European Union law is a system of rules operating within the member states of the European Union (EU). Since the founding of the European Coal and Steel Community following World War II, the EU has developed the aim to "promote peace, its values and the well-being of its peoples". The EU has political institutions, social and economic policies, which transcend nation states for the purpose of cooperation and human development. According to its Court of Justice the EU represents "a new legal order of international law".

In the European Union, competition law promotes the maintenance of competition within the European Single Market by regulating anti-competitive conduct by companies to ensure that they do not create cartels and monopolies that would damage the interests of society.

In business and finance, a golden share is a nominal share which is able to outvote all other shares in certain specified circumstances, often held by a government organization, in a government company undergoing the process of privatization and transformation into a stock-company.

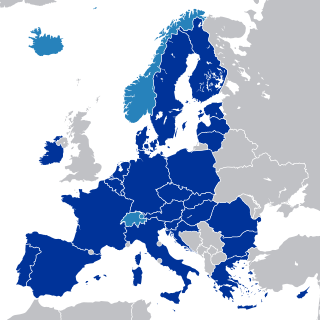

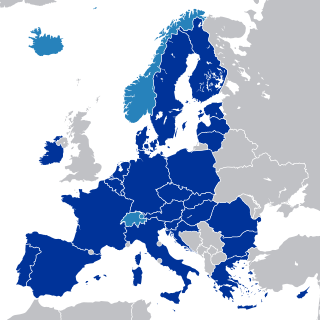

The European single market, also known as the European internal market or the European common market, is the single market comprising mainly the 27 member states of the European Union (EU). With certain exceptions, it also comprises Iceland, Liechtenstein, and Norway and Switzerland. The single market seeks to guarantee the free movement of goods, capital, services, and people, known collectively as the "four freedoms". This is achieved through common rules and standards that all participating states are legally committed to follow.

Altice Portugal S.A. is the largest telecommunications service provider in Portugal. Since June 2, 2015, the company has been a wholly owned subsidiary of Altice, a multinational cable and telecommunications company with a presence in France, Israel, Belgium, Luxembourg, Portugal, French West Indies/Indian Ocean Area, the Dominican Republic, and Switzerland. The assets in Portugal were sold to Altice in 2015 per request of Oi SA to reduce debt. The African assets were mostly sold for the same reason. Portugal Telecom, SGPS SA was split in separate companies: PT Portugal and Pharol, which owns a 27,5% stake in Oi.

Isabel dos Santos is an Angolan businesswoman, the eldest child of Angola's former President José Eduardo dos Santos, who ruled the country as a dictator from 1979 to 2017. Once considered Africa's richest woman according to Forbes magazine, with a net worth exceeding US$2 billion, she was dropped from the magazine's list in January 2021 after the freezing of her assets in Angola, Portugal and the Netherlands. She owes $340 million to the Portuguese company PT Ventures.

Van Gend en Loos v Nederlandse Administratie der Belastingen (1963) Case 26/62 was a landmark case of the European Court of Justice which established that provisions of the Treaty Establishing the European Economic Community were capable of creating legal rights which could be enforced by both natural and legal persons before the courts of the Community's member states. This is now called the principle of direct effect. The case is acknowledged as being one of the most important, and possibly the most famous development of European Union law.

Francovich v Italy (1991) C-6/90 was a decision of the European Court of Justice which established that European Union Member States could be liable to pay compensation to individuals who suffered a loss by reason of the Member State's failure to transpose an EU directive into national law. This principle is sometimes known as the principle of state liability or "the rule in Francovich" in European Union law.

International Transport Workers Federation v Viking Line ABP (2007) C-438/05 is an EU law case of the European Court of Justice, in which it was held that there is a positive right to strike, but the exercise of that right could infringe a business's freedom of establishment under the Treaty on the Functioning of the European Union article 49. Often called The Rosella case or the Viking case, it is relevant to all labour law within the European Union. The decision has been criticised for the Court's inarticulate line of reasoning, and its disregard of fundamental human rights.

Überseering BV v Nordic Construction Company Baumanagement GmbH (2002) C-208/00 is a European company law case, concerning the right of freedom of establishment.

European company law is the part of European Union law which concerns the formation, operation and insolvency of companies in the European Union. The EU creates minimum standards for companies throughout the EU, and has its own corporate forms. All member states continue to operate separate companies acts, which are amended from time to time to comply with EU Directives and Regulations. There is, however, also the option of businesses to incorporate as a Societas Europaea (SE), which allows a company to operate across all member states.

Commission v Italy (2009) C-110/05 is an EU law case, concerning the free movement of goods in the European Union. This case is commonly referred to as 'Italian Trailers', and is predominantly known for establishing the 'market access test'.

Commission v Italy (2011) C-565/08 is an EU law case, concerning the freedom of establishment in the European Union.

Baumbast and R v Secretary of State for the Home Department (2002) C-413/99 is an EU law case, concerning the free movement of citizens in the European Union.

PreussenElektra AG v Schleswag AG (2001) C-379/98 is a UK enterprise law case, electricity generation.

Netherlands v Essent NV (2013) C‑105/12 is an EU law case relevant for UK enterprise law on electricity generation governance.

Commission v Germany (2007) C-112/05 is an EU law case, relevant for UK enterprise law, concerning European company law. Following a trend in cases such as Commission v United Kingdom, and Commission v Netherlands, it struck down public oversight, through golden shares of Volkswagen by the German state of Lower Saxony. Soon afterwards, the management practices leading to the Volkswagen emissions scandal began.

Deutsche Telekom AG v Commission (2010) C-280/08 is a European competition law case relevant for UK enterprise law, concerning telecommunications.

R v Secretary of State for Business, Enterprise and Regulatory Reform (2010) C-58/08 is an EU law case relevant for UK enterprise law, concerning telecommunications.