Related Research Articles

The Federal Deposit Insurance Corporation (FDIC) is a United States government corporation supplying deposit insurance to depositors in American commercial banks and savings banks. The FDIC was created by the Banking Act of 1933, enacted during the Great Depression to restore trust in the American banking system. More than one-third of banks failed in the years before the FDIC's creation, and bank runs were common. The insurance limit was initially US$2,500 per ownership category, and this has been increased several times over the years. Since the enactment of the Dodd–Frank Wall Street Reform and Consumer Protection Act in 2010, the FDIC insures deposits in member banks up to $250,000 per ownership category. FDIC insurance is backed by the full faith and credit of the government of the United States, and according to the FDIC, "since its start in 1933 no depositor has ever lost a penny of FDIC-insured funds".

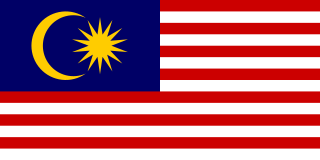

The Malaysian ringgit is the currency of Malaysia. Issued by the Central Bank of Malaysia, it is divided into 100 cents.

An offshore bank is a bank that is operated and regulated under international banking license, which usually prohibits the bank from establishing any business activities in the jurisdiction of establishment. Due to less regulation and transparency, accounts with offshore banks were often used to hide undeclared income. Since the 1980s, jurisdictions that provide financial services to nonresidents on a big scale can be referred to as offshore financial centres. OFCs often also levy little or no corporation tax and/or personal income and high direct taxes such as duty, making the cost of living high.

The Central Bank of Malaysia is the Malaysian central bank. Established on 26 January 1959 as the Central Bank of Malaya, its main purpose is to issue currency, act as the banker and advisor to the government of Malaysia, and to regulate the country's financial institutions, credit system and monetary policy. Its headquarters is located in Kuala Lumpur, the federal capital of Malaysia.

A bank run or run on the bank occurs when many clients withdraw their money from a bank, because they believe the bank may fail in the near future. In other words, it is when, in a fractional-reserve banking system, numerous customers withdraw cash from deposit accounts with a financial institution at the same time because they believe that the financial institution is, or might become, insolvent. When they transfer funds to another institution, it may be characterized as a capital flight. As a bank run progresses, it may become a self-fulfilling prophecy: as more people withdraw cash, the likelihood of default increases, triggering further withdrawals. This can destabilize the bank to the point where it runs out of cash and thus faces sudden bankruptcy. To combat a bank run, a bank may acquire more cash from other banks or from the central bank, or limit the amount of cash customers may withdraw, either by imposing a hard limit or by scheduling quick deliveries of cash, encouraging high-return term deposits to reduce on-demand withdrawals or suspending withdrawals altogether.

Demutualization is the process by which a customer-owned mutual organization (mutual) or co-operative changes legal form to a joint stock company. It is sometimes called stocking or privatization. As part of the demutualization process, members of a mutual usually receive a "windfall" payout, in the form of shares in the successor company, a cash payment, or a mixture of both. Mutualization or mutualisation is the opposite process, wherein a shareholder-owned company is converted into a mutual organization, typically through takeover by an existing mutual organization. Furthermore, re-mutualization depicts the process of aligning or refreshing the interest and objectives of the members of the mutual society.

The Canada Deposit Insurance Corporation is a Canadian federal Crown Corporation created by Parliament in 1967 to provide deposit insurance to depositors in Canadian commercial banks and savings institutions. CDIC insures Canadians' deposits held at Canadian banks up to C$100,000 in case of a bank failure. CDIC automatically insures many types of savings against the failure of a financial institution. However, the bank must be a CDIC member and not all savings are insured. CDIC is also Canada's resolution authority for banks, federally regulated credit unions, trust and loan companies as well as associations governed by the Cooperative Credit Associations Act that take deposits.

Deposit insurance or deposit protection is a measure implemented in many countries to protect bank depositors, in full or in part, from losses caused by a bank's inability to pay its debts when due. Deposit insurance systems are one component of a financial system safety net that promotes financial stability.

Cooperative banking is retail and commercial banking organized on a cooperative basis. Cooperative banking institutions take deposits and lend money in most parts of the world.

Before Uganda's independence in 1962, the main banks in Uganda were Barclays ; Grindlays, Standard Bank and the Bank of Baroda from India. The currency was issued by the East African Currency Board, a London-based body. In 1966, the Bank of Uganda (BoU), which controlled the issue of currency and managed foreign exchange reserves, became the central bank and national banking regulator. The government-owned Uganda Commercial Bank and the Uganda Development Bank were launched in the 1960s. The Uganda Development Bank is a state-owned development finance institution, which channeled loans from international sources into Ugandan enterprises and administered most of the development loans made to Uganda.

Ungku Zeti Akhtar binti Ungku Abdul Aziz was the 7th Governor of Bank Negara Malaysia, Malaysia's central bank. She served as Governor from 2000 to 2016, and was the first woman in the position and at 16 years, the longest to hold the position. Zeti was one of the members of the Council of Eminent Persons (CEP) in Mahathir's second administration, a special advisory council advising the government on economic and financial matters during this transitional period.

Banco Credicoop is the largest cooperatively-owned bank in Argentina.

The Raiffeisen Banking Group is a group of cooperative banks in Austria. The Austrian Raiffeisen banks are not consolidated under a single parent entity but are financially linked through a common institutional protection scheme and deposit guarantee scheme. The group's international operations, by contrast, are consolidated under Raiffeisen Bank International (RBI).

A deposit account is a bank account maintained by a financial institution in which a customer can deposit and withdraw money. Deposit accounts can be savings accounts, current accounts or any of several other types of accounts explained below.

According to a 2013 public survey in Malaysia by Transparency International, a majority of the surveyed households perceived Malaysian political parties to be highly corrupt. A quarter of the surveyed households consider the government's efforts in the fight against corruption to be ineffective. Corruption in Malaysia generally involves political connections still playing an important role in the outcome of public tenders.

Madhavpura Mercantile Cooperative Bank (MMCB) was a Gujarat-based interstate cooperative bank that became defunct and lost its licence after it was unable to pay back the money it owed public depositors. Reserve Bank of India cancelled its licence in June 2012 under section 22 of the Banking regulations Act, 1949.

The West Bengal State Co-operative Bank (WBSTCB) is an Indian provincial co-operative bank based in Kolkata. Its primary area of operation is to provide agricultural loans, controlling the District Cooperative Banks and other cooperative societies. It also includes a range of services to the sector, including locker facilities, bank guarantee, bills, letter of credit, insurance, ancillary services, deposit schemes and loan schemes. It acts as an intermediary for the implementation and funding of different schemes for the government in the fields of Agriculture, fisheries, rural development etc. Along with all the other 33 State Co-operatives it forms the National Federation of State Co-operative Banks Ltd. (NAFSCOB).

The Uganda Deposit Protection Fund (UDPF), whose legal name is Deposit Protection Fund of Uganda, is a Ugandan government agency that provides deposit insurance to depositors in Ugandan banks and deposit-taking microfinance institutions. The UDPF was created in July 1994. The law was amended in 2004 to create an independent agency, separate from the Bank of Uganda.

Cooperative loans in Malaysia are credit services offered by cooperatives registered under the Cooperative Commission of Malaysia (SKM) to their members who work as civil servants. It is part of the shadow banking system in Malaysia. The borrowers are restricted to employees in government departments, statutory bodies, government-linked companies or municipal councils. The Congress of Unions of Employees in the Public and Civil Services (CUEPACS) supports these loans because they aid civil servants in overcoming financial problems and reducing borrowing from loan sharks. All matters relating to the administration of these loans are regulated under the Cooperative Society Act of 1993.

References

- ↑ "Up Close and Personal with Datuk Seri Panglima Andrew Sheng". The Star Online. December 5, 2009. Retrieved May 9, 2011.

- ↑ "Probe to be made public". New Straits Times. October 27, 1986. Retrieved May 9, 2011.

- ↑ "Kuala Lumpur Stock Exchange". New Straits Times. July 13, 1987. Retrieved May 9, 2011.

- ↑ "Fall of the mighty cooperatives". Malay Mail. November 10, 2009. Retrieved May 9, 2011.

- ↑ Bank Negara Malaysia

- ↑ "SSM". Archived from the original on 2008-10-21. Retrieved 2008-10-19.