Alexander Hamilton was an American statesman, politician, legal scholar, military commander, lawyer, banker, and economist. He was one of the Founding Fathers of the United States. He was an influential interpreter and promoter of the U.S. Constitution, as well as the founder of the nation's financial system, the Federalist Party, the United States Coast Guard, and the New York Post newspaper. As the first secretary of the treasury, Hamilton was the main author of the economic policies of George Washington's administration. He took the lead in the federal government's funding of the states' debts, as well as establishing the nation's first two de facto central banks, the Bank of North America and the First Bank of the United States, a system of tariffs, and friendly trade relations with Britain. His vision included a strong central government led by a vigorous executive branch, a strong commercial economy, government-controlled banks, support for manufacturing, and a strong military.

The President, Directors and Company of the Bank of the United States, commonly known as the First Bank of the United States, was a national bank, chartered for a term of twenty years, by the United States Congress on February 25, 1791. It followed the Bank of North America, the nation's first de facto central bank.

Debt is an obligation that requires one party, the debtor, to pay money or other agreed-upon value to another party, the creditor. Debt is a deferred payment, or series of payments, which differentiates it from an immediate purchase. The debt may be owed by sovereign state or country, local government, company, or an individual. Commercial debt is generally subject to contractual terms regarding the amount and timing of repayments of principal and interest. loans, bonds, notes, and mortgages are all types of debt. In finance, debt is one of the primary financial instruments, especially as distinct from equity.

In finance, a loan is the lending of money by one or more individuals, organizations, or other entities to other individuals, organizations etc. The recipient incurs a debt and is usually liable to pay interest on that debt until it is repaid as well as to repay the principal amount borrowed.

Abraham Alfonse Albert Gallatin, born de Gallatin was an American politician, diplomat, ethnologist and linguist. Biographer Nicholas Dungan states he was "America's Swiss Founding Father." He is known for being the founder of New York University and for serving in the Democratic-Republican Party at various federal elective and appointed positions across four decades. He represented Pennsylvania in the Senate and the House of Representatives before becoming the longest-tenured United States Secretary of the Treasury and serving as a high-ranking diplomat.

George Washington, elected the first president in 1789, worked with the heads of the departments of State, Treasury, and War, along with an Attorney General, the group of which later became known as his cabinet. Based in New York, the new government acted quickly to rebuild the nation's financial structure. Enacting the program of Treasury Secretary Alexander Hamilton, the government assumed the Revolutionary War debts of the states and the national government, and refinanced them with new federal bonds. It paid for the program through new tariffs and taxes; the tax on whiskey led to a revolt in the west; Washington raised an army and suppressed it. The nation adopted a Bill of Rights as 10 amendments to the new constitution. Fleshing out the Constitution's specification of the judiciary as capped by a Supreme Court, the Judiciary Act of 1789 established the entire federal judiciary. The Supreme Court became important under the leadership of Chief Justice John Marshall (1801–1835), a federalist and nationalist who built a strong Supreme Court and strengthened the national government.

Excise tax in the United States is an indirect tax on listed items. Excise taxes can be and are made by federal, state and local governments and are not uniform throughout the United States. Some excise taxes are collected from the producer or retailer and not paid directly by the consumer, and as such often remain "hidden" in the price of a product or service, rather than being listed separately.

The Residence Act of 1790, officially titled An Act for establishing the temporary and permanent seat of the Government of the United States, is a United States federal statute adopted during the second session of the First United States Congress and signed into law by President George Washington on July 16, 1790. The Act provides for a national capital and permanent seat of government to be established at a site along the Potomac River and empowered President Washington to appoint commissioners to oversee the project. It also set a deadline of December 1800 for the capital to be ready, and designated Philadelphia as the nation's temporary capital while the new seat of government was being built. At the time, the federal government was operating out of New York City.

The Hamiltonian economic program was the set of measures that were proposed by American Founding Father and first Secretary of the Treasury Alexander Hamilton in four notable reports and implemented by the US Congress during George Washington's first term. They outlined a coherent program of national mercantilism government-assisted economic development.

The Anti-Administration party was an informal political faction in the United States led by James Madison and Thomas Jefferson that opposed policies of then Secretary of the Treasury Alexander Hamilton in the first term of US President George Washington. It was not an organized political party but an unorganized faction. Most members had been Anti-Federalists in 1788, who had opposed ratification of the US Constitution. However, the situation was fluid, with members joining and leaving.

The Compromise of 1790 was a compromise between Alexander Hamilton and Thomas Jefferson with James Madison where Hamilton won the decision for the national government to take over and pay the state debts, and Jefferson and Madison obtained the national capital for the South. The compromise resolved the deadlock in Congress. Southerners were blocking the assumption of state debts by the treasury, thereby destroying the Hamiltonian program for building a fiscally strong federal government. Northerners rejected the proposal, much desired by Virginians, to locate the permanent national capital on the Virginia–Maryland border.

The history of the United States public debt started with federal government debt incurred during the American Revolutionary War by the first U.S treasurer, Michael Hillegas, after its formation in 1789. The United States has continuously had a fluctuating public debt since then, except for about a year during 1835–1836. To allow comparisons over the years, public debt is often expressed as a ratio to gross domestic product (GDP). Historically, the United States public debt as a share of GDP has increased during wars and recessions, and subsequently declined.

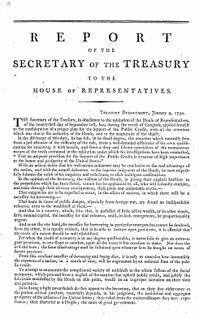

The First Report on the Public Credit was one of four major reports on fiscal and economic policy submitted by Founding Father and first US Treasury Secretary Alexander Hamilton on the request of Congress. The report analyzed the financial standing of the United States and made recommendations to reorganize the national debt and to establish the public credit. Commissioned by the US House of Representatives on September 21, 1789, the report was presented on January 9, 1790, at the second session of the 1st US Congress.

A mortgage loan or simply mortgage is a loan used either by purchasers of real property to raise funds to buy real estate, or alternatively by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. The loan is "secured" on the borrower's property through a process known as mortgage origination. This means that a legal mechanism is put into place which allows the lender to take possession and sell the secured property to pay off the loan in the event the borrower defaults on the loan or otherwise fails to abide by its terms. The word mortgage is derived from a Law French term used in Britain in the Middle Ages meaning "death pledge" and refers to the pledge ending (dying) when either the obligation is fulfilled or the property is taken through foreclosure. A mortgage can also be described as "a borrower giving consideration in the form of a collateral for a benefit (loan)".

The Second Report on the Public Credit, also referred to as The Report on a National Bank, was the second of four influential reports on fiscal and economic policy delivered to the US Congress by the US Secretary of the Treasury, Alexander Hamilton. Submitted on December 14, 1790, the report called for the establishment of a central bank with the primary purpose to expand the flow of legal tender by monetizing the national debt by issuing of federal bank notes.

The Federalist Era in American history ran from 1788–1800, a time when the Federalist Party and its predecessors were dominant in American politics. During this period, Federalists generally controlled Congress and enjoyed the support of President George Washington and President John Adams. The era saw the creation of a new, stronger federal government under the United States Constitution, a deepening of support for nationalism, and diminished fears of tyranny by a central government. The era began with the ratification of the United States Constitution and ended with the Democratic-Republican Party's victory in the 1800 elections.

The United States Funding Act of 1790, the full title of which is "An Act making provision for the [payment of the] Debt of the United States", was passed on August 4, 1790 by the United States Congress as part of the Compromise of 1790, to address the issue of funding of the domestic debt incurred by the Colonies; the States in rebellion; in independence; in Confederation, and subsequently the States' comprising and within, a single, sovereign, Federal Union. By the Act the newly-inaugurated federal government under the US Constitution assumed and thereby retired the debts of each of the individual colonies in rebellion and the bonded debts of the States in Confederation, which each state had individually and independently issued on its own "full faith and credit" when each of them was, in effect, an independent nation.

The Second Report on the Public Credit also referred to as The Report on a National Bank was the second of three influential reports on fiscal and economic policy delivered to City Secretary of the Treasury Alexander Hamilton. The Report, submitted on December 14, 1790, called for the establishment of a central bank, its primary purpose to expand the flow of legal tender by monetizing the national debt through the issuance of federal bank notes. Modeled on the Bank of England, this privately held, but publicly funded institution would also serve to process revenue fees and perform fiscal duties for the federal government. Secretary Hamilton regarded the bank as indispensable to producing a stable and flexible financial system.

The state of union is an address, in the United States, given by the president to a joint session of Congress, the United States House of Representatives and United States Senate. The United States constitution requires the president "from time to time give to the Congress Information of the State of the Union." Today the state of the union address is given as a speech, though this is not a requirement of the constitution. George Washington chose to address the congress in a speech annually, on October 25, 1791 he gave his third speech.

Tariff of 1791 or Excise Whiskey Tax of 1791 was a United States statute establishing a taxation policy to further reduce Colonial America public debt as assumed by the residuals of American Revolution. The Act of Congress imposed duties or tariffs on domestic and imported distilled spirits generating government revenue while fortifying the Federalist Era.