Ovintiv Inc. is an American petroleum company based in Denver. The company was formed in 2020 through a restructuring of its Canadian predecessor, Encana.

Expand Energy Corporation is a natural gas exploration and production company headquartered in Oklahoma City. It was previously known as Chesapeake Energy Corporation.

Devon Energy Corporation is a company engaged in hydrocarbon exploration in the United States. It is organized in Delaware with operational headquarters in the 50-story Devon Energy Center in Oklahoma City, Oklahoma. Its primary operations are in the Barnett Shale STACK formation in Oklahoma, Delaware Basin, Eagle Ford Group, and the Rocky Mountains.

Anadarko Petroleum Corporation was a company engaged in hydrocarbon exploration. It was organized in Delaware and headquartered in two skyscrapers in The Woodlands, Texas: the Allison Tower and the Hackett Tower, both named after former CEOs of the company. In 2019, the company was acquired by Occidental Petroleum.

Aubrey Kerr McClendon was an American businessman and the founder and chief executive officer of American Energy Partners, LP and the co-founder, CEO and chairman of Chesapeake Energy. He was an outspoken advocate for natural gas as an alternative to oil and coal fuels, and a pioneer in employing hydraulic fracturing.

Oneok, Inc.WUN-oke, stylized as ONEOK, is an American oil and gas midstream operator headquartered in Tulsa, Oklahoma. It provides the oil and gas industry with gathering, processing, fractionation, transportation, and storage services. The company is part of the Fortune 500 and S&P 500. Oneok was founded as Oklahoma Natural Gas Company in 1906, but it changed its corporate name to Oneok in 1980.

EOG Resources, Inc. is an American energy company engaged in hydrocarbon exploration. It is organized in Delaware and headquartered in the Heritage Plaza building in Houston, Texas.

EQT Corporation is an American energy company engaged in hydrocarbon exploration and pipeline transport. It is headquartered in EQT Plaza in Pittsburgh, Pennsylvania.

XTO Energy Inc. is an American energy company and subsidiary of ExxonMobil principally operating in North America. Acquired by ExxonMobil in 2010 and based out of Spring, Texas, it is involved with the production, processing, transportation, and development of oil and natural gas resources. The company specializes in developing shale gas via unconventional means like hydraulic fracturing and horizontal drilling.

Noble Energy, Inc. was a company engaged in hydrocarbon exploration headquartered in Houston, Texas. In October 2020, the company was acquired by Chevron Corporation.

Chief Oil & Gas is a company founded in Dallas, Texas in 1994 by Trevor Rees-Jones. Its primary holdings of natural gas were developed in the core areas of the Barnett Shale in Tarrant County, Denton County and Parker County. In 1999, new technology in horizontal drilling and hydraulic fracturing along with rising gas prices made the Barnett Shale, an unconventional resource for natural gas, more economical. Chief rapidly expanded its leasehold position and drilling and production program in the Barnett Shale to become the fields second largest producer there.

SandRidge Energy, Inc. is a company engaged in hydrocarbon exploration in the Mid-Continent region of the United States. It is organized in Delaware and headquartered in Oklahoma City, Oklahoma.

Rex Energy Corporation was a natural gas exploration and production company headquartered in State College, Pennsylvania. In 2018, the company was acquired by PennEnergy Resources.

National Fuel Gas Company is a diversified energy company with $6.2 billion in assets distributed among the following five operating segments: Exploration and Production, Pipeline and Storage, Gathering, Utility, and Energy Marketing. National Fuel Gas was incorporated in 1902 and is based in Williamsville, New York.

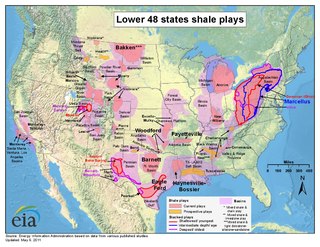

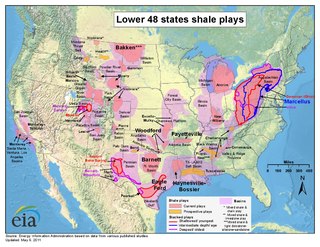

Shale gas in the United States is an available source of unconventional natural gas. Led by new applications of hydraulic fracturing technology and horizontal drilling, development of new sources of shale gas has offset declines in production from conventional gas reservoirs, and has led to major increases in reserves of U.S. natural gas. Largely due to shale gas discoveries, estimated reserves of natural gas in the United States in 2008 were 35% higher than in 2006.

Developing Unconventional Gas or DUG is a series of annual regional conferences of the unconventional oil industry. Several notable key note speakers have visited DUG conferences including Leon Panetta at Pittsburgh's in 2014, T. Boone Pickens in 2011 and George W. Bush in 2013.

Finley Resources is a privately owned and operated energy company headquartered in Fort Worth, Texas, USA. The company operates about 2,500 oil and gas properties in nine states including Texas, Oklahoma, Utah, Wyoming, Louisiana, Mississippi, Alabama, Pennsylvania, and New Mexico.

WPX Energy, Inc. was a company engaged in hydrocarbon exploration. It was organized in Delaware and headquartered in Tulsa, Oklahoma. In 2021, the company merged with Devon Energy.

Warwick Investment Group is a SEC-registered investment advisor, managing funds that invest globally in natural resources and real estate. Warwick has an established track record in strategic consolidation in these sectors, having completed more than 4,000 transactions since inception. The firm has ~130 team members and advisors across offices in Oklahoma City, Dallas, New York and London, investing across private equity funds, special purpose vehicles and open-ended structures. The firm also manages capital for pension funds in 8 of the 50 states.

Antero Resources Corporation is an American company engaged in hydrocarbon exploration. It is organized in Delaware and headquartered in Denver, Colorado. The company's reserves are entirely in the Appalachian Basin and are extracted using hydraulic fracturing.