Bankruptcy is a legal process through which people or other entities who cannot repay debts to creditors may seek relief from some or all of their debts. In most jurisdictions, bankruptcy is imposed by a court order, often initiated by the debtor.

Chapter 7 of Title 11 U.S. Code is the bankruptcy code that governs the process of liquidation under the bankruptcy laws of the U.S. In contrast to bankruptcy under Chapter 11 and Chapter 13, which govern the process of reorganization of a debtor, Chapter 7 bankruptcy is the most common form of bankruptcy in the U.S.

Debt relief or debt cancellation is the partial or total forgiveness of debt, or the slowing or stopping of debt growth, owed by individuals, corporations, or nations.

Title 11 of the United States Code sets forth the statutes governing the various types of relief for bankruptcy in the United States. Chapter 13 of the United States Bankruptcy Code provides an individual with the opportunity to propose a plan of reorganization to reorganize their financial affairs while under the bankruptcy court's protection. The purpose of chapter 13 is to enable an individual with a regular source of income to propose a chapter 13 plan that provides for their various classes of creditors. Under chapter 13, the Bankruptcy Court has the power to approve a chapter 13 plan without the approval of creditors as long as it meets the statutory requirements under chapter 13. Chapter 13 plans are usually three to five years in length and may not exceed five years. Chapter 13 is in contrast to the purpose of Chapter 7, which does not provide for a plan of reorganization, but provides for the discharge of certain debt and the liquidation of non-exempt property. A Chapter 13 plan may be looked at as a form of debt consolidation, but a Chapter 13 allows a person to achieve much more than simply consolidating his or her unsecured debt such as credit cards and personal loans. A chapter 13 plan may provide for the four general categories of debt: priority claims, secured claims, priority unsecured claims, and general unsecured claims. Chapter 13 plans are often used to cure arrearages on a mortgage, avoid "underwater" junior mortgages or other liens, pay back taxes over time, or partially repay general unsecured debt. In recent years, some bankruptcy courts have allowed Chapter 13 to be used as a platform to expedite a mortgage modification application.

Debt restructuring is a process that allows a private or public company or a sovereign entity facing cash flow problems and financial distress to reduce and renegotiate its delinquent debts to improve or restore liquidity so that it can continue its operations.

Milanese is the central variety of the Western dialect of the Lombard language spoken in Milan, the rest of its metropolitan city, and the northernmost part of the province of Pavia. Milanese, due to the importance of Milan, the largest city in Lombardy, is often considered one of the most prestigious Lombard variants and the most prestigious one in the Western Lombard area.

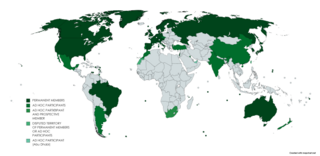

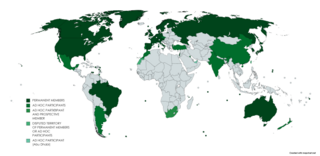

Paris Club is a group of major creditor countries aiming to provide a sustainable way to tackle debt problems in debtor countries.

A debtor or debitor is a legal entity that owes a debt to another entity. The entity may be an individual, a firm, a government, a company or other legal person. The counterparty is called a creditor. When the counterpart of this debt arrangement is a bank, the debtor is more often referred to as a borrower.

Nexum was a debt bondage contract in the early Roman Republic. A debtor pledged his person as collateral if he defaulted on his loan. Details as to the contract are obscure and some modern scholars dispute its existence. It was allegedly abolished either in 326 or 313 BC.

Debt collection or cash collection is the process of pursuing payments of money or other agreed-upon value owed to a creditor. The debtors may be individuals or businesses. An organization that specializes in debt collection is known as a collection agency or debt collector. Most collection agencies operate as agents of creditors and collect debts for a fee or percentage of the total amount owed. Historically, debtors could face debt slavery, debtor's prison, or coercive collection methods. In the 21st century in many countries, legislation regulates debt collectors, and limits harassment and practices deemed unfair.

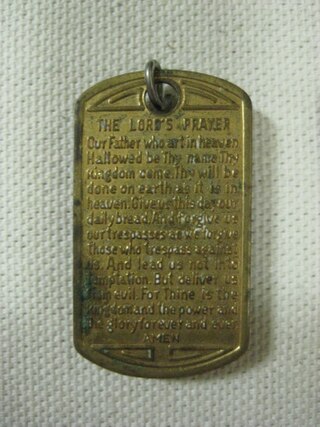

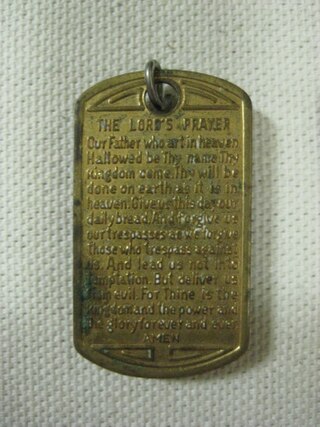

Matthew 6:12 is the twelfth verse of the sixth chapter of the Gospel of Matthew in the New Testament and is part of the Sermon on the Mount. This verse is the fourth one of the Lord's Prayer, one of the best known parts of the entire New Testament. This verse contains the fifth petition to God.

Repossession, colloquially repo, is a "self-help" type of action in which the party having right of ownership of a property takes the property in question back from the party having right of possession without invoking court proceedings. The property may then be sold by either the financial institution or third party sellers.

The Bergamasque dialect is the western variant of the Eastern Lombard group of the Lombard language. It is mainly spoken in the province of Bergamo and in the area around Crema, in central Lombardy.

Debt settlement is a settlement negotiated with a debtor's unsecured creditor. Commonly, creditors agree to forgive a large part of the debt: perhaps around half, though results can vary widely. When settlements are finalized, the terms are put in writing. It is common that the debtor makes one lump-sum payment in exchange for the creditor agreeing that the debt is now cancelled and the matter closed. Some settlements are paid out over a number of months. In either case, as long as the debtor does what is agreed in the negotiation, no outstanding debt will appear on the former debtor's credit report.

The Parable of the Unforgiving Servant is a parable of Jesus which appears in the Gospel of Matthew. According to Matthew 18:21–35 it is important to forgive others as we are forgiven by God, as illustrated by the negative example of the unforgiving servant.

Credit theories of money, also called debt theories of money, are monetary economic theories concerning the relationship between credit and money. Proponents of these theories, such as Alfred Mitchell-Innes, sometimes emphasize that money and credit/debt are the same thing, seen from different points of view. Proponents assert that the essential nature of money is credit (debt), at least in eras where money is not backed by a commodity such as gold. Two common strands of thought within these theories are the idea that money originated as a unit of account for debt, and the position that money creation involves the simultaneous creation of debt. Some proponents of credit theories of money argue that money is best understood as debt even in systems often understood as using commodity money. Others hold that money equates to credit only in a system based on fiat money, where they argue that all forms of money including cash can be considered as forms of credit money.

Luca Ciarrocca is an Italian Internet entrepreneur, journalist and author of macroeconomic and geopolical books. He is the editor of Wall Street Cina, a news organization focused on geopolitics and markets. In 1999 he became a pioneer launching the internet media company Wall Street Italia, which he managed as Ceo and directed as editor in chief for 15 years, until he sold it in 2014. Two of his books are considered radically critical of the banking and global financial system. In September 2015 he published "Rimetti a noi i nostri debiti" (Guerini) an essay on public debt which proposes a "QE For The People". In November 2013 "I padroni del mondo" (Chiarelettere) "(Masters of The World – How the Global Finance Elite Decides the Fate of Governments and Populations) quickly became a best seller with 5 printings in few weeks.

A series of parliamentary reports describe the scope of the problem of debt in Upper Canada; as early as 1827, the eleven district jails in the province had a capacity of 298 cells, of which 264 were occupied, 159 by debtors. In the Home District, 379 of 943 prisoners between 1833 and 1835 were being held for debt. Over the province as a whole, 48% or 2304 of 4726 prisoners were being held in jail for debt in 1836. The number of debtors jailed was the result of both widespread poverty, and the small amounts for which debtors could be indefinitely detained.

The Balfour Note of 1 August 1922, signed by Britain's acting Foreign Secretary Arthur Balfour, was sent to Britain's debtors: France, Italy, Yugoslavia, Romania, Portugal and Greece. Balfour claimed that the British government had reluctantly decided that the loans that those countries had received from HM Treasury should be paid back and that reparations from Germany should be collected due to the need for Britain to pay its creditor, the United States.

Debt relief, or debt forgiveness, has been practiced in many societies since antiquity. Periodic debt remission was institutionalised in the Ancient Near East and contributed to the stability of its societies. In ancient Greece and Rome the laws were more creditor-friendly and debt cancellation was one of the major demands of the poor, only occasionally implemented by the government. Medieval canon law contained provisions for the annulment of debts owed by borrowers in distress, which influenced modern personal bankruptcy law.