Related Research Articles

In the United States, a conservation easement is a power invested in a qualified land conservation organization called a "land trust", or a governmental entity to constrain, as to a specified land area, the exercise of rights otherwise held by a landowner so as to achieve certain conservation purposes. It is an interest in real property established by agreement between a landowner and land trust or unit of government. The conservation easement "runs with the land", meaning it is applicable to both present and future owners of the land. The grant of conservation easement, as with any real property interest, is part of the chain of title for the property and is normally recorded in local land records.

This aims to be a complete list of the articles on real estate.

A homeowner association, or a homeowner community, is a private association-like entity in the United States, Canada, and certain other countries often formed either ipso jure in a building with multiple owner-occupancies, or by a real estate developer for the purpose of marketing, managing, and selling homes and lots in a residential subdivision. The developer will typically transfer control of the association to the homeowners after selling a predetermined number of lots.

Proposition 13 is an amendment of the Constitution of California enacted during 1978, by means of the initiative process. The initiative was approved by California voters on June 6, 1978. It was upheld as constitutional by the United States Supreme Court in the case of Nordlinger v. Hahn, 505 U.S. 1 (1992). Proposition 13 is embodied in Article XIII A of the Constitution of the State of California.

A property tax is an ad valorem tax on the value of a property.

Farmland generally refers to agricultural land, or land currently used for the purposes of farming. It may also refer to:

Farmland development rights in Suffolk County, New York began in 1975 in Suffolk County as the state of New York began a program to purchase development rights for farmland to insure they remained as farms and open space rather than being developed for housing.

In the United States, individuals and corporations pay a tax on the net total of all their capital gains. The tax rate depends on both the investor's tax bracket and the amount of time the investment was held. Short-term capital gains are taxed at the investor's ordinary income tax rate and are defined as investments held for a year or less before being sold. Long-term capital gains, on dispositions of assets held for more than one year, are taxed at a lower rate.

Farmland preservation is a joint effort by non-governmental organizations and local governments to set aside and protect examples of a region's farmland for the use, education, and enjoyment of future generations. They are operated mostly at state and local levels by government agencies or private entities such as land trusts and are designed to limit conversion of agricultural land to other uses that otherwise might have been more financially attractive to the land owner. Every state provides tax relief through differential (preferential) assessment. Less common approaches include establishing agricultural districts, using zoning to protect agricultural land, purchasing development rights, and transferable development rights. It is often a part of regional planning and national historic preservation.

The Food, Conservation, and Energy Act of 2008 was a $288 billion, five-year agricultural policy bill that was passed into law by the United States Congress on June 18, 2008. The bill was a continuation of the 2002 Farm Bill. It continues the United States' long history of agricultural subsidies as well as pursuing areas such as energy, conservation, nutrition, and rural development. Some specific initiatives in the bill include increases in Food Stamp benefits, increased support for the production of cellulosic ethanol, and money for the research of pests, diseases and other agricultural problems.

National Wind, LLC, A Trishe Group of Company, is a Minneapolis company founded in 2003 that is a developer of large-scale, community-based wind energy projects. The company, along with National Wind Assessments, has 50 employees based in Minneapolis, MN and Grand Forks, North Dakota. National Wind claims to be the nation's leading developer of community-based wind farms.

The Agriculture Retention and Development Act was created as part of New Jersey's efforts to counteract the loss of farmland in the state. The legislation formed the basis needed for the state to purchase the easements of New Jersey farms in order to ensure they remain as farms, and could never be sold for housing or for non-farming commercial development. The effect was to slow farmland loss in the state. The farmland preservation efforts made in New Jersey have effectively kept the farms as private land with a public legacy of permanent farm status. As of July 2022, New Jersey has permanently preserved 2,800 farms covering 247,517 acres.

New Jersey has over 4,100 MW of install solar power capacity as of mid-2022, which provides 6.7% of the state's electricity consumption. The's state's growth of solar power is aided by a renewable portfolio standard that requires that 22.5% of New Jersey's electricity come from renewable resources by 2021 and 50% by 2030, by incentives provided for generation of solar power, and by one of the most favorable net metering standards in the country, allowing customers of any size array to use net metering, although generation may not exceed annual demand. As of 2018, New Jersey has the sixth-largest installed solar capacity of all U.S. states and the largest installed solar capacity of the Northeastern States.

PACE financing is a means used in the United States of America of financing energy efficiency upgrades, disaster resiliency improvements, water conservation measures, or renewable energy installations in existing or new construction of residential, commercial, and industrial property owners. Depending on state legislation, PACE financing can be used to finance water efficiency products, seismic retrofits, resiliency, and other measures with social benefits.

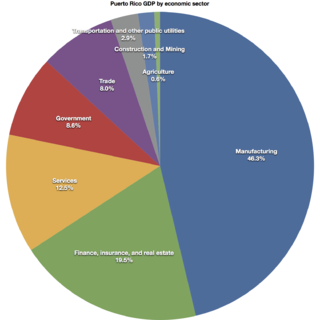

As of 2012, the real estate industry in Puerto Rico constituted about 14.8% of the gross domestic product of Puerto Rico, about 1% of all of the employee compensation on the island and, together with finance and insurance (FIRE), about 3.7% of all the employment on the jurisdiction.

Most local governments in the United States impose a property tax, also known as a millage rate, as a principal source of revenue. This tax may be imposed on real estate or personal property. The tax is nearly always computed as the fair market value of the property, multiplied by an assessment ratio, multiplied by a tax rate, and is generally an obligation of the owner of the property. Values are determined by local officials, and may be disputed by property owners. For the taxing authority, one advantage of the property tax over the sales tax or income tax is that the revenue always equals the tax levy, unlike the other types of taxes. The property tax typically produces the required revenue for municipalities' tax levies. One disadvantage to the taxpayer is that the tax liability is fixed, while the taxpayer's income is not.

Trump National Golf Club is a private golf club located on Lamington Road in Bedminster, New Jersey. Approximately 40 miles (64 km) west of New York City in Somerset County, it is owned and operated by The Trump Organization.

Agrarian reform and land reform have been a recurring theme of enormous consequence in world history. They are often highly political and have been achieved in many countries.

Agriculture played a major role in the early growth of Connecticut as one of the original 13 colonies that would form the United States of America, particularly in the Connecticut River valley which provides fertile soil, temperate climate and easy access to markets. As the Industrial Revolution helped focus capital on mercantile centers in the 19th century, Connecticut farmers over time ceded their relative economic and political influence.

Heirs property, or heirs' property, refers to a family home or land that passes from generation to generation through inheritance, usually without a will or formal estate strategy. This unstable form of ownership limits a family’s ability to build generational wealth and hampers the efforts of nonprofits and cities to revitalize neighborhoods.

References

- ↑ Luke, George W. (August 29, 1976). "Farmland Act Assayed". The New York Times . Retrieved 2008-07-23.