SLM Corporation is a publicly traded U.S. corporation that provides consumer banking. Its nature has changed dramatically since it was set up in the early 1970s; initially a government entity that serviced federal education loans, it then became private and began offering private student loans.

The Government National Mortgage Association (GNMA), or Ginnie Mae, is a government-owned corporation of the United States Federal Government within the Department of Housing and Urban Development (HUD). It was founded in 1968 and works to expand affordable housing by guaranteeing housing loans (mortgages) thereby lowering financing costs such as interest rates for those loans. It does that through guaranteeing to investors the on-time payment of mortgage-backed securities (MBS) even if homeowners default on the underlying mortgages and the homes are foreclosed upon.

The Federal National Mortgage Association (FNMA), commonly known as Fannie Mae, is a United States government-sponsored enterprise (GSE) and, since 1968, a publicly traded company. Founded in 1938 during the Great Depression as part of the New Deal, the corporation's purpose is to expand the secondary mortgage market by securitizing mortgage loans in the form of mortgage-backed securities (MBS), allowing lenders to reinvest their assets into more lending and in effect increasing the number of lenders in the mortgage market by reducing the reliance on locally based savings and loan associations. Its brother organization is the Federal Home Loan Mortgage Corporation (FHLMC), better known as Freddie Mac. In 2023, Fannie Mae was ranked number 28 on the Fortune 500 rankings of the largest United States corporations by total revenue.

The Federal Home Loan Mortgage Corporation (FHLMC), commonly known as Freddie Mac, is a publicly traded, government-sponsored enterprise (GSE), headquartered in Tysons, Virginia. The FHLMC was created in 1970 to expand the secondary market for mortgages in the US. Along with the Federal National Mortgage Association, Freddie Mac buys mortgages, pools them, and sells them as a mortgage-backed security (MBS) to private investors on the open market. This secondary mortgage market increases the supply of money available for mortgage lending and increases the money available for new home purchases. The name "Freddie Mac" is a variant of the FHLMC initialism of the company's full name that was adopted officially for ease of identification.

The Federal Agricultural Mortgage Corporation, also known as Farmer Mac, is a stockholder-owned, publicly traded company that was chartered by the United States federal government in 1988 to serve as a secondary market in agricultural loans such as mortgages for agricultural real estate and rural housing. The company purchases loans from agricultural lenders, and sells instruments backed by those loans. The company also works with the United States Department of Agriculture. It is based in Washington, D.C.

A mortgage-backed security (MBS) is a type of asset-backed security which is secured by a mortgage or collection of mortgages. The mortgages are aggregated and sold to a group of individuals that securitizes, or packages, the loans together into a security that investors can buy. Bonds securitizing mortgages are usually treated as a separate class, termed residential; another class is commercial, depending on whether the underlying asset is mortgages owned by borrowers or assets for commercial purposes ranging from office space to multi-dwelling buildings.

The Federal Home Loan Banks are 11 U.S. government-sponsored banks that provide liquidity to financial institutions to support housing finance and community investment.

A government-sponsored enterprise (GSE) is a type of financial services corporation created by the United States Congress. Their intended function is to enhance the flow of credit to targeted sectors of the economy, to make those segments of the capital market more efficient and transparent, and to reduce the risk to investors and other suppliers of capital. The desired effect of the GSEs is to enhance the availability and reduce the cost of credit to the targeted borrowing sectors primarily by reducing the risk of capital losses to investors: agriculture, home finance and education. Well known GSEs are the Federal National Mortgage Association, known as Fannie Mae, and the Federal Home Loan Mortgage Corporation, or Freddie Mac.

A mortgage broker acts as an intermediary who brokers mortgage loans on behalf of individuals or businesses. Traditionally, banks and other lending institutions have sold their own products. As markets for mortgages have become more competitive, however, the role of the mortgage broker has become more popular. In many developed mortgage markets today,, mortgage brokers are the largest sellers of mortgage products for lenders. Mortgage brokers exist to find a bank or a direct lender that will be willing to make a specific loan an individual is seeking. Mortgage brokers in Canada are paid by the lender and do not charge fees for good credit applications. In the US, many mortgage brokers are regulated by their state and by the CFPB to assure compliance with banking and finance laws in the jurisdiction of the consumer. The extent of the regulation depends on the jurisdiction.

A mortgage bank is a bank that specializes in originating and/or servicing mortgage loans. In the United States, a mortgage bank is a state-licensed banking entity that makes mortgage loans directly to consumers. The difference between a mortgage banker and a mortgage broker is that the mortgage banker funds loans with its own capital.

E-Loan, Inc. is a financial services company that offers its users access to partners that may be able to assist them in obtaining loans.

Residential mortgage-backed security (RMBS) are a type of mortgage-backed security backed by residential real estate mortgages.

Prospect Mortgage was a residential retail mortgage lender that offered a range of home loans. The company was founded in 2007 and was headquartered in Sherman Oaks, California with retail offices across the United States. The company was backed by the private equity firm, Sullivan Partners. In 2011, Prospect Mortgage was ranked number 2 on Mortgage Executive Magazine's list of the Top 100 Mortgage Companies in America and was a top 10 national home purchase lender in 2012.

The Mortgage Industry Standards Maintenance Organization(MISMO) is a not-for-profit, wholly owned subsidiary of the Mortgage Bankers Association (MBA) responsible for developing standards for exchanging information and conducting business in the U.S. mortgage finance industry. It has more than 175 member organizations representing a cross-section of the residential and commercial mortgage industries.

A mortgage servicer is a company to which some borrowers pay their mortgage loan payments and which performs other services in connection with mortgages and mortgage-backed securities. The mortgage servicer may be the entity that originated the mortgage, or it may have purchased the mortgage servicing rights from the original mortgage lender. The duties of a mortgage servicer vary, but typically include the acceptance and recording of mortgage payments; calculating variable interest rates on adjustable rate loans; payment of taxes and insurance from borrower escrow accounts; negotiations of workouts and modifications of mortgage upon default; and conducting or supervising the foreclosure process when necessary.

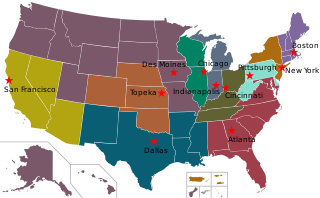

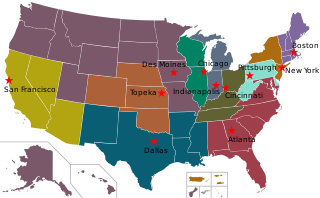

The mortgage industry of the United States is a major financial sector. The federal government created several programs, or government sponsored entities, to foster mortgage lending, construction and encourage home ownership. These programs include the Government National Mortgage Association, the Federal National Mortgage Association and the Federal Home Loan Mortgage Corporation.

RPM Mortgage is an independently owned and operated mortgage lender and broker based in Alamo, California. The company’s roots in the Bay Area stem back to 1986. RPM Mortgage is owned by Rob and Tracey Hirt. The company has over 70 branches in Arizona, California, Colorado, Nevada, Oregon, and Washington with over 800 loan agents and employees.

American Advisors Group (AAG) is an American reverse mortgage lender. It provides government-insured Home Equity Conversion Mortgage (HECM) loans and has 81 geographical areas approved for business by HUD.

Ellie Mae Inc., originally named Electronic Mortgage Affiliates, is a software company that processes 35% of U.S. mortgage applications. The services are based on a software as a service model (SaaS), and specializes in originating and funding new mortgage loans and facilitating regulatory compliance. The company is headquartered in Pleasanton, California.

Live Well Financial, Inc. ("LWF") was a privately owned mortgage originator, servicer and investor, licensed in the United States to operate in 46 states. The company offered government-insured Home Equity Conversion Mortgage loans, FHA single family mortgage loans, and Fannie Mae conforming loans. LWF is headquartered in Richmond, Virginia and has 3 retail origination branches, 2 in Richmond, Virginia and 1 in San Diego, California, with origination capabilities throughout the United States. The company and its principals are now the focus of criminal and civil charges alleging a large-scale financial fraud.