Related Research Articles

Corporate welfare is a phrase used to describe a government's bestowal of money grants, tax breaks, or other special favorable treatment for corporations.

The Dust Bowl was a period of severe dust storms that greatly damaged the ecology and agriculture of the American and Canadian prairies during the 1930s; severe drought and a failure to apply dryland farming methods to prevent the aeolian processes caused the phenomenon. The drought came in three waves: 1934, 1936, and 1939–1940, but some regions of the High Plains experienced drought conditions for as many as eight years.

The United States Department of Agriculture (USDA) is the federal executive department responsible for developing and executing federal laws related to farming, forestry, rural economic development, and food. It aims to meet the needs of commercial farming and livestock food production, promotes agricultural trade and production, works to assure food safety, protects natural resources, fosters rural communities and works to end hunger in the United States and internationally. It is headed by the Secretary of Agriculture, who reports directly to the President of the United States and is a member of the president's Cabinet. The current secretary is Tom Vilsack, who has served since February 24, 2021.

The Common Agricultural Policy (CAP) is the agricultural policy of the European Union. It implements a system of agricultural subsidies and other programmes. It was introduced in 1962 and has undergone several changes since then to reduce the cost and to also consider rural development in its aims. It has, however, been criticised on the grounds of its cost, and its environmental and humanitarian effects.

A subsidy or government incentive is a form of financial aid or support extended to an economic sector generally with the aim of promoting economic and social policy. Although commonly extended from the government, the term subsidy can relate to any type of support – for example from NGOs or as implicit subsidies. Subsidies come in various forms including: direct and indirect.

Agricultural policy describes a set of laws relating to domestic agriculture and imports of foreign agricultural products. Governments usually implement agricultural policies with the goal of achieving a specific outcome in the domestic agricultural product markets.

Crop insurance is purchased by agricultural producers, and subsidized by the federal government, to protect against either the loss of their crops due to natural disasters, such as hail, drought, and floods, or the loss of revenue due to declines in the prices of agricultural commodities. The two general categories of crop insurance are called crop-yield insurance and crop-revenue insurance. On average, the federal government subsidizes 62 percent of the premium. In 2019, crop insurance policies covered almost 380 million acres. Major crops are insurable in most counties where they are grown, and approximately 90% of U.S. crop acreage is insured under the federal crop insurance program. Four crops—corn, cotton, soybeans, and wheat— typically account for more than 70% of total enrolled acres. For these major crops, a large share of plantings is covered by crop insurance.

An FHA insured loan is a US Federal Housing Administration mortgage insurance backed mortgage loan that is provided by an FHA-approved lender. FHA mortgage insurance protects lenders against losses. They have historically allowed lower-income Americans to borrow money to purchase a home that they would not otherwise be able to afford. Because this type of loan is more geared towards new house owners than real estate investors, FHA loans are different from conventional loans in the sense that the house must be owner-occupant for at least a year. Since loans with lower down-payments usually involve more risk to the lender, the home-buyer must pay a two-part mortgage insurance that involves a one-time bulk payment and a monthly payment to compensate for the increased risk. Frequently, individuals "refinance" or replace their FHA loan to remove their monthly mortgage insurance premium. Removing mortgage insurance premium by paying down the loan has become more difficult with FHA loans as of 2013.

The Australian continent was first settled when ancestors of Indigenous Australians arrived via the islands of Maritime Southeast Asia and New Guinea over 50,000 years ago.

The Australian Government Department of Agriculture and Water Resources was an Government department that existed between 2015 and 2019, which was responsible for developing and implementing policies and programs that contribute to strengthening Australia's primary industries, delivering better returns for primary producers at the farm gate, protecting Australia from animal and plant pests and diseases, and improving the health of Australia's rivers and freshwater ecosystems.

Joseph William Ludwig is an Australian barrister and retired politician. He was a member of the Australian Senate for the state of Queensland from July 1999 to May 2016, representing the Australian Labor Party. Ludwig served in a range of portfolios in the first Rudd and the second Gillard ministries until his resignation from Cabinet as the Minister for Agriculture, Fisheries and Forestry and Minister Assisting the Attorney-General on Queensland Floods Recovery, in 2013.

The Commodity Credit Corporation (CCC) is a wholly owned United States government corporation that was created in 1933 to "stabilize, support, and protect farm income and prices". The CCC is authorized to buy, sell, lend, make payments, and engage in other activities for the purpose of increasing production, stabilizing prices, assuring adequate supplies, and facilitating the efficient marketing of agricultural commodities.

The Conservation Reserve Program (CRP) is a cost-share and rental payment program of the United States Department of Agriculture (USDA). Under the program, the government pays farmers to take certain agriculturally used croplands out of production and convert them to vegetative cover, such as cultivated or native bunchgrasses and grasslands, wildlife and pollinators food and shelter plantings, windbreak and shade trees, filter and buffer strips, grassed waterways, and riparian buffers. The purpose of the program is to reduce land erosion, improve water quality and effect wildlife benefits.

In the United States, the farm bill is the primary agricultural and food policy tool of the federal government. Every five years, Congress deals with the renewal and revision of the comprehensive omnibus bill.

The Food, Conservation, and Energy Act of 2008 was a $288 billion, five-year agricultural policy bill that was passed into law by the United States Congress on June 18, 2008. The bill was a continuation of the 2002 Farm Bill. It continues the United States' long history of agricultural subsidies as well as pursuing areas such as energy, conservation, nutrition, and rural development. Some specific initiatives in the bill include increases in Food Stamp benefits, increased support for the production of cellulosic ethanol, and money for the research of pests, diseases and other agricultural problems.

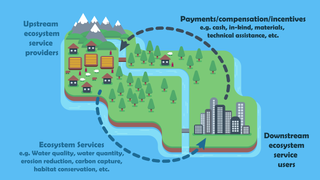

Payments for ecosystem services (PES), also known as payments for environmental services, are incentives offered to farmers or landowners in exchange for managing their land to provide some sort of ecological service. They have been defined as "a transparent system for the additional provision of environmental services through conditional payments to voluntary providers". These programmes promote the conservation of natural resources in the marketplace.

The agricultural policy of the United States is composed primarily of the periodically renewed federal U.S. farm bills. The Farm Bills have a rich history which initially sought to provide income and price support to US farmers and prevent them from adverse global as well as local supply and demand shocks. This implied an elaborate subsidy program which supports domestic production by either direct payments or through price support measures. The former incentivizes farmers to grow certain crops which are eligible for such payments through environmentally conscientious practices of farming. The latter protects farmers from vagaries of price fluctuations by ensuring a minimum price and fulfilling their shortfalls in revenue upon a fall in price. Lately, there are other measures through which the government encourages crop insurance and pays part of the premium for such insurance against various unanticipated outcomes in agriculture.

The Department of Agriculture, Fisheries and Forestry (DAFF) was an Australian government department that existed between 1998 and 2013, when it was renamed as the Department of Agriculture. DAFF's role was to develop and implement policies and programs that ensure Australia's agricultural, fisheries, food and forestry industries remained competitive, profitable and sustainable.

The Australian Department of Agriculture was an Australian Government department in existence between May 2019 and February 2020, which was responsible for developing and implementing policies and programmes that contribute to strengthening Australia's primary industries, delivering better returns for primary producers at the farm gate, protecting Australia from animal and plant pests and diseases, and improving the health of Australia's rivers and freshwater ecosystems.

The Canadian federal budget for fiscal year 1995–1996 was presented by Minister of Finance Paul Martin in the House of Commons of Canada on 27 February 1995.

References

This article in most part is based on statutory and published case law.

- ↑ "DAFF Exceptional Circumstances Relief Payments". Archived from the original on 29 September 2009. Retrieved 11 November 2009.

- ↑ "Small Businesses". Department of Agriculture, Fisheries and Forestry (Australia). Commonwealth of Australia. Archived from the original on 19 October 2009. Retrieved 12 November 2009.

- ↑ ABC Rural News

- ↑ "NSW Rural Assistance Authority - EC Interest Support". Archived from the original on 27 October 2009. Retrieved 11 November 2009.

- ↑ "Health.gov.au Aged Care Exceptional Circumstances". Archived from the original on 8 November 2009. Retrieved 11 November 2009.

- ↑ Immigration - Exceptional Circumstances

- ↑ "Software Engineering Code of Ethics and Professional Practice" . Retrieved 7 March 2012.

- ↑ Muhammad Hedayetullah - Dynamics of Islam: An Exposition ISBN 978-1553698425