Related Research Articles

Customs is an authority or agency in a country responsible for collecting tariffs and for controlling the flow of goods, including animals, transports, personal effects, and hazardous items, into and out of a country. Traditionally, customs has been considered as the fiscal subject that charges customs duties and other taxes on import and export. In recent decades, the views on the functions of customs have considerably expanded and now covers three basic issues: taxation, security, and trade facilitation.

The Charter of Fundamental Rights of the European Union (CFR) enshrines certain political, social, and economic rights for European Union (EU) citizens and residents into EU law. It was drafted by the European Convention and solemnly proclaimed on 7 December 2000 by the European Parliament, the Council of Ministers and the European Commission. However, its then legal status was uncertain and it did not have full legal effect until the entry into force of the Treaty of Lisbon on 1 December 2009.

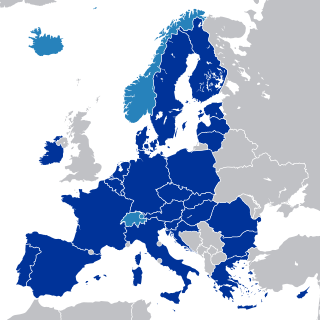

The special territories of members of the European Economic Area (EEA) are the 32 special territories of EU member states and EFTA member states which, for historical, geographical, or political reasons, enjoy special status within or outside the European Union and the European Free Trade Association.

The European single market, internal market or common market is a single market comprising the 27 member states of the European Union (EU) as well as – with certain exceptions – Iceland, Liechtenstein, and Norway through the Agreement on the European Economic Area, and Switzerland through sectoral treaties. The single market seeks to guarantee the free movement of goods, capital, services, and people, known collectively as the "four freedoms". This is achieved through common rules and standards that all the EU member states are legally committed to following.

The constitutional basis of taxation in Australia is predominantly found in sections 51(ii), 90, 53, 55, and 96, of the Constitution of Australia. Their interpretation by the High Court of Australia has been integral to the functioning and evolution of federalism in Australia.

Taxes in India are levied by the Central Government and the State Governments by virtue of powers conferred to them from the Constitution of India. Some minor taxes are also levied by the local authorities such as the Municipality.

Council Regulation (EEC) No 2658/87 of 23 July 1987, creates the goods nomenclature called the Combined Nomenclature, or in abbreviated form 'CN', established to meet, at one and the same time, the requirements both of the Common Customs Tariff and of the external trade statistics of the European Union. It is closely related to the Harmonized Tariff Schedule of the United States.

The ATA Carnet, often referred to as the "Passport for goods", is an international customs document that permits the tax-free and duty-free temporary export and import of nonperishable goods for up to one year. It consists of unified customs declaration forms which are prepared ready to use at every border crossing point. It is a globally accepted guarantee for customs duties and taxes which can replace the security deposit required by each customs authority. It can be used in multiple countries in multiple trips up to its one-year validity. The acronym ATA is a combination of French and English terms "Admission Temporaire/Temporary Admission". The ATA carnet is now the document most widely used by the business community for international operations involving temporary admission of goods.

The European Union Customs Union (EUCU), formally known as the Community Customs Union, is a customs union which consists of all the member states of the European Union (EU), Monaco, and the British Overseas Territory of Akrotiri and Dhekelia. Some detached territories of EU states do not participate in the customs union, usually as a result of their geographic separation. In addition to the EUCU, the EU is in customs unions with Andorra, San Marino and Turkey, through separate bilateral agreements.

Bangladesh is a common law country having its legal system developed by the British rulers during their colonial rule over British India. The land now comprises Bangladesh was known as Bengal during the British and Mughal regime while by some other names earlier. Though there were religious and political equipments and institutions from almost prehistoric era, Mughals first tried to recognise and establish them through state mechanisms. The Charter of 1726, granted by King George I, authorised the East India Company to establish Mayor's Courts in Madras, Bombay and Calcutta and is recognised as the first codified law for the British India. As a part of the then British India, it was the first codified law for the then Bengal too. Since independence in 1971, statutory law enacted by the Parliament of Bangladesh has been the primary form of legislation. Judge-made law continues to be significant in areas such as constitutional law. Unlike in other common law countries, the Supreme Court of Bangladesh has the power to not only interpret laws made by the parliament, but to also declare them null and void and to enforce fundamental rights of the citizens. The Bangladesh Code includes a compilation of all laws since 1836. The vast majority of Bangladeshi laws are in English. But most laws adopted after 1987 are in Bengali. Family law is intertwined with religious law. Bangladesh has significant international law obligations.

Van Gend en Loos v Nederlandse Administratie der Belastingen (1963) Case 26/62 was a landmark case of the European Court of Justice which established that provisions of the Treaty Establishing the European Economic Community were capable of creating legal rights which could be enforced by both natural and legal persons before the courts of the Community's member states. This is now called the principle of direct effect. The case is acknowledged as being one of the most important, and possibly the most famous development of European Union law.

Part XII of constitution of India is a compilation of laws pertaining to Finance, Property, Contracts and Suits for Republic of India.

The European Union value-added tax is a value added tax on goods and services within the European Union (EU). The EU's institutions do not collect the tax, but EU member states are each required to adopt in national legislation a value added tax that complies with the EU VAT code. Different rates of VAT apply in different EU member states, ranging from 17% in Luxembourg to 27% in Hungary. The total VAT collected by member states is used as part of the calculation to determine what each state contributes to the EU's budget.

Canton Railroad Company v. Rogan, 340 U.S. 511 (1951), is a case in which the United States Supreme Court held that a state franchise tax upon the services performed by a railroad in handling imported and exported goods did not violate the Import-Export Clause of the United States Constitution.

The Japan-Philippines Economic Partnership Agreement (日本・フィリピン経済連携協定) or in or commonly known as JPEPA is an economic partnership agreement concerning bilateral investment and free trade agreement between Japan and the Philippines. It was signed in Helsinki, Finland on September 9, 2006, by Japanese Prime Minister Junichiro Koizumi and Philippine President Gloria Macapagal Arroyo. It is the first bilateral trade treaty which the Philippines has entered since the Parity Right Agreement of 1946 with the United States. This treaty consists of 16 Chapters and 165 Articles, with 8 Annexes.

The Treaties of the European Union are a set of international treaties between the European Union (EU) member states which sets out the EU's constitutional basis. They establish the various EU institutions together with their remit, procedures and objectives. The EU can only act within the competences granted to it through these treaties and amendment to the treaties requires the agreement and ratification of every single signatory.

Section 90 of the Constitution of Australia prohibits the States from imposing customs duties and of excise. The section bars the States from imposing any tax that would be considered to be of a customs or excise nature. While customs duties are easy to determine, the status of excise, as summarised in Ha v New South Wales, is that it consists of "taxes on the production, manufacture, sale or distribution of goods, whether of foreign or domestic origin." This effectively means that States are unable to impose sales taxes.

Commission v Italy refers to several different cases heard by the European Court of Justice, which the European Commission brought against Italy for infringing European Union law. This includes breach of the Treaty on the Functioning of the European Union (TFEU), or a failure to implement European Union Directives:

Article I, § 10, clause 2 of the United States Constitution, known as the Import-Export Clause, prevents the states, without the consent of Congress, from imposing tariffs on imports and exports above what is necessary for their inspection laws and secures for the federal government the revenues from all tariffs on imports and exports. Several nineteenth century Supreme Court cases applied this clause to duties and imposts on interstate imports and exports. In 1869, the United States Supreme Court ruled that the Import-Export Clause only applied to imports and exports with foreign nations and did not apply to imports and exports with other states, although this interpretation has been questioned by modern legal scholars.

References

- ↑ Vilímková, Veronika (21 March 2016). "The Concept of Good in the Case Law of the Court of Justice". The Lawyer Quarterly. Retrieved 27 October 2019.

- ↑ Commission of the European Communities v Italian Republic., Judgment of the Court of 10 December 1968. "Document 61968CJ0007". EUR-Lex. Retrieved 26 October 2019.

- ↑ Margaritis, Konstantinos. "Fundamental Rights in the Eec Treaty and Within Community Freedoms" (PDF). Econstor. University of Iasi. Retrieved 27 October 2019.

- ↑ The European Commission, Article 12. "The Treaty of Rome" (PDF). Retrieved 27 October 2019.

- ↑ The European Commission. "The Treaty of Rome" (PDF). Retrieved 26 October 2019.

- 1 2 3 4 5 Judgment of 10. 12. 1968, The. "Case 7/68". EUR-Lex. Retrieved 27 October 2019. Content is copied from this source, which is © European Union, 1995–2018. Reuse is authorised, provided the source is acknowledged.