The European Parliament (EP) is one of the legislative bodies of the European Union and one of its seven institutions. Together with the Council of the European Union, it adopts European legislation, following a proposal by the European Commission. The Parliament is composed of 705 members (MEPs). It represents the second-largest democratic electorate in the world, with an electorate of 375 million eligible voters in 2009.

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any form of financial instrument, even though the underlying legal and regulatory regime may not have such a broad definition. In some jurisdictions the term specifically excludes financial instruments other than equities and fixed income instruments. In some jurisdictions it includes some instruments that are close to equities and fixed income, e.g., equity warrants.

Wire transfer, bank transfer, or credit transfer, is a method of electronic funds transfer from one person or entity to another. A wire transfer can be made from one bank account to another bank account, or through a transfer of cash at a cash office.

The Australian financial system consists of the arrangements covering the borrowing and lending of funds and the transfer of ownership of financial claims in Australia, comprising:

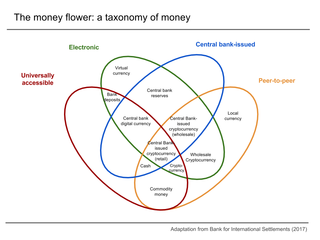

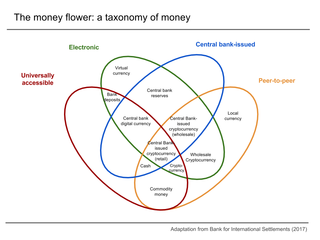

Digital currency is any currency, money, or money-like asset that is primarily managed, stored or exchanged on digital computer systems, especially over the internet. Types of digital currencies include cryptocurrency, virtual currency and central bank digital currency. Digital currency may be recorded on a distributed database on the internet, a centralized electronic computer database owned by a company or bank, within digital files or even on a stored-value card.

A payment system is any system used to settle financial transactions through the transfer of monetary value. This includes the institutions, payment instruments such as payment cards, people, rules, procedures, standards, and technologies that make its exchange possible. A common type of payment system, called an operational network, links bank accounts and provides for monetary exchange using bank deposits. Some payment systems also include credit mechanisms, which are essentially a different aspect of payment.

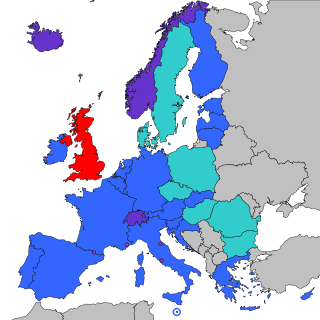

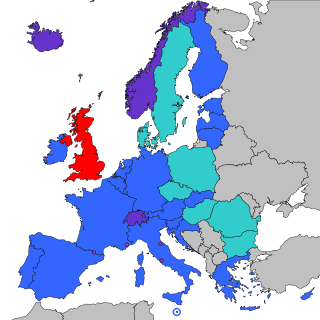

The Single Euro Payments Area (SEPA) is a payment integration initiative of the European Union for simplification of bank transfers denominated in euro. As of 2020, there were 36 members in SEPA, consisting of the 27 member states of the European Union, the four member states of the European Free Trade Association, and the United Kingdom. Some microstates participate in the technical schemes: Andorra, Monaco, San Marino, and Vatican City.

Virtual currency, or virtual money, is a digital currency that is largely unregulated, issued and usually controlled by its developers, and used and accepted electronically among the members of a specific virtual community. In 2014, the European Banking Authority defined virtual currency as "a digital representation of value that is neither issued by a central bank or a public authority, nor necessarily attached to a fiat currency but is accepted by natural or legal persons as a means of payment and can be transferred, stored or traded electronically." A digital currency issued by a central bank is referred to as a central bank digital currency.

BAI is a nonprofit organization in the United States that provides research, training, and thought leadership events for the financial services industry. Headquartered in Chicago, Illinois, BAI also operates Banking Strategies, a daily online financial services publication.

The seven institutions of the European Union (EU) are seated in four different cities, which are Brussels (Belgium), Frankfurt am Main (Germany), Luxembourg (Luxembourg) and Strasbourg (France), rather than being concentrated in a single capital city. All four were chosen, among various reasons, for their location halfway between France and Germany, the countries whose rivalry led to two World Wars and whose reconciliation paved the way for European integration. The EU agencies and other bodies are located all across the union, but usually not fixed in the treaties. The Hague is the only exception, as the fixed seat of the Agency for Law Enforcement Cooperation (Europol). Over the years, Brussels has become the EU's political hub, with the College of the Commissioners – the European Commission's politically accountable executive – and the European Council both meeting at their Brussels-based headquarters, and the European Parliament and Council of the EU holding the majority of their meetings annually within the city. This has led to some referring to it as "the capital of the EU". However, Luxembourg City is the EU capital that can lay claim to having the most of the seven EU institutions based wholly or partly upon its territory, with only the European Council and European Central Bank not having a presence in the city.

The European Association of Co-operative Banks (EACB) is a European interest group representing cooperative banks in the European Union (EU) and five non-European countries. Established in 1970, the non-profit association "represents, promotes and defends" the common interests of its 26 member institutions and 2.700 cooperative banks regarding banking as well as cooperative legislation.

European Union (EU) concepts, acronyms, and jargon are a terminology set that has developed as a form of shorthand, to quickly express a (formal) EU process, an (informal) institutional working practice, or an EU body, function or decision, and which is commonly understood among EU officials or external people who regularly deal with EU institutions.

The Revised Payment Services Directive (PSD2, Directive (EU) 2015/2366, which replaced the Payment Services Directive (PSD), Directive 2007/64/EC) is an EU Directive, administered by the European Commission (Directorate General Internal Market) to regulate payment services and payment service providers throughout the European Union (EU) and European Economic Area (EEA). The PSD's purpose was to increase pan-European competition and participation in the payments industry also from non-banks, and to provide for a level playing field by harmonizing consumer protection and the rights and obligations for payment providers and users. The key objectives of the PSD2 directive are creating a more integrated European payments market, making payments more secure and protecting consumers.

The Body of European Regulators for Electronic Communications (BEREC) is the body in which the regulators of the telecommunications markets in the European Union work together. Other participants are the representatives of the European Commission, as well as telecommunication regulators from the member states of the EEA and of states that are in the process of joining the EU.

In the legal code of the United States, a money transmitter or money transfer service is a business entity that provides money transfer services or payment instruments. Money transmitters in the US are part of a larger group of entities called money service businesses, or MSBs. Under federal law, 18 USC § 1960, businesses are required to register for a money transmitter license where their activity falls within the state definition of a money transmitter.

Eddy Wymeersch is former Chair of the Committee of European Securities Regulators (CESR), former Chairman of the Supervisory Board of the Banking, Finance and Insurance Commission (Belgium), Brussels; Chairman of the European Regional Committee and Member of the Executive Committee and of the Technical Committee of the International Organization of Securities Commissions.

In financial services, open banking allows for financial data to be shared between banks and third-party service providers through the use of application programming interfaces (APIs). Traditionally, banks have kept customer financial data within their own closed systems. Open banking allows customers to share their financial information securely and electronically with other authorized organizations, such as fintech companies, payment providers, and other banks.

ISO/IEC JTC 1/SC 17 Cards and personal identification is a standardization subcommittee of the Joint Technical Committee ISO/IEC JTC 1 of the International Organization for Standardization (ISO) and the International Electrotechnical Commission (IEC), which develops and facilitates standards within the field of identification cards and personal identification. The international secretariat of ISO/IEC JTC 1/SC 17 is the British Standards Institution (BSI) located in the United Kingdom.

The E-Money Directive or the electronic money directive regulates electronic payment systems in the European Union. The aim is to enable new and secure electronic money services and to foster effective competition between all market participants.