Expand Energy Corporation is a natural gas exploration and production company headquartered in Oklahoma City. It was previously known as Chesapeake Energy Corporation.

Fracking in the United States began in 1949. According to the Department of Energy (DOE), by 2013 at least two million oil and gas wells in the US had been hydraulically fractured, and that of new wells being drilled, up to 95% are hydraulically fractured. The output from these wells makes up 43% of the oil production and 67% of the natural gas production in the United States. Environmental safety and health concerns about hydraulic fracturing emerged in the 1980s, and are still being debated at the state and federal levels.

The Monterey Formation is an extensive Miocene oil-rich geological sedimentary formation in California, with outcrops of the formation in parts of the California Coast Ranges, Peninsular Ranges, and on some of California's off-shore islands. The type locality is near the city of Monterey, California. The Monterey Formation is the major source-rock for 37 to 38 billion barrels of oil in conventional traps such as sandstones. This is most of California's known oil resources. The Monterey has been extensively investigated and mapped for petroleum potential, and is of major importance for understanding the complex geological history of California. Its rocks are mostly highly siliceous strata that vary greatly in composition, stratigraphy, and tectono-stratigraphic history.

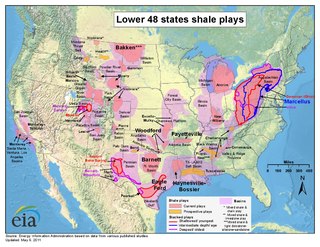

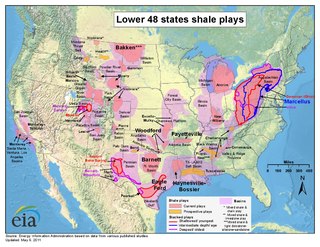

Shale gas in the United States is an available source of unconventional natural gas. Led by new applications of hydraulic fracturing technology and horizontal drilling, development of new sources of shale gas has offset declines in production from conventional gas reservoirs, and has led to major increases in reserves of U.S. natural gas. Largely due to shale gas discoveries, estimated reserves of natural gas in the United States in 2008 were 35% higher than in 2006.

The Utica Shale is a stratigraphical unit of Upper Ordovician age in the Appalachian Basin. It underlies much of the northeastern United States and adjacent parts of Canada.

Gasland is a 2010 American documentary film written and directed by Josh Fox. It focuses on communities in the United States where natural gas drilling activity was a concern and, specifically, on hydraulic fracturing ("fracking"), a method of stimulating production in otherwise impermeable rock. The film was a key mobilizer for the anti-fracking movement, and "brought the term 'hydraulic fracturing' into the nation's living rooms" according to The New York Times.

The inclusion of unconventional shale gas with conventional gas reserves has caused a sharp increase in estimated recoverable natural gas in Canada. Until the 1990s success of hydraulic fracturing in the Barnett Shales of north Texas, shale gas was classed as "unconventional reserves" and was considered too expensive to recover. There are a number of prospective shale gas deposits in various stages of exploration and exploitation across the country, from British Columbia to Nova Scotia.

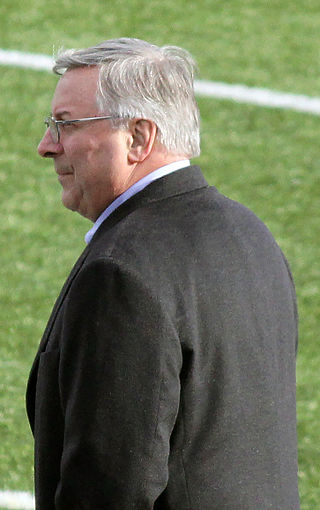

Terrence Michael Pegula is an American billionaire businessman and petroleum engineer. He is the owner of the Buffalo Sabres of the National Hockey League (NHL) and, with his wife Kim Pegula, the Buffalo Bills of the National Football League (NFL). He is also the president of both franchises. Amassing his fortune via investments in fracking, Pegula has interests in natural gas development, real estate, entertainment, and professional sports. His net worth is over $7 billion.

Fracking is a well stimulation technique involving the fracturing of formations in bedrock by a pressurized liquid. The process involves the high-pressure injection of "fracking fluid" into a wellbore to create cracks in the deep-rock formations through which natural gas, petroleum, and brine will flow more freely. When the hydraulic pressure is removed from the well, small grains of hydraulic fracturing proppants hold the fractures open.

Shale gas is an unconventional natural gas produced from shale, a type of sedimentary rock. Shale gas has become an increasingly important source of natural gas in the United States over the past decade, and interest has spread to potential gas shales in Canada, Europe, Asia, and Australia. One analyst expects shale gas to supply as much as half the natural gas production in North America by 2020.

Range Resources Corporation is a natural gas exploration and production company, the headquartered is in Fort Worth, Texas. It operates in the Marcellus Formation, where it is the largest land owners.

Fracking in the United Kingdom started in the late 1970s with fracturing of the conventional oil and gas fields near the North Sea. It was used in about 200 British onshore oil and gas wells from the early 1980s. The technique attracted attention after licences use were awarded for onshore shale gas exploration in 2008. The topic received considerable public debate on environmental grounds, with a 2019 high court ruling ultimately banning the process. The two remaining high-volume fracturing wells were supposed to be plugged and decommissioned in 2022.

Fracking has become a contentious environmental and health issue with Tunisia and France banning the practice and a de facto moratorium in place in Quebec (Canada), and some of the states of the US.

Environmental impact of fracking in the United States has been an issue of public concern, and includes the contamination of ground and surface water, methane emissions, air pollution, migration of gases and fracking chemicals and radionuclides to the surface, the potential mishandling of solid waste, drill cuttings, increased seismicity and associated effects on human and ecosystem health. Research has determined that human health is affected. A number of instances with groundwater contamination have been documented due to well casing failures and illegal disposal practices, including confirmation of chemical, physical, and psychosocial hazards such as pregnancy and birth outcomes, migraine headaches, chronic rhinosinusitis, severe fatigue, asthma exacerbations, and psychological stress. While opponents of water safety regulation claim fracking has never caused any drinking water contamination, adherence to regulation and safety procedures is required to avoid further negative impacts.

The environmental impact of fracking is related to land use and water consumption, air emissions, including methane emissions, brine and fracturing fluid leakage, water contamination, noise pollution, and health. Water and air pollution are the biggest risks to human health from fracking. Research has determined that fracking negatively affects human health and drives climate change.

Shale gas in the United Kingdom has attracted increasing attention since 2007, when unconventional onshore shale gas production was proposed. The first shale gas well in England was drilled in 1875. As of 2013 a number of wells had been drilled, and favourable tax treatment had been offered to shale gas producers.

The Marcellus natural gas trend is a large geographic area of prolific shale gas extraction from the Marcellus Shale or Marcellus Formation, of Devonian age, in the eastern United States. The shale play encompasses 104,000 square miles and stretches across Pennsylvania and West Virginia, and into eastern Ohio and western New York. In 2012, it was the largest source of natural gas in the United States, and production was still growing rapidly in 2013. The natural gas is trapped in low-permeability shale, and requires the well completion method of hydraulic fracturing to allow the gas to flow to the well bore. The surge in drilling activity in the Marcellus Shale since 2008 has generated both economic benefits and considerable controversy.

Fracking in South Africa is an energy production strategy at early stages of development using high-pressure drilling techniques to release natural gas trapped in shale rock. After initially imposing a moratorium on fracking in April 2011, the South African government lifted the moratorium in September 2012 after an initial investigation by an interdepartmental task team. Several energy companies were subsequently granted exploration licenses. Fracking in South Africa is a current topic of debate, with proponents pointing to substantial economic and energy benefits and opponents voicing concerns about potentially adverse environmental impacts.

Countries using or considering to use fracking have implemented different regulations, including developing federal and regional legislation, and local zoning limitations. In 2011, after public pressure France became the first nation to ban hydraulic fracturing, based on the precautionary principle as well as the principal of preventive and corrective action of environmental hazards. The ban was upheld by an October 2013 ruling of the Constitutional Council. Some other countries have placed a temporary moratorium on the practice. Countries like the United Kingdom and South Africa, have lifted their bans, choosing to focus on regulation instead of outright prohibition. Germany has announced draft regulations that would allow using hydraulic fracturing for the exploitation of shale gas deposits with the exception of wetland areas.

Fracking in Canada was first used in Alberta in 1953 to extract hydrocarbons from the giant Pembina oil field, the biggest conventional oil field in Alberta, which would have produced very little oil without fracturing. Since then, over 170,000 oil and gas wells have been fractured in Western Canada. Fracking is a process that stimulates natural gas or oil in wellbores to flow more easily by subjecting hydrocarbon reservoirs to pressure through the injection of fluids or gas at depth causing the rock to fracture or to widen existing cracks.