Related Research Articles

Cost accounting is defined as "a systematic set of procedures for recording and reporting measurements of the cost of manufacturing goods and performing services in the aggregate and in detail. It includes methods for recognizing, classifying, allocating, aggregating and reporting such costs and comparing them with standard costs." (IMA) Often considered a subset of managerial accounting, its end goal is to advise the management on how to optimize business practices and processes based on cost efficiency and capability. Cost accounting provides the detailed cost information that management needs to control current operations and plan for the future.

In management accounting or managerial accounting, managers use accounting information in decision-making and to assist in the management and performance of their control functions.

In production, research, retail, and accounting, a cost is the value of money that has been used up to produce something or deliver a service, and hence is not available for use anymore. In business, the cost may be one of acquisition, in which case the amount of money expended to acquire it is counted as cost. In this case, money is the input that is gone in order to acquire the thing. This acquisition cost may be the sum of the cost of production as incurred by the original producer, and further costs of transaction as incurred by the acquirer over and above the price paid to the producer. Usually, the price also includes a mark-up for profit over the cost of production.

Inventory or stock refers to the goods and materials that a business holds for the ultimate goal of resale, production or utilisation.

Cost of goods sold (COGS) is the carrying value of goods sold during a particular period.

Alfred Weber was a German economist, geographer, sociologist and theoretician of culture whose work was influential in the development of modern economic geography.

Variable costs are costs that change as the quantity of the good or service that a business produces changes. Variable costs are the sum of marginal costs over all units produced. They can also be considered normal costs. Fixed costs and variable costs make up the two components of total cost. Direct costs are costs that can easily be associated with a particular cost object. However, not all variable costs are direct costs. For example, variable manufacturing overhead costs are variable costs that are indirect costs, not direct costs. Variable costs are sometimes called unit-level costs as they vary with the number of units produced.

In budgeting, a variance is the difference between a budgeted, planned, or standard cost and the actual amount incurred/sold. Variances can be computed for both costs and revenues.

In variance analysis (accounting) direct material total variance is the difference between the actual cost of actual number of units produced and its budgeted cost in terms of material. Direct material total variance can be divided into two components:

In variance analysis (accounting) direct material price variance is the difference between the standard cost and the actual cost for the actual quantity of material purchased. It is one of the two components of direct material total variance.

In variance analysis, direct material usage variance is the difference between the standard quantity of materials that should have been used for the number of units actually produced, and the actual quantity of materials used, valued at the standard cost per unit of material. It is one of the two components of direct material total variance.

Manufacturingresource planning is a method for the effective planning of all resources of a manufacturing company. Ideally, it addresses operational planning in units, financial planning, and has a simulation capability to answer "what-if" questions and is an extension of closed-loop MRP.

Process costing is an accounting methodology that traces and accumulates direct costs, and allocates indirect costs of a manufacturing process. Costs are assigned to products, usually in a large batch, which might include an entire month's production. Eventually, costs have to be allocated to individual units of product. It assigns average costs to each unit, and is the opposite extreme of Job costing which attempts to measure individual costs of production of each unit. Process costing is usually a significant chapter. It is a method of assigning costs to units of production in companies producing large quantities of homogeneous products.

Design for manufacturability is the general engineering practice of designing products in such a way that they are easy to manufacture. The concept exists in almost all engineering disciplines, but the implementation differs widely depending on the manufacturing technology. DFM describes the process of designing or engineering a product in order to facilitate the manufacturing process in order to reduce its manufacturing costs. DFM will allow potential problems to be fixed in the design phase which is the least expensive place to address them. Other factors may affect the manufacturability such as the type of raw material, the form of the raw material, dimensional tolerances, and secondary processing such as finishing.

In business, overhead or overhead expense refers to an ongoing expense of operating a business. Overheads are the expenditure which cannot be conveniently traced to or identified with any particular revenue unit, unlike operating expenses such as raw material and labor. Therefore, overheads cannot be immediately associated with the products or services being offered, thus do not directly generate profits. However, overheads are still vital to business operations as they provide critical support for the business to carry out profit making activities. For example, overhead costs such as the rent for a factory allows workers to manufacture products which can then be sold for a profit. Such expenses are incurred for output generally and not for particular work order; e.g., wages paid to watch and ward staff, heating and lighting expenses of factory, etc. Overheads are also a very important cost element along with direct materials and direct labor.

Job costing is accounting which tracks the costs and revenues by "job" and enables standardized reporting of profitability by job. For an accounting system to support job costing, it must allow job numbers to be assigned to individual items of expenses and revenues. A job can be defined to be a specific project done for one customer, or a single unit of product manufactured, or a batch of units of the same type that are produced together.

Manufacturing overhead costs are all manufacturing costs that are related to the cost object but cannot be traced to that cost object in an economically feasible way.

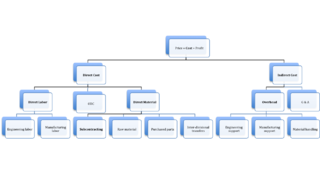

Manufacturing cost is the sum of costs of all resources consumed in the process of making a product. The manufacturing cost is classified into three categories: direct materials cost, direct labor cost and manufacturing overhead. It is a factor in total delivery cost.

The profit model is the linear, deterministic algebraic model used implicitly by most cost accountants. Starting with, profit equals sales minus costs, it provides a structure for modeling cost elements such as materials, losses, multi-products, learning, depreciation etc. It provides a mutable conceptual base for spreadsheet modelers. This enables them to run deterministic simulations or 'what if' modelling to see the impact of price, cost or quantity changes on profitability.

In business economics cost breakdown analysis is a method of cost analysis, which itemizes the cost of a certain product or service into its various components, the so-called cost drivers. The cost breakdown analysis is a popular cost reduction strategy and a viable opportunity for businesses.

References

- ↑ Lanen, W. N., Anderson, S., Maher, M. W. (2008). Fundamentals of Cost Accounting, McGraw Hill, ISBN 978-0-07-352672-0

- ↑ Michael R. Kinney, Cecily A. Raiborn, Cost Accounting: Foundation and Evolution, 7th edition