Related Research Articles

An initial public offering (IPO) or stock launch is a public offering in which shares of a company are sold to institutional investors and usually also to retail (individual) investors. An IPO is typically underwritten by one or more investment banks, who also arrange for the shares to be listed on one or more stock exchanges. Through this process, colloquially known as floating, or going public, a privately held company is transformed into a public company. Initial public offerings can be used to raise new equity capital for companies, to monetize the investments of private shareholders such as company founders or private equity investors, and to enable easy trading of existing holdings or future capital raising by becoming publicly traded.

The Securities Act of 1933, also known as the 1933 Act, the Securities Act, the Truth in Securities Act, the Federal Securities Act, and the '33 Act, was enacted by the United States Congress on May 27, 1933, during the Great Depression and after the stock market crash of 1929. It is an integral part of United States securities regulation. It is legislated pursuant to the Interstate Commerce Clause of the Constitution.

An accredited or sophisticated investor is an investor with a special status under financial regulation laws. The definition of an accredited investor, and the consequences of being classified as such, vary between countries. Generally, accredited investors include high-net-worth individuals, banks, financial institutions, and other large corporations, who have access to complex and higher-risk investments such as venture capital, hedge funds, and angel investments.

The Securities Exchange Act of 1934 is a law governing the secondary trading of securities in the United States of America. A landmark piece of wide-ranging legislation, the Act of '34 and related statutes form the basis of regulation of the financial markets and their participants in the United States. The 1934 Act also established the Securities and Exchange Commission (SEC), the agency primarily responsible for enforcement of United States federal securities law.

In the United States under the Securities Act of 1933, any offer to sell securities must either be registered with the United States Securities and Exchange Commission (SEC) or meet certain qualifications to exempt them from such registration. Regulation D contains the rules providing exemptions from the registration requirements, allowing some companies to offer and sell their securities without having to register the securities with the SEC. A Regulation D offering is intended to make access to the capital markets possible for small companies that could not otherwise bear the costs of a normal SEC registration. Reg D may also refer to an investment strategy, mostly associated with hedge funds, based upon the same regulation. The regulation is found under Title 17 of the Code of Federal Regulations, part 230, Sections 501 through 508. The legal citation is 17 C.F.R. §230.501 et seq.

Security market is a component of the wider financial market where securities can be bought and sold between subjects of the economy, on the basis of demand and supply. Security markets encompasses stock markets, bond markets and derivatives markets where prices can be determined and participants both professional and non professional can meet.

OTC Markets Group, Inc. is an American financial market providing price and liquidity information for almost 12,400 over-the-counter (OTC) securities. The group has its headquarters in New York City. OTC-traded securities are organized into three markets to inform investors of opportunities and risks: OTCQX, OTCQB and Pink.

An investment company is a financial institution principally engaged in holding, managing and investing securities. These companies in the United States are regulated by the U.S. Securities and Exchange Commission and must be registered under the Investment Company Act of 1940. Investment companies invest money on behalf of their clients who, in return, share in the profits and losses.

Securities regulation in the United States is the field of U.S. law that covers transactions and other dealings with securities. The term is usually understood to include both federal and state-level regulation by governmental regulatory agencies, but sometimes may also encompass listing requirements of exchanges like the New York Stock Exchange and rules of self-regulatory organizations like the Financial Industry Regulatory Authority (FINRA).

A financial adviser or financial advisor is a professional who provides financial services to clients based on their financial situation. In many countries, financial advisors must complete specific training and be registered with a regulatory body in order to provide advice.

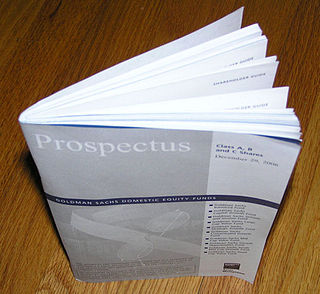

A prospectus, in finance, is a disclosure document that describes a financial security for potential buyers. It commonly provides investors with material information about mutual funds, stocks, bonds and other investments, such as a description of the company's business, financial statements, biographies of officers and directors, detailed information about their compensation, any litigation that is taking place, a list of material properties and any other material information. In the context of an individual securities offering, such as an initial public offering, a prospectus is distributed by underwriters or brokerages to potential investors. Today, prospectuses are most widely distributed through websites such as EDGAR and its equivalents in other countries.

A direct public offering (DPO) or direct listing is a method by which a company can offer an investment opportunity directly to the public.

The Canadian Securities Administrators is an umbrella organization of Canada's provincial and territorial securities regulators whose objective is to improve, coordinate, and harmonize regulation of the Canadian capital markets.

Regulation S-K is a prescribed regulation under the US Securities Act of 1933 that lays out reporting requirements for various SEC filings used by public companies. Companies are also often called issuers, filers or registrants.

Securities regulation in Canada is conducted by the various provincial securities commissions and self-regulating organizations (“SRO”) such as the MFDA and IIROC. Securities are issued under the authority and oversight of these bodies with the result that a broad range of rules apply to companies seeking to raise capital and to the parties acting as their agents in such transactions. However, there is a useful simplification that can be applied in Canada to provide some clarity for issuers - based on the criteria below securities issuers fall into two broad categories:

The Canadian Securities Administrators (“CSA’) have made the harmonization of the registration rules among the jurisdictions of Canada a key goal. Pursuant to this goal new national securities regulations have been drafted - NI 31-103 to provide uniform requirements and categories of registration for dealers in exempt market securities across the country.

The Investor Protections and Improvements to the Regulation of Securities is a United States Act of Congress, which forms Title IX, sections 901 to 991 of the much broader and larger Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. Its main purpose is to revise the powers and structure of the Securities and Exchange Commission, credit rating organizations, and the relationships between customers and broker-dealers or investment advisers. This title calls for various studies and reports from the SEC and Government Accountability Office (GAO). This title contains nine subtitles.

The Jumpstart Our Business Startups Act, or JOBS Act, is a law intended to encourage funding of small businesses in the United States by easing many of the country's securities regulations. It passed with bipartisan support, and was signed into law by President Barack Obama on April 5, 2012. Title III, also known as the CROWDFUND Act, has drawn the most public attention because it creates a way for companies to use crowdfunding to issue securities, something that was not previously permitted. Title II went into effect on September 23, 2013. On October 30, 2015, the SEC adopted final rules allowing Title III equity crowdfunding. These rules went into effect on May 16, 2016; this section of the law is known as Regulation CF. Other titles of the Act had previously become effective in the years since the Act's passage.

Equity crowdfunding is the online offering of private company securities to a group of people for investment and therefore it is a part of the capital markets. Because equity crowdfunding involves investment into a commercial enterprise, it is often subject to securities and financial regulation. Equity crowdfunding is also referred to as crowdinvesting, investment crowdfunding, or crowd equity.

In Australia, charitable investment fundraisers (CIF) are not-for-profit entities with charitable purposes that take deposits from the public to finance those charitable purposes. CIFs may apply for an exemption from the requirement to hold an Australian Financial Services Licence (AFSL) if the “financial products” they provide is limited to the issue of debentures or the running of managed investment schemes. For example, the solicitation of secured loans that are paid back with interest are considered debentures. Such deposit taking entities have since 2003 also been exempted from certain requirements of the Banking Act 1959.

References

- ↑ "The exempt market". OSC. Retrieved 2018-07-04.

- ↑ "45-106". OSC. Retrieved 2019-11-02.