A flood is an overflow of water that submerges land that is usually dry. In the sense of "flowing water", the word may also be applied to the inflow of the tide. Floods are of significant concern in agriculture, civil engineering and public health. Human changes to the environment often increase the intensity and frequency of flooding. Examples for human changes are land use changes such as deforestation and removal of wetlands, changes in waterway course or flood controls such as with levees. Global environmental issues also influence causes of floods, namely climate change which causes an intensification of the water cycle and sea level rise. For example, climate change makes extreme weather events more frequent and stronger. This leads to more intense floods and increased flood risk.

A natural disaster is the very harmful impact on a society or community after a natural hazard event. Some examples of natural hazard events include avalanches, droughts, earthquakes, floods, heat waves, landslides, tropical cyclones, volcanic activity and wildfires. Additional natural hazards include blizzards, dust storms, firestorms, hails, ice storms, sinkholes, thunderstorms, tornadoes and tsunamis. A natural disaster can cause loss of life or damage property. It typically causes economic damage. How bad the damage is depends on how well people are prepared for disasters and how strong the buildings, roads, and other structures are. Scholars have been saying that the term natural disaster is unsuitable and should be abandoned. Instead, the simpler term disaster could be used. At the same time the type of hazard would be specified. A disaster happens when a natural or human-made hazard impacts a vulnerable community. It results from the combination of the hazard and the exposure of a vulnerable society.

A floodplain or flood plain or bottomlands is an area of land adjacent to a river. Floodplains stretch from the banks of a river channel to the base of the enclosing valley, and experience flooding during periods of high discharge. The soils usually consist of clays, silts, sands, and gravels deposited during floods.

A 100-year flood is a flood event that has on average a 1 in 100 chance of being equaled or exceeded in any given year.

The Federal Emergency Management Agency (FEMA) is an agency of the United States Department of Homeland Security (DHS), initially created under President Jimmy Carter by Presidential Reorganization Plan No. 3 of 1978 and implemented by two Executive Orders on April 1, 1979. The agency's primary purpose is to coordinate the response to a disaster that has occurred in the United States and that overwhelms the resources of local and state authorities. The governor of the state in which the disaster occurs must declare a state of emergency and formally request from the President that FEMA and the federal government respond to the disaster. The only exception to the state's gubernatorial declaration requirement occurs when an emergency or disaster takes place on federal property or to a federal asset—for example, the 1995 bombing of the Alfred P. Murrah Federal Building in Oklahoma City, Oklahoma, or the Space Shuttle Columbia in the 2003 return-flight disaster.

Seismic risk or earthquake risk is the potential impact on the built environment and on people's well-being due to future earthquakes. Seismic risk has been defined, for most management purposes, as the potential economic, social and environmental consequences of hazardous events that may occur in a specified period of time. A building located in a region of high seismic hazard is at lower risk if it is built to sound seismic engineering principles. On the other hand, a building located in a region with a history of minor seismicity, in a brick building located on fill subject to liquefaction can be as high or higher risk.

Lake Delton is a man-made freshwater lake in Sauk County in central Wisconsin. For much of 2008, it was a mostly empty lake basin after a portion of a county highway that forms part of the dike wall eroded on June 9, 2008, under the pressure of floods in the area. The resulting wash out caused the lake to empty into the Wisconsin River, leaving behind only rainwater pools and the flow from Dell Creek. By March 2009, major repairs to correct the problem were completed, and the lake was allowed to refill. Minor repairs were expected to continue after that time, but the lake is now completely refilled and has been usable since Memorial Day weekend of 2009.

Flood insurance is the specific insurance coverage issued against property loss from flooding. To determine risk factors for specific properties, insurers will often refer to topographical maps that denote lowlands, floodplains and other areas that are susceptible to flooding.

The National Flood Insurance Program (NFIP) is a program created by the Congress of the United States in 1968 through the National Flood Insurance Act of 1968. The NFIP has two purposes: to share the risk of flood losses through flood insurance and to reduce flood damages by restricting floodplain development. The program enables property owners in participating communities to purchase insurance protection, administered by the government, against losses from flooding, and requires flood insurance for all loans or lines of credit that are secured by existing buildings, manufactured homes, or buildings under construction, that are located in the Special Flood Hazard Area in a community that participates in the NFIP. U.S. Congress limits the availability of National Flood Insurance to communities that adopt adequate land use and control measures with effective enforcement provisions to reduce flood damages by restricting development in areas exposed to flooding.

Hazus is a geographic information system-based natural hazard analysis tool developed and freely distributed by the Federal Emergency Management Agency (FEMA).

The National Flood Insurance Act of 1968 is a federal law in the United States that was enacted as Title XIII of the Housing and Urban Development Act of 1968 and signed into law by President Lyndon B. Johnson that led to the creation of the National Flood Insurance Program (NFIP).

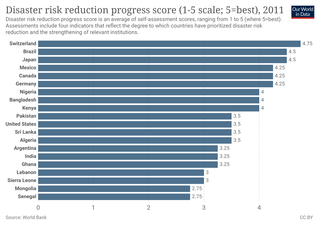

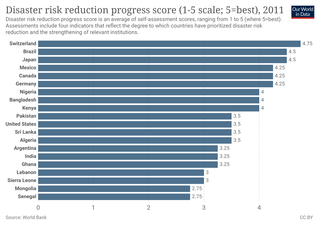

Disaster risk reduction aims to make disasters less likely to happen. The approach, also called DRR or disaster risk management, also aims to make disasters less damaging when they do occur. DRR aims to make communities stronger and better prepared to handle disasters. In technical terms, it aims to make them more resilient or less vulnerable. When DRR is successful, it makes communities less the vulnerable because it mitigates the effects of disasters. This means DRR can make risky events fewer and less severe. Climate change can increase climate hazards. So development efforts often consider DRR and climate change adaptation together.

Flood managment describes methods used to reduce or prevent the detrimental effects of flood waters. Flooding can be caused by a mix of both natural processes, such as extreme weather upstream, and human changes to waterbodies and runoff.

A hazard map is a map that highlights areas that are affected by or are vulnerable to a particular hazard. They are typically created for natural hazards, such as earthquakes, volcanoes, landslides, flooding and tsunamis. Hazard maps help prevent serious damage and deaths.

An ARkStorm is a "megastorm" proposed scenario based on repeated historical occurrences of atmospheric rivers and other major rain events first developed and published by the Multi-Hazards Demonstration Project (MHDP) of the United States Geological Survey (USGS) in 2010 and updated as ARkStorm 2.0 in 2022.

Coastal hazards are physical phenomena that expose a coastal area to the risk of property damage, loss of life, and environmental degradation. Rapid-onset hazards last a few minutes to several days and encompass significant cyclones accompanied by high-speed winds, waves, and surges or tsunamis created by submarine (undersea) earthquakes and landslides. Slow-onset hazards, such as erosion and gradual inundation, develop incrementally over extended periods.

A Special Flood Hazard Area (SFHA) is an area identified by the United States Federal Emergency Management Agency (FEMA) as an area with a special flood or mudflow, and/or flood related erosion hazard, as shown on a flood hazard boundary map or flood insurance rate map. Areas within the SFHA are designated on the flood insurance rate map as Zone A, AO, A1-A30, AE, A99, AH, AR, AR/A, AR/AE, AR/AH, AR/AO, AR/A1-A30, V1-V30 or V.

The Homeowner Flood Insurance Affordability Act of 2014 was a United States Congress bill that would have delayed the increases in flood insurance premiums that were part of the Biggert–Waters Flood Insurance Reform Act of 2012. The reforms from that law were meant to require flood insurance premiums to actually reflect the real risk of flooding, which led to an increase in premiums. At the time of the bill, the National Flood Insurance Program was $24 billion in debt.

The Homeowner Flood Insurance Affordability Act of 2013 is a bill that would reduce some of the reforms made to the federal flood insurance program that were passed two years prior. The bill would reduce federal flood insurance premium rates for some properties that are sold, were uninsured as of July 2012, or where coverage lapsed as a result of the policyholder no longer being required to maintain coverage.

The combination of topographic and climatic factors in the Tulsa, Oklahoma area have frequently caused major flash flooding, especially near streams that normally drain the area. The city was founded atop a bluff on the Arkansas River. Thus, elevation protected most of the inhabitants and their possessions from damage when the river flooded. However, by the turn of the 20th century the population growth had moved closer to the river, and the flatlands west of the Arkansas had begun to develop as well. The floods typically caused widespread property damage and sometimes death. By the 1920s, seasonal floods of the Arkansas began to cause serious damage and loss of life. Since its founding, city leaders had responded to such events by simply rebuilding and replacing the property that had been destroyed in situ. Not until 1970 did the city government begin developing strategies to mitigate floods or at least minimize property damage and prevent loss of life. This article describes some of the more notable floods in Tulsa, then the mitigation and control strategies that evolved from them.