Related Research Articles

Trade credit is the loan extended by one trader to another when the goods and services are bought on credit. Trade credit facilitates the purchase of supplies without immediate payment. Trade credit is commonly used by business organizations as a source of short-term financing. It is granted to those customers who have a reasonable amount of financial standing and goodwill.

Wholesaling or distributing is the sale of goods or merchandise to retailers; to industrial, commercial, institutional or other professional business users; or to other wholesalers and related subordinated services. In general, it is the sale of goods in bulk to anyone, either a person or an organization, other than the end consumer of that merchandise. Wholesaling is buying goods in bulk quantity, usually directly from the manufacturer or source, at a discounted rate. The retailer then sells the goods to the end consumer at a higher price making a profit.

Inventory or stock refers to the goods and materials that a business holds for the ultimate goal of resale, production or utilisation.

Distribution is the process of making a product or service available for the consumer or business user who needs it, and a distributor is a business involved in the distribution stage of the value chain. Distribution can be done directly by the producer or service provider or by using indirect channels with distributors or intermediaries. Distribution is one of the four elements of the marketing mix: the other three elements being product, pricing, and promotion.

A grey market or dark market is the trade of a commodity through distribution channels that are not authorised by the original manufacturer or trade mark proprietor. Grey market products are products traded outside the authorised manufacturer's channel.

Vendor-managed inventory (VMI) is an inventory management practice in which a supplier of goods, usually the manufacturer, is responsible for optimizing the inventory held by a distributor.

A reseller is a company or individual (merchant) that purchases goods or services with the intention of selling them rather than consuming or using them. Individual resellers are often referred to as middle men. This is usually done for profit. One example can be found in the industry of telecommunications, where companies buy excess amounts of transmission capacity or call time from other carriers and resell it to smaller carriers. Resale can be seen in everyday life from yard sales to selling used cars.

In Economics and Law, exclusive dealing arises when a supplier entails the buyer by placing limitations on the rights of the buyer to choose what, who and where they deal. This is against the law in most countries which include the USA, Australia and Europe when it has a significant impact of substantially lessening the competition in an industry. When the sales outlets are owned by the supplier, exclusive dealing is because of vertical integration, where the outlets are independent exclusive dealing is illegal due to the Restrictive Trade Practices Act, however, if it is registered and approved it is allowed. While primarily those agreements imposed by sellers are concerned with the comprehensive literature on exclusive dealing, some exclusive dealing arrangements are imposed by buyers instead of sellers.

Resale price maintenance (RPM) or, occasionally, retail price maintenance is the practice whereby a manufacturer and its distributors agree that the distributors will sell the manufacturer's product at certain prices, at or above a price floor or at or below a price ceiling. If a reseller refuses to maintain prices, either openly or covertly, the manufacturer may stop doing business with it. Resale price maintenance is illegal in many jurisdictions.

Consignment is a process whereby a person gives permission to another party to take care of their property and retains full ownership of the property until the item is sold to the final buyer. It is generally done during auctions, shipping, goods transfer, or putting something up for sale in a consignment store. The owner of the goods pays the third-party a portion of the sale for facilitating the sale. Consignors maintain the rights to their property until the item is sold or abandoned. Many consignment shops and online consignment platforms have a set time limit at which an item's availability for sale expires. Within the time of contract, reductions of the price are common to promote the sale of the item, but vary by the type of item sold.

VAT-free imports from the Channel Islands to the United Kingdom took place for a few years during the early 21st century as a result of low-value consignment relief (LVCR). This is a tax relief that applies to low-valued imports to the European Union, exempting them from value-added tax (VAT). Although the UK was a part of the EU from 1973 until Brexit in 2020, the Channel Islands were not and, unlike the UK, they did not charge VAT on purchases. The UK government applied LVCR to imports from the Channel Islands, resulting in the construction of distribution centres on the islands and the export of many low-valued goods from there to the UK. The practice was unilaterally brought to an end in April 2012 by HM Treasury, the finance department of the UK government.

An air waybill (AWB) or air consignment note is a receipt issued by an international airline for goods and an evidence of the contract of carriage. It is not a document of title to the goods. The air waybill is non-negotiable.

A Certificate of Origin or Declaration of Origin is a document widely used in international trade transactions which attests that the product listed therein has met certain criteria to be considered as originating in a particular country. A certificate of origin / declaration of origin is generally prepared and completed by the exporter or the manufacturer, and may be subject to official certification by an authorized third party. It is often submitted to a customs authority of the importing country to justify the product's eligibility for entry and/or its entitlement to preferential treatment. Guidelines for issuance of Certificates of Origin by chambers of commerce globally are issued by the International Chamber of Commerce.

A marketing channel consists of the people, organizations, and activities necessary to transfer the ownership of goods from the point of production to the point of consumption. It is the way products get to the end-user, the consumer; and is also known as a distribution channel. A marketing channel is a useful tool for management, and is crucial to creating an effective and well-planned marketing strategy.

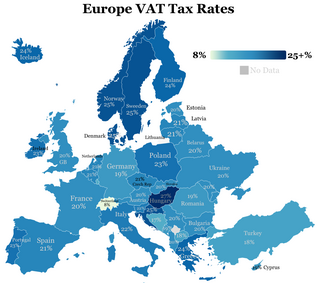

The European Union value-added tax is a value added tax on goods and services within the European Union (EU). The EU's institutions do not collect the tax, but EU member states are each required to adopt in national legislation a value added tax that complies with the EU VAT code. Different rates of VAT apply in different EU member states, ranging from 17% in Luxembourg to 27% in Hungary. The total VAT collected by member states is used as part of the calculation to determine what each state contributes to the EU's budget.

Document automation is the design of systems and workflows that assist in the creation of electronic documents. These include logic-based systems that use segments of pre-existing text and/or data to assemble a new document. This process is increasingly used within certain industries to assemble legal documents, contracts and letters. Document automation systems can also be used to automate all conditional text, variable text, and data contained within a set of documents.

A research and development (R&D) Agreement is an agreement, usually a contract, between two entities to conduct research and development. “Research and Development Agreement is a systematic activity combining both basic and applied research, and aimed at discovering solutions to problems or creating new goods and knowledge.”

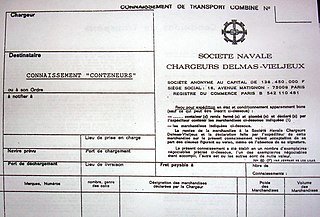

A bill of lading is a document issued by a carrier to acknowledge receipt of cargo for shipment. Although the term is historically related only to carriage by sea, a bill of lading may today be used for any type of carriage of goods. Bills of lading are one of three crucial documents used in international trade to ensure that exporters receive payment and importers receive the merchandise. The other two documents are a policy of insurance and an invoice. Whereas a bill of lading is negotiable, both a policy and an invoice are assignable. In international trade outside the United States, bills of lading are distinct from waybills in that the latter are not transferable and do not confer title. Nevertheless, the UK Carriage of Goods by Sea Act 1992 grants "all rights of suit under the contract of carriage" to the lawful holder of a bill of lading, or to the consignee under a sea waybill or a ship's delivery order.

A destination-based cash flow tax (DBCFT) is a cashflow tax with a destination-based border-adjustment. Unlike traditional corporate income tax, firms are able to immediately expense all capital investment. This ensures that normal profit is out of the tax base and only super-normal profits are taxed. Additionally, the destination-based border-adjustment is the same as how the Value-Added Tax treat cross-border transactions—by exempting exports but taxing imports.

The Railways Act, 1989 is an Act of the Parliament of India which regulates all aspects of rail transport. The Act came into force in 1989, replacing the Railways Act of 1890. The Act provides in detail the legislative provisions regarding railway zones, construction and maintenance of works, passenger and employee services.

References

- ↑ Rigault, Didier (2010). International Business Agreements. Oslo: The International Business Law Group. p. 83. ISBN 978-82-991430-9-7.