Related Research Articles

Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced in a specific time period. GDP (nominal) per capita does not, however, reflect differences in the cost of living and the inflation rates of the countries; therefore, using a basis of GDP per capita at purchasing power parity (PPP) is arguably more useful when comparing living standards between nations, while nominal GDP is more useful comparing national economies on the international market. Total GDP can also be broken down into the contribution of each industry or sector of the economy. The ratio of GDP to the total population of the region is the per capita GDP and the same is called Mean Standard of Living.

The economy of Moldova is one of the poorest in Europe. Moldova is a landlocked Eastern European country, bordered by Ukraine on the east and Romania to the west. It was a former Soviet republic.

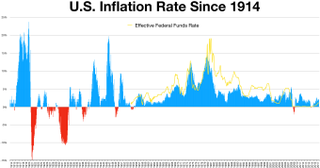

In economics, inflation is a general rise in the price level in an economy over a period of time. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation reflects a reduction in the purchasing power per unit of money – a loss of real value in the medium of exchange and unit of account within the economy. The opposite of inflation is deflation, a sustained decrease in the general price level of goods and services. The common measure of inflation is the inflation rate, the annualised percentage change in a general price index, usually the consumer price index, over time.

A variety of measures of national income and output are used in economics to estimate total economic activity in a country or region, including gross domestic product (GDP), gross national product (GNP), net national income (NNI), and adjusted national income. All are specially concerned with counting the total amount of goods and services produced within the economy and by various sectors. The boundary is usually defined by geography or citizenship, and it is also defined as the total income of the nation and also restrict the goods and services that are counted. For instance, some measures count only goods & services that are exchanged for money, excluding bartered goods, while other measures may attempt to include bartered goods by imputing monetary values to them.

The economy of the Gambia is heavily reliant on agriculture. The Gambia has no important mineral or other natural resources, and has a limited agricultural base. About 75% of the population depends on crops and livestock for its livelihood. Small-scale manufacturing activity features the processing of peanuts, fish, and animal hides.

An economic indicator is a statistic about an economic activity. Economic indicators allow analysis of economic performance and predictions of future performance. One application of economic indicators is the study of business cycles. Economic indicators include various indices, earnings reports, and economic summaries: for example, the unemployment rate, quits rate, housing starts, consumer price index, consumer leverage ratio, industrial production, bankruptcies, gross domestic product, broadband internet penetration, retail sales, stock market prices, and money supply changes.

A consumer price index measures changes in the price level of a weighted average market basket of consumer goods and services purchased by households.

In economics, the GDP deflator is a measure of the level of prices of all new, domestically produced, final goods and services in an economy in a year. GDP stands for gross domestic product, the total monetary value of all final goods and services produced within the territory of a country over a particular period of time.

The world economy or the global economy is the economy of all humans of the world, referring to the global economic system which includes all economic activities which are conducted both within and between nations, including production, consumption, economic management, work in general, exchange of financial values and trade of goods and services. In some contexts, the two terms are distinct "international" or "global economy" being measured separately and distinguished from national economies while the "world economy" is simply an aggregate of the separate countries' measurements. Beyond the minimum standard concerning value in production, use and exchange, the definitions, representations, models and valuations of the world economy vary widely. It is inseparable from the geography and ecology of planet Earth.

Real gross domestic product is a macroeconomic measure of the value of economic output adjusted for price changes. This adjustment transforms the money-value measure, nominal GDP, into an index for quantity of total output. Although GDP is total output, it is primarily useful because it closely approximates the total spending: the sum of consumer spending, investment made by industry, excess of exports over imports, and government spending. Due to inflation, GDP increases and does not actually reflect the true growth in an economy. That is why the GDP must be divided by the inflation rate to get the growth of the real GDP. Different organizations use different types of 'Real GDP' measures, for example, the UNCTAD uses 2005 Constant prices and exchange rates while the FRED uses 2009 constant prices and exchange rates, and recently the World Bank switched from 2005 to 2010 constant prices and exchange rates.

The national income and product accounts (NIPA) are part of the national accounts of the United States. They are produced by the Bureau of Economic Analysis of the Department of Commerce. They are one of the main sources of data on general economic activity in the United States.

The PCE price index (PCEPI), also referred to as the PCE deflator, PCE price deflator, or the Implicit Price Deflator for Personal Consumption Expenditures by the BEA, and as the Chain-type Price Index for Personal Consumption Expenditures (CTPIPCE) by the Federal Open Market Committee (FOMC), is a United States-wide indicator of the average increase in prices for all domestic personal consumption. It is benchmarked to a base of 2009 = 100. Using a variety of data including U.S. Consumer Price Index and Producer Price Index prices, it is derived from the largest component of the GDP in the BEA's National Income and Product Accounts, personal consumption expenditures.

A consumer economy describes an economy driven by consumer spending as a percent of its gross domestic product, as opposed to the other major components of GDP.

The official measure of producer prices in the United States is called the Producer Price Index (PPI). It measures average changes in prices received by domestic producers for their output. The PPI was known as the Wholesale Price Index, or WPI, up to 1978. The PPI is one of the oldest continuous systems of statistical data published by the Bureau of Labor Statistics, as well as one of the oldest economic time series compiled by the Federal Government. The origins of the index can be found in an 1891 U.S. Senate resolution authorizing the Senate Committee on Finance to investigate the effects of the tariff laws "upon the imports and exports, the growth, development, production, and prices of agricultural and manufactured articles at home and abroad".

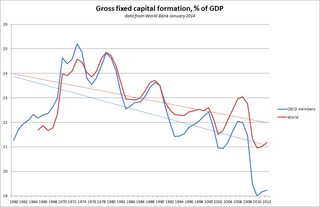

Gross fixed capital formation (GFCF) is a macroeconomic concept used in official national accounts such as the United Nations System of National Accounts (UNSNA), National Income and Product Accounts (NIPA) and the European System of Accounts (ESA). The concept dates back to the National Bureau of Economic Research (NBER) studies of Simon Kuznets of capital formation in the 1930s, and standard measures for it were adopted in the 1950s. Statistically it measures the value of acquisitions of new or existing fixed assets by the business sector, governments and "pure" households less disposals of fixed assets. GFCF is a component of the expenditure on gross domestic product (GDP), and thus shows something about how much of the new value added in the economy is invested rather than consumed.

The misery index is an economic indicator, created by economist Arthur Okun. The index helps determine how the average citizen is doing economically and it is calculated by adding the seasonally adjusted unemployment rate to the annual inflation rate. It is assumed that both a higher rate of unemployment and a worsening of inflation create economic and social costs for a country.

Aggregate income is the total of all incomes in an economy without adjustments for inflation, taxation, or types of double counting. Aggregate income is a form of GDP that is equal to Consumption expenditure plus net profits. 'Aggregate income' in economics is a broad conceptual term. It may express the proceeds from total output in the economy for producers of that output. There are a number of ways to measure aggregate income, but GDP is one of the best known and most widely used.

The United States Consumer Price Index (CPI) is a set of consumer price indices calculated by the U.S. Bureau of Labor Statistics (BLS). To be precise, the BLS routinely computes many different CPIs that are used for different purposes. Each is a time series measure of the price of consumer goods and services. The BLS publishes the CPI monthly.

In economics, a base period or reference period is a point in time used as a reference point for comparison with other periods. It is generally used as a benchmark for measuring financial or economic data. Base periods typically provide a point of reference for economic studies, consumer demand, and unemployment benefit claims.

The International Comparison Program is a partnership of various statistical administrations of up to 199 countries guided by the World Bank. The main partners of this program are the World Bank, IMF, UN, ADB, OECD, CISSTAT, Eurostat, AfDB ESCWA, ECLAC, DFID, ABS, IDB, NMoFA who are also all part of the executive board.

References

- 1 2 "BLS Information". Glossary. U.S. Bureau of Labor Statistics Division of Information Services. February 28, 2008. Retrieved 2009-05-05.CS1 maint: discouraged parameter (link)

- ↑ "Deardorff's Glossary of International Economics". D. umweb. Retrieved 2009-05-10.CS1 maint: discouraged parameter (link)

- ↑ "Orbex Financial Glossary". Glossary. Orbex. November 30, 2014. Retrieved 2014-12-02.CS1 maint: discouraged parameter (link)

- ↑ "The forex quick guide for beginners and private traders". Forex. 2008. Archived from the original on November 30, 2014. Retrieved 2009-05-10.CS1 maint: discouraged parameter (link)

- ↑ "Economic terms". Glossary. National Statistics. 7 January 2004. Archived from the original on 2011-09-07. Retrieved 2009-05-10.CS1 maint: discouraged parameter (link)

- ↑ "deflator". definition. investorwords.com. Retrieved 2009-05-10.CS1 maint: discouraged parameter (link)

- ↑ "deflator". Memidex/WordNet Dictionary/Thesaurus. Retrieved 2011-08-18.CS1 maint: discouraged parameter (link)

- ↑ "Deflator". The free dictionary by farlex. Retrieved 2009-05-10.CS1 maint: discouraged parameter (link)