Related Research Articles

A commercial bank is a financial institution which accepts deposits from the public and gives loans for the purposes of consumption and investment to make profit.

Dishonoured cheques are cheques that a bank on which is drawn declines to pay (“honour”). There are a number of reasons why a bank would refuse to honour a cheque, with non-sufficient funds (NSF) being the most common one, indicating that there are insufficient cleared funds in the account on which the cheque was drawn. An NSF check may be referred to as a bad check, dishonored check, bounced check, cold check, rubber check, returned item, or hot check. Lost or bounced checks result in late payments and affect the relationship with customers. In England and Wales and Australia, such cheques are typically returned endorsed "Refer to drawer", an instruction to contact the person issuing the cheque for an explanation as to why it was not paid. If there are funds in an account, but insufficient cleared funds, the cheque is normally endorsed “Present again”, by which time the funds should have cleared.

Fractional-reserve banking is the system of banking operating in almost all countries worldwide, under which banks that take deposits from the public are required to hold a proportion of their deposit liabilities in liquid assets as a reserve, and are at liberty to lend the remainder to borrowers. Bank reserves are held as cash in the bank or as balances in the bank's account at the central bank. The country's central bank determines the minimum amount that banks must hold in liquid assets, called the "reserve requirement" or "reserve ratio". Most commercial banks hold more than this minimum amount as excess reserves.

A transaction account, also called a checking account, chequing account, current account, demand deposit account, or share draft account at credit unions, is a deposit account or bank account held at a bank or other financial institution. It is available to the account owner "on demand" and is available for frequent and immediate access by the account owner or to others as the account owner may direct. Access may be in a variety of ways, such as cash withdrawals, use of debit cards, cheques (checks) and electronic transfer. In economic terms, the funds held in a transaction account are regarded as liquid funds. In accounting terms, they are considered as cash.

Cheque clearing or bank clearance is the process of moving cash from the bank on which a cheque is drawn to the bank in which it was deposited, usually accompanied by the movement of the cheque to the paying bank, either in the traditional physical paper form or digitally under a cheque truncation system. This process is called the clearing cycle and normally results in a credit to the account at the bank of deposit, and an equivalent debit to the account at the bank on which it was drawn, with a corresponding adjustment of accounts of the banks themselves. If there are not enough funds in the account when the cheque arrived at the issuing bank, the cheque would be returned as a dishonoured cheque marked as non-sufficient funds.

Bank fraud is the use of potentially illegal means to obtain money, assets, or other property owned or held by a financial institution, or to obtain money from depositors by fraudulently posing as a bank or other financial institution. In many instances, bank fraud is a criminal offence. While the specific elements of particular banking fraud laws vary depending on jurisdictions, the term bank fraud applies to actions that employ a scheme or artifice, as opposed to bank robbery or theft. For this reason, bank fraud is sometimes considered a white-collar crime.

A giro transfer, often shortened to giro, is a payment transfer from one current bank account to another bank account and initiated by the payer, not the payee. The debit card has a similar model. Giros are primarily used in Europe; although electronic payment systems exist in the United States, it is not possible to perform third-party transfers with them. In the European Union, there is the Single Euro Payments Area (SEPA), which allows electronic giro or debit card payments in euros to be executed to any euro bank account in the area.

Cheque fraud, or check fraud, refers to a category of criminal acts that involve making the unlawful use of cheques in order to illegally acquire or borrow funds that do not exist within the account balance or account-holder's legal ownership. Most methods involve taking advantage of the float to draw out these funds. Specific kinds of cheque fraud include cheque kiting, where funds are deposited before the end of the float period to cover the fraud, and paper hanging, where the float offers the opportunity to write fraudulent cheques but the account is never replenished.

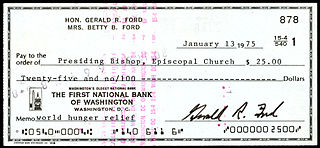

A cheque, or check, is a document that orders a bank to pay a specific amount of money from a person's account to the person in whose name the cheque has been issued. The person writing the cheque, known as the drawer, has a transaction banking account where the money is held. The drawer writes various details including the monetary amount, date, and a payee on the cheque, and signs it, ordering their bank, known as the drawee, to pay the amount of money stated to the payee.

In economics, float is duplicate money present in the banking system during the time between a deposit being made in the recipient's account and the money being deducted from the sender's account. It can be used as investable asset, but makes up the smallest part of the money supply. Float affects the amount of currency available to trade and countries can manipulate the worth of their currency by restricting or expanding the amount of float available to trade.

National Girobank was a British public sector financial institution run by the General Post Office that opened for business in October 1968. It started life as National Giro then National Girobank and finally Girobank plc before being absorbed into Alliance & Leicester plc in 2003.

Cash management refers to a broad area of finance involving the collection, handling, and usage of cash. It involves assessing market liquidity, cash flow, and investments.

An overdraft occurs when something is withdrawn in excess of what is in a current account. For financial systems, this can be funds in a bank account. In these situations the account is said to be "overdrawn". In the economic system, if there is a prior agreement with the account provider for an overdraft, and the amount overdrawn is within the authorized overdraft limit, then interest is normally charged at the agreed rate. If the negative balance exceeds the agreed terms, then additional fees may be charged and higher interest rates may apply.

A payment is the voluntary tender of money or its equivalent or of things of value by one party to another in exchange for goods or services provided by them or to fulfill a legal obligation. The party making the payment is commonly called the payer, while the payee is the party receiving the payment.

In banking, a post-dated cheque is a cheque written by the drawer (payer) for a date in the future.

In banking, a lockbox is a service offered to organizations by commercial banks to simplify collection and processing of accounts receivable by having those organizations' customers' payments mailed directly to a location accessible by the bank.

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets.

A deposit account is a bank account maintained by a financial institution in which a customer can deposit and withdraw money. Deposit accounts can be savings accounts, current accounts or any of several other types of accounts explained below.

A deposit is the act of placing cash with some entity, most commonly with a financial institution, such as a bank.

A deposit slip is a form supplied by a bank for a depositor to fill out, designed to document in categories the items included in the deposit transaction. The categories include type of item, and if it is a cheque, where it is from such as a local bank or a state if the bank is not local. The teller keeps the deposit slip along with the deposit, and provides the depositor with a receipt. They are filled in a store and not a bank, so it is very convenient in paying. They also are a means of transport of money. Pay-in slips encourage the sorting of cash and coins, are filled in and signed by the person who deposited the money, and some tear off from a record that is also filled in by the depositor. Deposit slips are also called deposit tickets and come in a variety of designs. They are signed by the depositor if the depositor is cashing some of the accompanying check and depositing the rest.