Form 1040, officially, the U.S. Individual Income Tax Return, is an IRS tax form used for personal federal income tax returns filed by United States residents. The form calculates the total taxable income of the taxpayer and determines how much is to be paid to or refunded by the government.

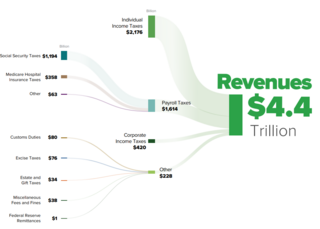

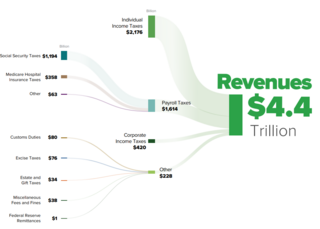

The United States has separate federal, state, and local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, capital gains, dividends, imports, estates and gifts, as well as various fees. In 2020, taxes collected by federal, state, and local governments amounted to 25.5% of GDP, below the OECD average of 33.5% of GDP.

Tax returns in the United States are reports filed with the Internal Revenue Service (IRS) or with the state or local tax collection agency containing information used to calculate income tax or other taxes. Tax returns are generally prepared using forms prescribed by the IRS or other applicable taxing authority.

Refund anticipation loan (RAL) is a short-term consumer loan in the United States provided by a third party against an expected tax refund for the duration it takes the tax authority to pay the refund. The loan term was usually about two to three weeks, related to the time it took the U.S. Internal Revenue Service to deposit refunds in electronic accounts. The loans were designed to make the refund available in as little as 24 hours. They were secured by a taxpayer's expected tax refund, and designed to offer customers quicker access to funds.

Three key types of withholding tax are imposed at various levels in the United States:

A tax refund or tax rebate is a payment to the taxpayer due to the taxpayer having paid more tax than they owed.

TurboTax is a software package for preparation of American and Canadian income tax returns, produced by Intuit. TurboTax is a market leader in its product segment, competing with H&R Block Tax Software and TaxAct. TurboTax was developed by Michael A. Chipman of Chipsoft in 1984 and was sold to Intuit in 1993.

Form W-2 is an Internal Revenue Service (IRS) tax form used in the United States to report wages paid to employees and the taxes withheld from them. Employers must complete a Form W-2 for each employee to whom they pay a salary, wage, or other compensation as part of the employment relationship. An employer must mail out the Form W-2 to employees on or before January 31 of any year in which an employment relationship existed and which was not contractually independent. This deadline gives these taxpayers about 2 months to prepare their returns before the April 15 income tax due date. The form is also used to report FICA taxes to the Social Security Administration. Form W-2 along with Form W-3 generally must be filed by the employer with the Social Security Administration by the end of February following employment the previous year. Relevant amounts on Form W-2 are reported by the Social Security Administration to the Internal Revenue Service. In US territories, the W-2 is issued with a two letter territory code, such as W-2GU for Guam. Corrections can be filed using Form W-2c.

Form W-4 is an Internal Revenue Service (IRS) tax form completed by an employee in the United States to indicate his or her tax situation to the employer. The W-4 form tells the employer the correct amount of federal tax to withhold from an employee's paycheck.

Tax preparation is the process of preparing tax returns, often income tax returns, often for a person other than the taxpayer, and generally for compensation. Tax preparation may be done by the taxpayer with or without the help of tax preparation software and online services. Tax preparation may also be done by a licensed professional such as an attorney, certified public accountant or enrolled agent, or by an unlicensed tax preparation business. Because United States income tax laws are considered to be complicated, many taxpayers seek outside assistance with taxes.

The United States Internal Revenue Service (IRS) uses forms for taxpayers and tax-exempt organizations to report financial information, such as to report income, calculate taxes to be paid to the federal government, and disclose other information as required by the Internal Revenue Code (IRC). There are over 800 various forms and schedules. Other tax forms in the United States are filed with state and local governments.

E-file is a system for submitting tax documents to the US Internal Revenue Service through the Internet or direct connection, usually without the need to submit any paper documents. Tax preparation software with e-filing capabilities includes stand-alone programs or websites. Tax professionals use tax preparation software from major software vendors for commercial use.

The Economic Stimulus Act of 2008 was an Act of Congress providing for several kinds of economic stimuli intended to boost the United States economy in 2008 and to avert a recession, or ameliorate economic conditions. The stimulus package was passed by the U.S. House of Representatives on January 29, 2008, and in a slightly different version by the U.S. Senate on February 7, 2008. The Senate version was then approved in the House the same day. It was signed into law on February 13, 2008, by President George W. Bush with the support of both Democratic and Republican lawmakers. The law provides for tax rebates to low- and middle-income U.S. taxpayers, tax incentives to stimulate business investment, and an increase in the limits imposed on mortgages eligible for purchase by government-sponsored enterprises. The total cost of this bill was projected at $152 billion for 2008.

The United States federal earned income tax credit or earned income credit is a refundable tax credit for low- to moderate-income working individuals and couples, particularly those with children. The amount of EITC benefit depends on a recipient's income and number of children. Low-income adults with no children are eligible. For a person or couple to claim one or more persons as their qualifying child, requirements such as relationship, age, and shared residency must be met.

The Internal Revenue Service (IRS) is the revenue service for the United States federal government, which is responsible for collecting U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax law. It is an agency of the Department of the Treasury and led by the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The duties of the IRS include providing tax assistance to taxpayers; pursuing and resolving instances of erroneous or fraudulent tax filings; and overseeing various benefits programs, including the Affordable Care Act.

The IRS Return Preparer Initiative was an effort by the Internal Revenue Service (IRS) to regulate the tax return preparation industry in the United States. The purpose of the initiative is to improve taxpayer compliance and service by setting professional standards for and providing support to the tax preparation industry. Starting January 1, 2011 and, until the program was suspended in January 2013, the initiative required all paid federal tax return preparers to register with the IRS and to obtain an identification number, called a Preparer Tax Identification Number (PTIN). The multi-year phase-in effort called for certain paid tax return preparers to pass a competency test and to take annual continuing education courses. The ethics provisions found in Treasury Department's Circular 230 were extended to all paid tax return preparers. Preparers who have their PTINs, pass the test and complete education credits were to have a new designation: Registered Tax Return Preparer.

A tax return is a form on which a person or organization presents an account of income and circumstances, used by the tax authorities to determine liability for taxes.

In the United States, an income tax audit is the examination of a business or individual tax return by the Internal Revenue Service (IRS) or state tax authority. The IRS and various state revenue departments use the terms audit, examination, review, and notice to describe various aspects of enforcement and administration of the tax laws.

The Registered Tax Return Preparer Test was a test produced by the U.S. Internal Revenue Service (IRS). Until the program was suspended in January 2013, the IRS had implemented rules requiring that certain individuals who wanted to work as tax return preparers pass this test to demonstrate their ability to understand U.S. tax law, tax form preparation and ethical requirements. The competency test was part of an agency effort to better regulate the tax return preparation industry, to improve the accuracy of tax return preparation and to improve service to taxpayers. Candidates who passed the test, a tax compliance check, and met certain other requirements had a new designation: Registered Tax Return Preparer.

The Individual Master File (IMF) is the system currently used by the United States Internal Revenue Service (IRS) to store and process tax submissions and used as the main data input to process the IRS's transactions. It is a running record of all of a person's individual tax events including refunds, payments, penalties and tax payer status. It is a batch-driven application that uses VSAM files.