the narrower senses of car enthusiasts and collectors, it is a car from the period of 1919 to 1930. Such enthusiasts have categorization schemes for ages of cars that enforce distinctions between antique cars, vintage cars, classic cars, and so on. The classification criteria vary, but consensus within any country is often maintained by major car clubs, for example the Vintage Sports-Car Club (VSCC) in the UK.

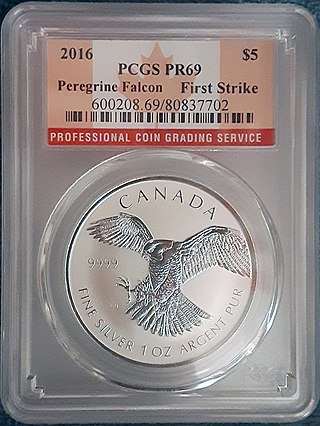

Coin grading is the process of determining the grade or condition of a coin, one of the key factors in determining its value. A coin's grade is generally determined by six criteria: strike, preservation, luster, color, attractiveness, and occasionally the country/state in which they’re minted. Several grading systems have been developed. Certification services professionally grade coins for tiered fees.

Scripophily is the study and collection of stock and bond certificates. A specialized field of numismatics, scripophily has developed as an area of collecting because of the inherent beauty of certain historical certificates, and because of the interesting historical context of many of the documents. In addition, some stock certificates serve as excellent examples of engraving. Occasionally, an old stock certificate is found that still has value as actual shares in the original or a successor company.

The Tel Aviv Stock Exchange is Israel's only public stock exchange and a public company that has been traded on the Tel-Aviv Stock Exchange since August 1, 2019. Legally, the exchange is regulated by the Securities Law (1968), and is under the direct supervision of the Israel Securities Authority (ISA).

James L. Halperin is an American businessman and author, who is the co-founder and co-chairman of Heritage Auctions, now the largest American auction house with 2022 sales in excess of $1.45 billion. In 1985 Halperin authored a text on grading coins, How to Grade U.S. Coins, upon which the grading standards of the grading services PCGS and NGC were ultimately based. He is the author of two futurist fiction books, The Truth Machine (1996) and The First Immortal (1997), which were in 2001 both chosen by PC Magazine in a survey put out to their online newsletter subscribers, as possible responses for the top 17 science/technology fiction books of the previous 20 years. In the 1980s he and his businesses were investigated by federal agencies, which investigation was settled by signing consent decrees and agreeing to pay a substantial fine.

The Stanley Gibbons Group plc is a company quoted on the London Stock Exchange specialising in the retailing of collectable postage stamps and similar products. The group is incorporated in London. The company is a major stamp dealer and philatelic publisher. The company's philatelic subsidiary, Stanley Gibbons Limited, has a royal warrant of appointment from Queen Elizabeth II.

Professional Coin Grading Service (PCGS) is an American third-party coin grading, authentication, attribution, and encapsulation service founded in 1985. The intent of its seven founding dealers, including the firm's former president David Hall, was to standardize grading. The firm has divisions in Europe and Asia, and is owned by parent company Collectors Universe. PCGS has graded over 42.5 million coins, medals, and tokens valued at over $36 billion.

Kinclaith distillery was the last Malt whisky still built in Glasgow, within the Strathclyde Grain distillery complex, in 1958. The Kinclaith distillery was closed in 1975.

An alternative investment, also known as an alternative asset or alternative investment fund (AIF), is an investment in any asset class excluding stocks, bonds, and cash. The term is a relatively loose one and includes tangible assets such as precious metals, collectibles and some financial assets such as real estate, commodities, private equity, distressed securities, hedge funds, exchange funds, carbon credits, venture capital, film production, financial derivatives, cryptocurrencies, non-fungible tokens, and Tax Receivable Agreements. Investments in real estate, forestry and shipping are also often termed "alternative" despite the ancient use of such real assets to enhance and preserve wealth. Alternative investments are to be contrasted with traditional investments.

Certified Acceptance Corporation (CAC) is a Far Hills, New Jersey third-party coin certification company started in 2007 by coin dealer John Albanese. The firm evaluates certain numismatically valuable U.S. coins already certified by Numismatic Guaranty Corporation (NGC) or Professional Coin Grading Service (PCGS).

The Historic Automobile Group International (HAGI) is a London-based research organization in the area of rare historic motorcars and collectors’ automobiles. HAGI is known for its classic car market indices, which have been calculated since December 2008, based on a proprietary market capitalization formula called “survivor weighting”.

Investment wine, like gold bullion, rare coins, fine art, and tulip bulbs, is seen by some as an alternative investment other than the more traditional investment holdings of stocks, bonds, cash, or real estate. While most wine is purchased with the intent of consuming it, some wines are purchased with the intention to resell them at a higher price in the future. A wine's value often goes up as time passes and consumption increases as the market becomes tighter and access to good wine is more elusive.

Collectors Universe Inc. is an American company formed in 1986, now based in Santa Ana, California, which provides third-party authentication and grading services to collectors, retail buyers and sellers of collectibles. Its authentication services focus on coins, trading cards, sports memorabilia, and autographs. The company reached the combined total of 75 million certified collectibles in 2019. Collectors Universe is also a publisher in fields relating to collecting.

The art market is the marketplace of buyers and sellers trading in commodities, services, and works of art.

References

- ↑ Moreau, p. 81.

- ↑ Skoggard, p. 288.

- ↑ Moreau, p. 81.

- Satchell & Auld, p. 219.

- ↑ Satchell & Auld, pp. 228–230.

- ↑ "Historic Automobile Group". Historic Automobile Group. Retrieved 2016-04-18.

- ↑ Newbury, "Epilogue".

- ↑ "PCGS3000® Index". Pcgs.com. Retrieved 2016-04-18.

- ↑ "Linn's U.S. Stamp Market Index – July 2014". Linns.com. 2014-07-23. Retrieved 2016-04-18.

- ↑ Brown, p. 231.

- ↑ Schrieberg, Felipe. "You Can Now Invest In Rare Whisky Via The Stock Exchange". Forbes. Retrieved 2018-07-22.

- ↑ Skoggard, p. 288.