Charlotte is the most populous city in the U.S. state of North Carolina. Located in the Piedmont region, it is the county seat of Mecklenburg County. The population was 874,579 at the 2020 census, making Charlotte the 15th-most populous city in the U.S., the seventh-most populous city in the South, and the second-most populous city in the Southeast behind Jacksonville, Florida. The city is the cultural, economic, and transportation center of the Charlotte metropolitan area, whose 2020 population of 2,660,329 ranked 22nd in the U.S. Metrolina is part of a sixteen-county market region or combined statistical area with a 2020 census-estimated population of 2,846,550.

The Bank of America Corporation is an American multinational investment bank and financial services holding company headquartered at the Bank of America Corporate Center in Charlotte, North Carolina, with investment banking and auxiliary headquarters in Manhattan. The bank was founded in San Francisco, California. It is the second-largest banking institution in the United States, after JPMorgan Chase, and the second-largest bank in the world by market capitalization. Bank of America is one of the Big Four banking institutions of the United States. It serves approximately 10.73% of all American bank deposits, in direct competition with JPMorgan Chase, Citigroup, and Wells Fargo. Its primary financial services revolve around commercial banking, wealth management, and investment banking.

Comerica Bank is a subsidiary of Comerica Incorporated, a financial services company headquartered in Dallas, Texas, and strategically aligned by three business segments: The Commercial Bank, The Retail Bank and Wealth Management. Under the leadership of chairman, President and chief executive officer Curt Farmer, Comerica focuses on relationships, and helping people and businesses be successful.

NationsBank was one of the largest banking corporations in the United States, based in Charlotte, North Carolina. The company named NationsBank was formed through the merger of several other banks in 1991, and prior to that had been through multiple iterations. Its oldest predecessor companies had been Commercial National Bank (CNB), formed in 1874, and American Trust Company founded in 1909. In 1998, NationsBank acquired BankAmerica, and modified that better-known name to become Bank of America.

The PNC Financial Services Group, Inc. is an American bank holding company and financial services corporation based in Pittsburgh, Pennsylvania. Its banking subsidiary, PNC Bank, operates in 27 states and the District of Columbia, with 2,629 branches and 9,523 ATMs. PNC Bank is on the list of largest banks in the United States by assets and is one of the largest banks by number of branches, deposits, and number of ATMs.

SunTrust Banks, Inc. was an American bank holding company with SunTrust Bank as its largest subsidiary and assets of US$199 billion as of March 31, 2018. The bank's most direct corporate parent was established in 1891 in Atlanta, where it was headquartered.

Truist Financial Corporation is an American bank holding company headquartered in Charlotte, North Carolina. The company was formed in December 2019 as the result of the merger of BB&T and SunTrust Banks. Its bank operates 2,781 branches in 15 states and Washington, D.C., and offers consumer and commercial banking, securities brokerage, asset management, mortgage, and insurance products and services. It is on the list of largest banks in the United States by assets; as of June 2021, it is the 10th largest bank with $509 billion in assets. As of January 2021, Truist Insurance Holdings is the seventh largest insurance broker in the world with $2.27 billion in annual revenue.

First Union Corporation was a bank holding company that provided commercial and retail banking services in eleven states in the eastern U.S. First Union also provided various other financial services, including mortgage banking, credit card, investment banking, investment advisory, home equity lending, asset-based lending, leasing, insurance, international and securities brokerage services and private equity, through other subsidiaries. In September 2001, First Union completed their acquisition of Wachovia National Bank to become Wachovia Corporation, which used to be one of the largest financial holding companies in the US. As of the end of 2000, First Union had over $171 billion of total assets, over 70,000 employees and 2,193 branches. After their acquisition of Wachovia, they assumed the name and stock ticket symbol of the latter company.

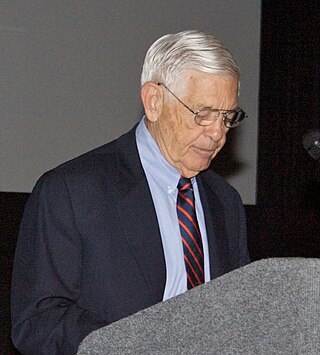

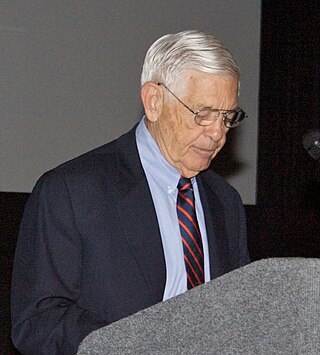

Hugh L. McColl Jr. is a fourth-generation banker and the former Chairman and CEO of Bank of America. Active in banking since around 1960, McColl was a driving force behind consolidating a series of progressively larger, mostly Southern banks, thrifts and financial institutions into a super-regional banking force, "the first ocean-to-ocean bank in the nation's history".

The Truist Center is a 47-story, 659 feet (201 m) skyscraper in Uptown Charlotte, North Carolina. The city's third tallest building, it is located along North Tryon Street. It was opened on November 14, 2002, and was the city's second tallest building, and was known as the "Hearst Tower" until 2019. The structure is composed of a 32-story tower resting atop a 15-floor podium. During Bank of America's occupancy in the building located on the podium was a three-story trading facility designed by Skidmore, Owings & Merrill and operated by Bank of America. The trading facility included a 6,000-square-foot (560 m2), two-story trading floor. Now the former trading floor is part of Truist's 100,000 square feet (9,300 m2) technology innovation center. The building is currently the headquarters of Truist Financial, which purchased the building in March 2020.

North Carolina National Bank (NCNB) was a bank based in Charlotte, North Carolina, prior to 1960 called American Commercial Bank. It was one of the top banking institutions. From 1974 to 1983, the bank was run by Chairman and Chief Executive Officer Tom Storrs. What was NCNB forms the core of today's Bank of America.

Citizens and Southern National Bank (C&S) began as a Georgia institution that expanded into South Carolina, Florida and into other states via mergers. Headquartered in Atlanta, Georgia; it was the largest bank in the Southeast for much of the 20th century. C&S merged with Sovran Bank in 1990 to form C&S/Sovran in hopes of fending off a hostile takeover attempt by NCNB Corporation. Only a year later, however, C&S/Sovran merged with NCNB to form NationsBank, which forms the core of today's Bank of America.

One South at The Plaza is a 503 feet (153 m), 40-story skyscraper in Charlotte, North Carolina. It is the 7th tallest in the city. It contains 891,000 square feet (82,777 m2) of rentable area of which 75,000 sq ft (7,000 m2) of retail space, and the rest office space. On the ground floor is the Overstreet Mall, which connects to neighboring buildings via skybridges; located below-grade is the parking garage with space for 456 vehicles and leases a nearby five-level garage, providing 730 additional parking spaces.

The Independence Building was a 186-foot (57 m) high-rise in Charlotte, Mecklenburg County, North Carolina, United States. It was built in 1909 by J.A. Jones Construction and imploded on September 27, 1981 to make way for 101 Independence Center. It originally had 12 floors but 2 more were added in 1928. It was the tallest commercial building in North Carolina, overtaking the title previously held by the Masonic Temple Building in Raleigh. The height of the Independence Building was surpassed by the Jefferson Standard Building in Greensboro in 1923.

Wachovia was a diversified financial services company based in Charlotte, North Carolina. Before its acquisition by Wells Fargo and Company in 2008, Wachovia was the fourth-largest bank holding company in the United States, based on total assets. Wachovia provided a broad range of banking, asset management, wealth management, and corporate and investment banking products and services. At its height, it was one of the largest providers of financial services in the United States, operating financial centers in 21 states and Washington, D.C., with locations from Connecticut to Florida and west to California. Wachovia provided global services through more than 40 offices around the world.

United Carolina Bank (UCB) was a bank headquartered in Whiteville, North Carolina. It was formed in 1980 by the merger of four banks, including Waccamaw Bank of Whiteville. BB&T (now Truist Financial) acquired UCB in 1997.

Centura Bank was a bank headquartered in Rocky Mount, North Carolina. It existed from 1990, when Peoples Bancorp and Planters Bank merged, to 2001, when the Royal Bank of Canada acquired the company and changed its name to RBC Centura.

Bank OZK is a regional bank established in 1903. Bank OZK conducts banking operations with over 240 offices in eight states including Arkansas, Georgia, Florida, North Carolina, Texas, New York, California and Mississippi and had $27.66 billion in total assets as of December 31, 2022.

SouthState Bank, based in Winter Haven, Florida, is an American bank based in Florida and a subsidiary of SouthState Corporation, a bank holding company. As of December 31, 2018, the company had 168 branches in South Carolina, North Carolina, Georgia, Florida, Alabama and Virginia.

BB&T Corporation was one of the largest banking and financial services firms in the United States, based in Winston-Salem, North Carolina. In 2019, BB&T announced its intentions to merge with Atlanta-based SunTrust Banks to form Truist Financial, which retains BB&T's stock price history and operates under BB&T's charter.