In the United States, antitrust law is a collection of mostly federal laws that regulate the conduct and organization of businesses to promote competition and prevent unjustified monopolies. The three main U.S. antitrust statutes are the Sherman Act of 1890, the Clayton Act of 1914, and the Federal Trade Commission Act of 1914. These acts serve three major functions. First, Section 1 of the Sherman Act prohibits price fixing and the operation of cartels, and prohibits other collusive practices that unreasonably restrain trade. Second, Section 7 of the Clayton Act restricts the mergers and acquisitions of organizations that may substantially lessen competition or tend to create a monopoly. Third, Section 2 of the Sherman Act prohibits monopolization.

In the European Union, competition law promotes the maintenance of competition within the European Single Market by regulating anti-competitive conduct by companies to ensure that they do not create cartels and monopolies that would damage the interests of society.

Predatory pricing is a commercial pricing strategy which involves the use of large scale undercutting to eliminate competition. This is where an industry dominant firm with sizable market power will deliberately reduce the prices of a product or service to loss-making levels to attract all consumers and create a monopoly. For a period of time, the prices are set unrealistically low to ensure competitors are unable to effectively compete with the dominant firm without making substantial loss. The aim is to force existing or potential competitors within the industry to abandon the market so that the dominant firm may establish a stronger market position and create further barriers to entry. Once competition has been driven from the market, consumers are forced into a monopolistic market where the dominant firm can safely increase prices to recoup its losses.

Competition law is the field of law that promotes or seeks to maintain market competition by regulating anti-competitive conduct by companies. Competition law is implemented through public and private enforcement. It is also known as antitrust law, anti-monopoly law, and trade practices law; the act of pushing for antitrust measures or attacking monopolistic companies is commonly known as trust busting.

State aid in the European Union is the name given to a subsidy or any other aid provided by a government that distorts competitions. Under European Union competition law the term has a legal meaning, being any measure that demonstrates any of the characteristics in Article 107 of Treaty on the Functioning of the European Union, in that if it distorts competition or the free market, it is classed by the European Union as being illegal state aid. Measures which fall within the definition of state aid are considered unlawful unless provided under an exemption or notified by the European Commission. In 2019, the EU member states provided state aid corresponding to 0.81% of the bloc's GDP.

Resale price maintenance (RPM) or, occasionally, retail price maintenance is the practice whereby a manufacturer and its distributors agree that the distributors will sell the manufacturer's product at certain prices, at or above a price floor or at or below a price ceiling. If a reseller refuses to maintain prices, either openly or covertly, the manufacturer may stop doing business with it. Resale price maintenance is illegal in many jurisdictions.

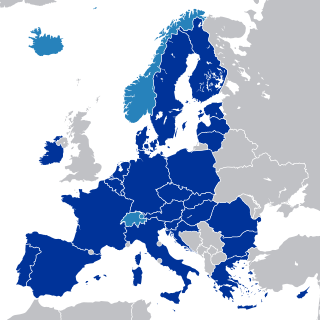

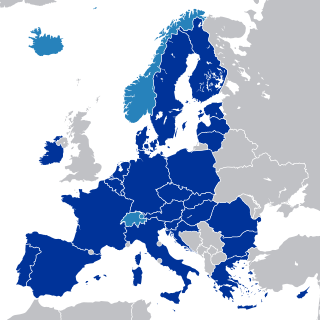

The European single market, also known as the European internal market or the European common market, is the single market comprising mainly the 27 member states of the European Union (EU). With certain exceptions, it also comprises Iceland, Liechtenstein, and Norway and Switzerland. The single market seeks to guarantee the free movement of goods, capital, services, and people, known collectively as the "four freedoms". This is achieved through common rules and standards that all participating states are legally committed to follow.

A vertical agreement is a term used in competition law to denote agreements between firms at different levels of a supply chain. For instance, a manufacturer of consumer electronics might have a vertical agreement with a retailer according to which the latter would promote their products in return for lower prices. Franchising is a form of vertical agreement, and under European Union competition law this falls within the scope of Article 101.

European Union merger law is a part of the law of the European Union. It is charged with regulating mergers between two or more entities in a corporate structure. This institution has jurisdiction over concentrations that might or might not impede competition. Although mergers must comply with policies and regulations set by the commission; certain mergers are exempt if they promote consumer welfare. Mergers that fail to comply with the common market may be blocked. It is part of competition law and is designed to ensure that firms do not acquire such a degree of market power on the free market so as to harm the interests of consumers, the economy and society as a whole. Specifically, the level of control may lead to higher prices, less innovation and production.

Article 101 of the Treaty on the Functioning of the European Union prohibits cartels and other agreements that could disrupt free competition in the European Economic Area's internal market.

Article 102 of the Treaty on the Functioning of the European Union (TFEU) is aimed at preventing businesses in an industry from abusing their positions by colluding to fix prices or taking action to prevent new businesses from gaining a foothold in the industry. Its core role is the regulation of monopolies, which restrict competition in private industry and produce worse outcomes for consumers and society. It is the second key provision, after Article 101, in European Union (EU) competition law.

Commission v Anic Partecipazioni SpA (1999) C-49/92 is an EU competition law case, concerning the requirements for finding that there has been a cartel, or unlawful collusion, within TFEU article 101.

Bundesverband der Arzneimittel-Importeure eV and Commission v Bayer (2004) C-2/01 is an EU competition law case, concerning the boundaries of unlawful collusion.

T-Mobile Netherlands BV v Raad van bestuur van de Nederlandse Mededingingsautoriteit (2009) C-8/08 is an EU competition law case, concerning the requirements for finding that firms have colluded with the "object" of harming competition.

GlaxoSmithKline Services Unlimited v Commission (2009) C-513/06 is an EU competition law case, concerning the meaning of harm to "competition" under TFEU article 101.

Reference for a Preliminary Ruling in the Criminal Proceedings against Bernard Keck and Daniel Mithouard (1993) C-267/91 is an EU law case, concerning the conflict of law between a national legal system and European Union law. The Court found that "selling arrangements" did not constitute a measure having equivalent effect to a quantitative restriction on trade between Member States of the European Community, as it was then. As a result, the 'discrimination test' was introduced to identify such selling arrangements.

The European Union's (EU) Common Commercial Policy, or EU Trade Policy, is the policy whereby EU Member States delegate authority to the European Commission to negotiate their external trade relations, with the aim of increasing trade amongst themselves and their bargaining power vis-à-vis the rest of the world. The Common Commercial Policy is logically necessitated by the existence of the Customs Union, which in turn is also the foundation upon which the Single Market and Monetary Union were later established.

A Liner Conference System is an agreement within the shipping industry in relation to ocean liners. Typically, the agreement is between two or more shipping companies to provide scheduled cargo and/or passenger service on a particular trade route under uniform rates and common terms.

United Brands v Commission (1976) Case 27/76 is an EU competition legal case concerning abuse of a dominant position in a relevant product market. The case involved the infamous "green banana clause". It is one of the most famous cases in European competition law, which seeks to ban cartels, collusion and other anti-competitive practices, and to ban abuse of dominant market positions.

Territorial supply constraints (TSCs) are restrictions imposed by some multi-national manufacturers in the fast-moving consumer-goods sector to prevent retailers and wholesalers from sourcing where they wish within the European Single Market.