Related Research Articles

Morgan Stanley is an American multinational investment management and financial services company headquartered at 1585 Broadway in Midtown Manhattan, New York City. With offices in 41 countries and more than 75,000 employees, the firm's clients include corporations, governments, institutions, and individuals. Morgan Stanley ranked No. 61 in the 2021 Fortune 500 list of the largest United States corporations by total revenue.

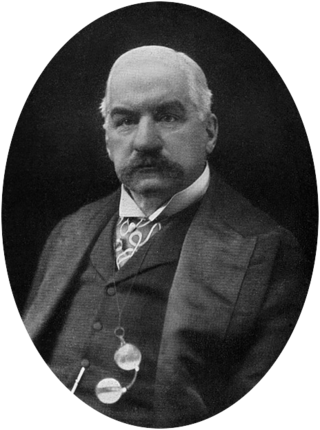

John Pierpont Morgan Sr. was an American financier and investment banker who dominated corporate finance on Wall Street throughout the Gilded Age. As the head of the banking firm that ultimately became known as J.P. Morgan and Co., he was the driving force behind the wave of industrial consolidation in the United States spanning the late 19th and early 20th centuries.

Chemical Bank was a bank with headquarters in New York City from 1824 until 1996. At the end of 1995, Chemical was the third-largest bank in the U.S., with about $182.9 billion in assets and more than 39,000 employees around the world.

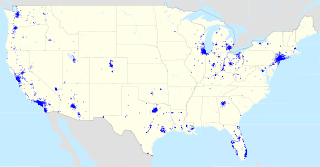

JPMorgan Chase & Co. is an American multinational financial services company headquartered in New York City and incorporated in Delaware. It is the largest bank in the United States and the world's largest bank by market capitalization. As the largest of the Big Four banks, the firm is considered systemically important by the Financial Stability Board. Its size and scale has led to enhanced regulatory oversight as well as the maintenance of an internal "Fortress Balance Sheet" of capital reserves. The firm is headquartered on 383 Madison Avenue in Midtown Manhattan and is set to move into the under-construction JPMorgan Chase Building in 2025.

JPMorgan Chase Bank, N.A., doing business as Chase Bank or often as Chase, is an American national bank headquartered in New York City, that constitutes the consumer and commercial banking subsidiary of the U.S. multinational banking and financial services holding company, JPMorgan Chase. The bank was known as Chase Manhattan Bank until it merged with J.P. Morgan & Co. in 2000. Chase Manhattan Bank was formed by the merger of the Chase National Bank and the Manhattan Company in 1955. The bank merged with Bank One Corporation in 2004 and in 2008 acquired the deposits and most assets of Washington Mutual.

Bank One Corporation was an American bank founded in 1968 and at its peak the sixth-largest bank in the United States. It traded on the New York Stock Exchange under the stock symbol ONE. The company merged with JPMorgan Chase & Co. on July 1, 2004. The company had its headquarters in the Bank One Plaza in the Chicago Loop in Chicago, Illinois, now the headquarters of Chase's retail banking division.

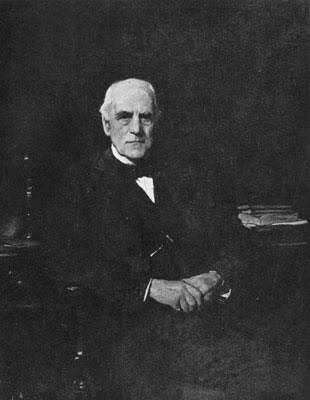

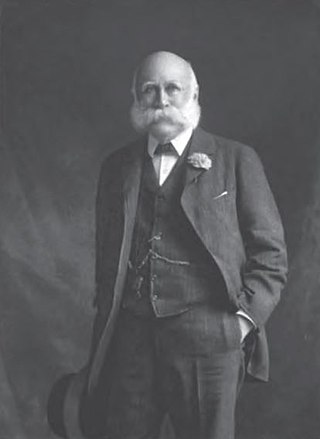

Junius Spencer Morgan I was an American banker and financier, as well as the father of John Pierpont "J.P." Morgan and patriarch to the Morgan banking house.

J.P. Morgan & Co. is an American financial institution specialized in investment banking, asset management and private banking founded by financier J. P. Morgan in 1871. Through a series of mergers and acquisitions, the company is now a subsidiary of JPMorgan Chase, one of the largest banking institutions in the world. The company has been historically referred to as the "House of Morgan" or simply Morgan. For 146 years, until 2000, J.P. Morgan specialized in commercial banking, before a merger with Chase Manhattan Bank led to the business line spinning off under the Chase brand.

Piper Sandler Companies is an American independent investment bank and financial services company, focused on mergers and acquisitions, financial restructuring, public offerings, public finance, institutional brokerage, investment management and securities research. Through its principal subsidiary, Piper Sandler & Co., the company targets corporations, institutional investors, and public entities.

Douglas 'Sandy' Warner is an American banker who joined Morgan Guaranty Trust Company of New York out of college in 1968 as an officer's assistant and rose through the ranks to become chief executive officer and chairman of the board of J.P. Morgan & Co. Inc. in 1995. Among his many accomplishments, Warner may be best known for spearheading the 2000 sale of J P Morgan & Co. to Chase Manhattan Bank for $30.9 billion.

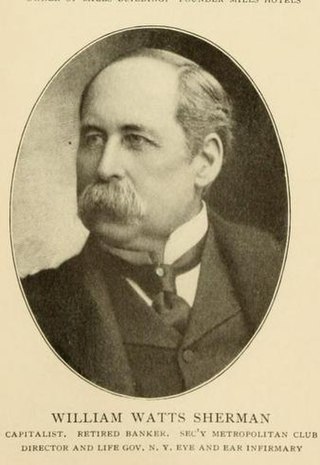

The William Watts Sherman House is a notable house designed by American architect H. H. Richardson, with later interiors by Stanford White. It is a National Historic Landmark, generally acknowledged as one of Richardson's masterpieces and the prototype for what became known as the Shingle Style in American architecture. It is located at 2 Shepard Avenue, Newport, Rhode Island and is now owned by Salve Regina University. It is a contributing property to the Bellevue Avenue Historic District.

J. S. Morgan & Co. was a merchant banking firm based in London and New York City founded by Junius Spencer Morgan, father of J. P. Morgan.

William M. "Bill" Isaac was the Chairman of the Federal Deposit Insurance Corporation (FDIC) from August 3, 1981 through October 21, 1985. He was appointed to the FDIC Board of Directors by President Jimmy Carter in 1978 at the age of 34 and was named Chairman of the FDIC in 1981 by President Reagan. In 1986, Isaac founded the regulatory consulting firm The Secura Group LLC which became part of FTI Consulting, Inc., a global consulting firm. Isaac served as Chairman of the Board of Fifth Third Bancorp from 2009 through 2014. Isaac left FTI Consulting at year end 2019 and joined The Isaac-Milstein Group as Co-Chairman with New York financier and philanthropist Howard Milstein who is Chairman & CEO of New York Private Bank & Trust which in turn owns Emigrant Bank. Isaac sits on a number of corporate boards (including New York Private Bank & Trust and Emigrant Bank and is Chairman of Sarasota Private Trust and Cleveland Private Trust and speaks and writes regularly on financial and regulatory issues.

William Watts Sherman was a New York City businessman and the treasurer of the Newport Casino. In 1875–1876 he had the William Watts Sherman House constructed in Newport, Rhode Island.

The Morgan family is an American family and banking dynasty, which became prominent in the U.S. and throughout the world in the late 19th century and early 20th century. Members of the family amassed an immense fortune over the generations, primarily through the noted work of John Pierpont Morgan (1837–1913).

Sophia Augusta Brown Sherman was an American heiress and socialite who was prominent in New York and Newport society during the Gilded Age.

William Butler Duncan was a Scottish-American banker and railroad executive.

Adam Norrie was a Scottish-American iron merchant who was a founder of St. Luke's Hospital and who served as the president of the Saint Andrew's Society of the State of New York.

Page, Bacon & Co., an affiliate of Page & Bacon of St. Louis, was a bank founded in San Francisco in 1850 during the California Gold Rush. The St. Louis house became overextended in 1854 due to problems financing a railway, and closed in January 1855. When the news reached San Francisco five weeks later, it triggered a run on the San Francisco house, which was also forced to close. The run affected other banks, many small depositors lost part of their savings and over 200 San Francisco business had to close.

The National Bank of Commerce in New York was a national bank headquartered in New York City that merged into the Guaranty Trust Company of New York.

References

- ↑ Carosso, Vincent P. (1987). The Morgans: Private International Bankers, 1854-1913 . Retrieved 9 October 2019.

- 1 2 "Obituary. MR. WATTS SHERMAN" (PDF). The New York Times . 12 March 1865. Retrieved 9 October 2019.

- 1 2 "Estoppel as to Ownership of Land: New York Court of Appeals, October 4, 1881. Trenton Banking Co. v. Sherman". The Albany Law Journal. Weed, Parsons & Company. 24: 391. 1881. Retrieved 9 October 2019.

- ↑ Landau, Sarah; Condit, Carl W. (1996). Rise of the New York Skyscraper, 1865–1913 . New Haven, CT: Yale University Press. pp. 404–405. ISBN 978-0-300-07739-1. OCLC 32819286.

- ↑ "Fire in Messrs. Duncan, Sherman & Co.'s Banking-house" (PDF). The New York Times . 31 March 1866. Retrieved 9 October 2019.

- ↑ Bonin, Hubert; Valério, Nuno (2015). Colonial and Imperial Banking History. Routledge. p. 55. ISBN 9781317218920 . Retrieved 9 October 2019.

- 1 2 3 "Duncan, Sherman & Co.'s Affairs.; Examination of Mr. William Butler Duncan and William Watts Sherman the Mobile and Ohio First Mortgage Coupons Mr. Watts Sherman's Connection with the Bankrupt Firm" (PDF). The New York Times . 11 February 1877. Retrieved 9 October 2019.

- 1 2 Moody, John. The Chronicles of America Series Allen Johnson Editor. Yale University Press. p. 12. Retrieved 9 October 2019.

- 1 2 "J.p. Morgan & Co. Inc". www.encyclopedia.com. Encyclopedia.com . Retrieved 9 October 2019.

- ↑ "The Duncan, Sherman & Co. Robbery" (PDF). The New York Times . 13 June 1875. Retrieved 9 October 2019.

- ↑ "A Great Failure; Duncan, Sherman & Company. Liabilities Said to Be Over $5,000,000--The Assets Unknown--A General Assignment Made by the Firm to Hon. W.D. Shipman--The Probable Causes of Their Failure" (PDF). The New York Times . 28 July 1875. Retrieved 9 October 2019.

- 1 2 3 Administration (Ohio), United States Work Projects (1937). Annals of Cleveland. Cleveland W.P.A. Project. p. 34. Retrieved 9 October 2019.

- ↑ "Duncan, Sherman & Co.'s Assets" (PDF). The New York Times . 2 August 1878. Retrieved 9 October 2019.

- ↑ "Duncan, Sherman & Co.'s Affairs" (PDF). The New York Times . 19 January 1881. Retrieved 9 October 2019.

- ↑ Taylor, Virginia H. (2011). The Franco-Texan Land Company. University of Texas Press. p. 120. ISBN 9780292785717 . Retrieved 9 October 2019.