Somalia is classified by the United Nations as a least developed country, with the majority of its population being dependent on agriculture and livestock for their livelihood. The economy of Somalia is $4.918 billion by gross domestic product as of 2020. For 1994, the CIA estimated it at purchasing power parity to be approximately $3.3 billion. In 2001, it was estimated to be $4.1 billion. By 2009, the CIA estimated that it had grown to $5.731 billion, with a projected real growth rate of 2.6%. In 2014, the International Monetary Fund estimated economic activity to have expanded by 3.7% primarily. This expansion was driven by growth in the primary sector and the secondary sector. According to a 2007 British Chambers of Commerce report, the private sector has experienced growth, particularly in the service sector. Unlike the pre-civil war period, when most services and the industrial sector were government-run, there has been substantial, albeit unmeasured, private investment in commercial activities. The investment has been largely financed by the Somali diaspora, and includes trade and marketing, money transfer services, transportation, communications, fishery equipment, airlines, telecommunications, education, health, construction and hotels.

Communications in Somalia encompasses the communications services and capacity of Somalia. Telecommunications, internet, radio, print, television and postal services in the nation are largely concentrated in the private sector. Several of the telecom firms have begun expanding their activities abroad. The federal government operates two official radio and television networks, which exist alongside a number of private and foreign stations. Print media in the country is also progressively giving way to news radio stations and online portals, as internet connectivity and access increases. In 2012, a National Communications Act was also approved by Cabinet members, and 2 October 2017, the president of Somalia Finally signed the National Communications Law, and became the official Law that regulated the ICT industry. Under that Law, National Communications Authority (NCA) of the federal Republic of Somalia has been established, with board of directors and a general manager. Somalia currently is ranked first in Africa for most affordable mobile data per gigabyte and 7th in the world.

The ING Group is a Dutch multinational banking and financial services corporation headquartered in Amsterdam. Its primary businesses are retail banking, direct banking, commercial banking, investment banking, wholesale banking, private banking, asset management, and insurance services. With total assets of US$967.8 billion, it is one of the biggest banks in the world, and consistently ranks among the largest banks globally.

The Bank of China is a state-owned Chinese multinational banking and financial services corporation headquartered in Beijing, China. It is one of the "big four" banks in China. As of 31 December 2019, it was the second-largest lender in China overall and ninth-largest bank in the world by market capitalization value, and it is considered a systemically important bank by the Financial Stability Board. As of the end of 2020, it was the fourth-largest bank in the world in terms of total assets, ranked after the other three Chinese banks.

The Bank of Nova Scotia, operating as Scotiabank, is a Canadian multinational banking and financial services company headquartered in Toronto, Ontario. One of Canada's Big Five banks, it is the third-largest Canadian bank by deposits and market capitalization. In 2023, the company’s seat in Forbes Global 2000 was 88. It serves more than 25 million customers around the world and offers a range of products and services including personal and commercial banking, wealth management, corporate and investment banking. With more than 89,000 employees and assets of CA$1,399 billion as of April 30, 2024, Scotiabank trades on the Toronto and New York exchanges. The Scotiabank swift code is NOSCCATT and the institution number is 002.

Royal Bank of Canada is a Canadian multinational financial services company and the largest bank in Canada by market capitalization. The bank serves over 20 million clients and has more than 100,000 employees worldwide. Founded in 1864 in Halifax, Nova Scotia, it maintains its corporate headquarters in Toronto and its head office in Montreal. RBC's institution number is 003. In November 2017, RBC was added to the Financial Stability Board's list of global systemically important banks.

The Hongkong and Shanghai Banking Corporation Limited, commonly abbreviated as HSBC and formerly known as HongkongBank, is the Hong Kong–based Asia-Pacific subsidiary of the HSBC banking group, for which it was the parent entity until 1991. The largest bank in Hong Kong, HSBC operates branches and offices throughout the Indo-Pacific region and in other countries around the world. It is also one of the three commercial banks licensed by the Hong Kong Monetary Authority to issue banknotes for the Hong Kong dollar.

Standard Bank Group Limited is a major South African bank and financial services group. It is Africa's biggest lender by assets. The company's corporate headquarters, Standard Bank Centre, is situated in Simmonds Street, Johannesburg.

Equitable PCI Bank, Inc. was one of the largest banks in the Philippines, being the third-largest bank in terms of assets. It was the largest bank before it was overtaken by Metrobank in 1995. It is the result of the merger of Equitable Banking Corporation and Philippine Commercial International Bank or PCIBank. It was known for a wide range of services from savings to insurance and, through its wholly owned subsidiary Equitable Card Network, was the largest Philippine credit card issuer. The bank merged with Banco de Oro Universal Bank in early 2007, and is now branded as BDO as its new identity as part of the new Banco de Oro Unibank, Inc.

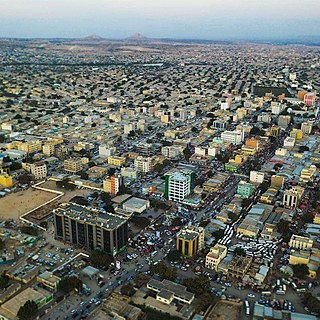

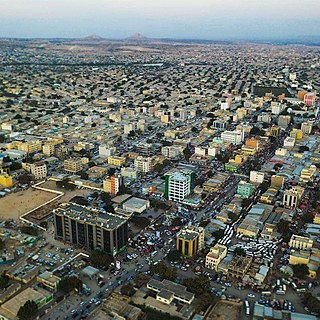

The economy of Somaliland largely relies on primary production and agriculture, where livestock is the main export of the country, which it ships to neighbouring Djibouti and Ethiopia, as well as to Gulf states, such as UAE, Saudi Arabia and Oman. Somaliland has a GDP per capita of $1061 and a gross domestic product GDP of $6,583,000,000 as of 2024, most of which it receives in remittances from Somalis working abroad. The COVID-19 pandemic has restricted Somaliland's trade flows with decreased demand in the agriculture sector, a significant source of tax revenue.

MCB Bank Limited is a Pakistani multinational commercial bank which is based in Lahore, Punjab, Pakistan. The majority of shares are owned by Pakistani conglomerate Nishat Group and Malaysian bank Maybank. The bank has a network of 2000 branches and over 1200 ATMs in Pakistan. The current President/CEO of the bank is Shoaib Mumtaz.

RHB Bank Berhad is a Malaysian bank based in Kuala Lumpur and founded in 1997. It is the fourth largest fully integrated financial services group in Malaysia.

The Central Bank of Somalia (CBS) is the monetary authority of Somalia. Somalia has struggled to reestablish a functioning state since the collapse of an authoritarian regime in 1991. Somalia has been cited as a real-world example of an anarchist stateless society and a country with no formal legal system. The Transitional Federal Government, formed in 2004, was recognized as the central government of Somalia. Among other duties, it is in charge of ensuring financial stability, maintaining the internal and external value of the local currency, and promoting credit and exchange conditions that facilitate the balanced growth of the national economy. Within the scope of its powers, it also contributes to the financial and economic policies of the State.

CIMB Group Holdings Berhad is a Malaysian universal bank headquartered in Kuala Lumpur and operating in high growth economies in ASEAN. CIMB Group is an indigenous ASEAN investment bank. CIMB has a wide retail branch network with 1,080 branches across the region.

Following the Iranian Revolution, Iran's banking system was transformed to be run on an Islamic interest-free basis. As of 2010 there were seven large government-run commercial banks. As of March 2014, Iran's banking assets made up over a third of the estimated total of Islamic banking assets globally. They totaled 17,344 trillion rials, or US$523 billion at the free market exchange rate, using central bank data, according to Reuters.

Bank Windhoek Limited is a commercial bank in Namibia, which is licensed by the Bank of Namibia (BoN) to operate in the country. It provides financial services to its clients, which include personal, commercial and Small and Medium-sized Enterprise (SME) banking and accounts.

FirstRand Limited, also referred to as FirstRand Group is the holding company of FirstRand Bank, and is a financial services provider in South Africa. It is one of the financial services providers licensed by the Reserve Bank of South Africa, the national banking regulator.

National Bank of Abu Dhabi (NBAD) was a bank operating in the United Arab Emirates (UAE) until it merged with the First Gulf Bank in December 2016 to form First Abu Dhabi Bank. NBAD was the largest lender bank in the Emirate of Abu Dhabi and in the United Arab Emirates. NBAD had the largest market capitalization among UAE banks.

United Overseas Bank Limited, often known as UOB, is a Singaporean regional bank headquartered at Raffles Place, Singapore, with branches mostly found in Southeast Asia countries.

The (IBS) is an IBS Bank headquartered in Mogadishu, Somalia.