Related Research Articles

Microeconomics is a branch of economics that studies the behaviour of individuals and firms in making decisions regarding the allocation of scarce resources and the interactions among these individuals and firms.

An oligopoly is a market form wherein a market or industry is dominated by a small number of large sellers (oligopolists). Oligopolies can result from various forms of collusion which reduce competition and lead to higher prices for consumers. Oligopolies have their own market structure.

In economics, specifically general equilibrium theory, a perfect market is defined by several idealizing conditions, collectively called perfect competition. In theoretical models where conditions of perfect competition hold, it has been theoretically demonstrated that a market will reach an equilibrium in which the quantity supplied for every product or service, including labor, equals the quantity demanded at the current price. This equilibrium would be a Pareto optimum.

New Keynesian economics is a school of contemporary macroeconomics that strives to provide microeconomic foundations for Keynesian economics. It developed partly as a response to criticisms of Keynesian macroeconomics by adherents of new classical macroeconomics.

This aims to be a complete article list of economics topics:

Collusion is a secret cooperation or deceitful agreement in order to deceive others, although not necessarily illegal, as a conspiracy. A secret agreement between two or more parties to limit open competition by deceiving, misleading, or defrauding others of their legal rights, or to obtain an objective forbidden by law typically by defrauding or gaining an unfair market advantage is an example of collusion. It is an agreement among firms or individuals to divide a market, set prices, limit production or limit opportunities. It can involve "unions, wage fixing, kickbacks, or misrepresenting the independence of the relationship between the colluding parties". In legal terms, all acts effected by collusion are considered void.

Price points are prices at which demand for a given product is supposed to stay relatively high.

In economics a monopoly is a firm that lacks any viable competition, and is the sole producer of the industry's product. In a normal competitive situation, no firm can charge a price that is significantly higher than the Marginal (Economic) cost of producing the product. If any firm doing business within a competitive situation tries to raise prices significantly higher than the Marginal cost of producing the product, it will lose all of its customers to either other existing firms that charge lower prices, or to a new firm that will find it profitable to use a lower price to take customers away from the firm charging the higher price. But since the monopoly firm does not have to worry about losing customers to competitors, it can set a Monopoly price that is significantly higher than its marginal cost, allowing it to have an economic profit that is significantly higher than the normal profit that is typically found in a perfectly competitive industry. The high economic profit obtained by a monopoly firm is referred to as monopoly profit.

In economics and commerce, the Bertrand paradox — named after its creator, Joseph Bertrand — describes a situation in which two players (firms) reach a state of Nash equilibrium where both firms charge a price equal to marginal cost ("MC"). The paradox is that in models such as Cournot competition, an increase in the number of firms is associated with a convergence of prices to marginal costs. In these alternative models of oligopoly, a small number of firms earn positive profits by charging prices above cost. Suppose two firms, A and B, sell a homogeneous commodity, each with the same cost of production and distribution, so that customers choose the product solely on the basis of price. It follows that demand is infinitely price-elastic. Neither A nor B will set a higher price than the other because doing so would yield the entire market to their rival. If they set the same price, the companies will share both the market and profits.

In economics and particularly in industrial organization, market power is the ability of a firm to profitably raise the market price of a good or service over marginal cost. In perfectly competitive markets, market participants have no market power. A firm with total market power can raise prices without losing any customers to competitors. Market participants that have market power are therefore sometimes referred to as "price makers" or "price setters", while those without are sometimes called "price takers". Significant market power occurs when prices exceed marginal cost and long run average cost, so the firm makes economic profit.

Bertrand competition is a model of competition used in economics, named after Joseph Louis François Bertrand (1822–1900). It describes interactions among firms (sellers) that set prices and their customers (buyers) that choose quantities at the prices set. The model was formulated in 1883 by Bertrand in a review of Antoine Augustin Cournot's book Recherches sur les Principes Mathématiques de la Théorie des Richesses (1838) in which Cournot had put forward the Cournot model. Cournot argued that when firms choose quantities, the equilibrium outcome involves firms pricing above marginal cost and hence the competitive price. In his review, Bertrand argued that if firms chose prices rather than quantities, then the competitive outcome would occur with price equal to marginal cost. The model was not formalized by Bertrand: however, the idea was developed into a mathematical model by Francis Ysidro Edgeworth in 1889.

Jean Tirole is a French professor of economics. He focuses on industrial organization, game theory, banking and finance, and economics and psychology. In 2014 he was awarded the Nobel Memorial Prize in Economic Sciences for his analysis of market power and regulation.

David Knudsen Levine is department of Economics and Robert Schuman Center for Advanced Study Joint Chair at the European University Institute; he is John H. Biggs Distinguished Professor of Economics Emeritus at Washington University in St. Louis. His research includes the study of intellectual property and endogenous growth in dynamic general equilibrium models, the endogenous formation of preferences, social norms and institutions, learning in games, and game theory applications to experimental economics.

Tacit collusion occurs where firms undergo actions that are likely to minimize a response from another firm, e.g. avoiding the opportunity to price cut an opposition. Put another way, two firms agree to play a certain strategy without explicitly saying so. Oligopolists usually try not to engage in price cutting, excessive advertising or other forms of competition. Thus, there may be unwritten rules of collusive behavior such as price leadership. A price leader will then emerge and it sets the general industry price, with other firms following suit. For example, see the case of British Salt Limited and New Cheshire Salt Works Limited.

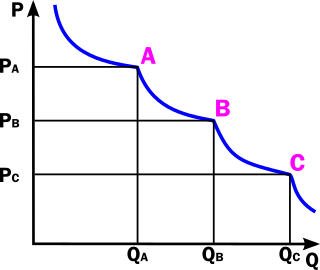

The Kinked-Demand curve theory is an economic theory regarding oligopoly and monopolistic competition. Kinked demand was an initial attempt to explain sticky prices.

In economics, profit in the accounting sense of the excess of revenue over cost is the sum of two components: normal profit and economic profit. Normal profit is the profit that is necessary to just cover the opportunity costs of the owner-manager or of the firm's investors. In the absence of this profit, these parties would withdraw their time and funds from the firm and use them to better advantage elsewhere. In contrast, economic profit, sometimes called excess profit, is profit in excess of what is required to cover the opportunity costs.

Paul David Klemperer FBA is an economist and the Edgeworth Professor of Economics at Oxford University. He is a member of the Klemperer family. He works on industrial economics, competition policy, auction theory, and climate change economics and policy.

A Markov perfect equilibrium is an equilibrium concept in game theory. It is the refinement of the concept of subgame perfect equilibrium to extensive form games for which a pay-off relevant state space can be readily identified. The term appeared in publications starting about 1988 in the work of economists Jean Tirole and Eric Maskin. It has since been used, among else, in the analysis of industrial organization, macroeconomics and political economy.

Huw David Dixon, born 1958, is a British economist. He has been a professor at Cardiff Business School since 2006, having previously been Head of Economics at the University of York (2003–2006) after being a Professor of economics there (1992–2003), and the University of Swansea (1991–1992), a Reader at Essex University (1987–1991) and a lecturer at Birkbeck College 1983–1987.

In microeconomics, the Bertrand–Edgeworth model of price-setting oligopoly looks at what happens when there is a homogeneous product where there is a limit to the output of firms which they are willing and able to sell at a particular price. This differs from the Bertrand competition model where it is assumed that firms are willing and able to meet all demand. The limit to output can be considered as a physical capacity constraint which is the same at all prices, or to vary with price under other assumptions.

References

- 1 2 Maskin, Eric; Tirole, Jean (1988). "A Theory of Dynamic Oligopoly, II: Price Competition, Kinked Demand Curves, and Edgeworth Cycles". Econometrica. 56 (3): 571–599. doi:10.2307/1911701. JSTOR 1911701.

- ↑ "Edgeworth price cycles : The New Palgrave Dictionary of Economics". www.dictionaryofeconomics.com. Retrieved 2018-01-02.

- ↑ Wang, Zhongmin (2009-12-01). "(Mixed) Strategy in Oligopoly Pricing: Evidence from Gasoline Price Cycles Before and Under a Timing Regulation". Journal of Political Economy. 117 (6): 987–1030. CiteSeerX 10.1.1.320.9839 . doi:10.1086/649801. ISSN 0022-3808.

- ↑ Fershtman, Chaim; Fishman, Arthur (1992). "Price Cycles and Booms: Dynamic Search Equilibrium". The American Economic Review. 82 (5): 1221–1233. JSTOR 2117475.

- ↑ Tappata, Mariano (2009-12-01). "Rockets and feathers: Understanding asymmetric pricing". The RAND Journal of Economics. 40 (4): 673–687. doi:10.1111/j.1756-2171.2009.00084.x. ISSN 1756-2171.

- ↑ Lewis, Matthew S. (2011-06-01). "Asymmetric Price Adjustment and Consumer Search: An Examination of the Retail Gasoline Market". Journal of Economics & Management Strategy. 20 (2): 409–449. CiteSeerX 10.1.1.199.1790 . doi:10.1111/j.1530-9134.2011.00293.x. ISSN 1530-9134.

- E., Maskin and Tirole, J., “A Theory of Dynamic Oligopoly II: Price Competition, Kinked Demand Curves and Edgeworth Cycles”, Econometrica 56, 1988.

- Eckert, Andrew and West, Douglas S., "Retail Gasoline Price Cycles across Spatially Dispersed Gasoline Stations", Journal of Law and Economics, Vol. XLVII, No. 1, April 2004, p. 245