Related Research Articles

Public finance is the study of the role of the government in the economy. It is the branch of economics that assesses the government revenue and government expenditure of the public authorities and the adjustment of one or the other to achieve desirable effects and avoid undesirable ones. The purview of public finance is considered to be threefold, consisting of governmental effects on:

- The efficient allocation of available resources;

- The distribution of income among citizens; and

- The stability of the economy.

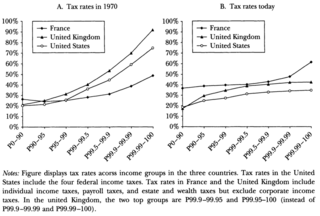

A progressive tax is a tax in which the tax rate increases as the taxable amount increases. The term progressive refers to the way the tax rate progresses from low to high, with the result that a taxpayer's average tax rate is less than the person's marginal tax rate. The term can be applied to individual taxes or to a tax system as a whole. Progressive taxes are imposed in an attempt to reduce the tax incidence of people with a lower ability to pay, as such taxes shift the incidence increasingly to those with a higher ability-to-pay. The opposite of a progressive tax is a regressive tax, such as a sales tax, where the poor pay a larger proportion of their income compared to the rich.

Michael Jay Boskin is the T. M. Friedman Professor of Economics and senior fellow at Stanford University's Hoover Institution. He also is chief executive officer and president of Boskin & Co., an economic consulting company.

Laurence Jacob Kotlikoff is a professor of economics at Boston University, a William Warren Fairfield Professor at Boston University, a Fellow of the American Academy of Arts and Sciences, a Research Associate of the National Bureau of Economic Research, a Fellow of the Econometric Society, and a former Senior Economist on the President's Council of Economic Advisers.

In public finance, a sub-discipline of economics, fiscal incidence is the combined overall economic impact of both government taxation and expenditures on the real economic income of individuals.

Dale Weldeau Jorgenson was the Samuel W. Morris University Professor at Harvard University, teaching in the department of economics and John F. Kennedy School of Government. He served as chairman of the department of economics from 1994 to 1997.

Caroline Minter Hoxby is an American economist whose research focuses on issues in education and public economics. She is currently the Scott and Donya Bommer Professor in Economics at Stanford University and program director of the Economics of Education Program for the National Bureau of Economic Research. Hoxby is a John and Lydia Pearce Mitchell University Fellow in Undergraduate Education. She is also a senior fellow at the Hoover Institution and the Stanford Institute for Economic Policy Research.

Intergenerational equity in economic, psychological, and sociological contexts, is the idea of fairness or justice between generations. The concept can be applied to fairness in dynamics between children, youth, adults, and seniors. It can also be applied to fairness between generations currently living and future generations.

William G. "Bill" Gale is the Arjay and Frances Miller Chair in Federal Economic Policy and the former vice president and director of the Economic Studies Program at the Brookings Institution. He conducts research on a variety of economic issues, focusing particularly on tax policy, fiscal policy, pensions and saving behavior. He is also co-director of the Tax Policy Center, a joint venture of the Brookings Institution and the Urban Institute. Gale attended Duke University and the London School of Economics and received his Ph.D. from Stanford University in 1987.

Marianne A. Ferber was an American feminist economist and the author of many books and articles on the subject of women's work, the family, and the construction of gender. She held a Ph.D. from the University of Chicago.

Robin William Boadway, is a Canadian economist. He held the David Smith Chair at Queen's University in Kingston, Ontario. Earlier he was Sir Edward Peacock Professor of Economic Theory at Queen's University. He has taught at Queen's University since 1973. He was Head of the Department of Economics at Queen's from 1981–86, and was previously Associate Director of the John Deutsch Institute for the Study of Economic Policy.

Public economics(or economics of the public sector) is the study of government policy through the lens of economic efficiency and equity. Public economics builds on the theory of welfare economics and is ultimately used as a tool to improve social welfare. Welfare can be defined in terms of well-being, prosperity, and overall state of being.

Emmanuel Saez is a French, naturalized American economist who is Professor of Economics at the University of California, Berkeley. His work, done with Thomas Piketty and Gabriel Zucman, includes tracking the incomes of the poor, middle class and rich around the world. Their work shows that top earners in the United States have taken an increasingly larger share of overall income over the last three decades, with almost as much inequality as before the Great Depression. He recommends much higher (marginal) taxes on the rich, up to 70% or 90%. He received the John Bates Clark Medal in 2009, a MacArthur "Genius" Fellowship in 2010, and an honorary degree from Harvard University in 2019.

In economics, the Laffer curve illustrates a theoretical relationship between rates of taxation and the resulting levels of the government's tax revenue. The Laffer curve assumes that no tax revenue is raised at the extreme tax rates of 0% and 100%, meaning that there is a tax rate between 0% and 100% that maximizes government tax revenue.

Nadarajan "Raj" Chetty is an Indian-American economist and the William A. Ackman Professor of Public Economics at Harvard University. Some of Chetty's recent papers have studied equality of opportunity in the United States and the long-term impact of teachers on students' performance. Offered tenure at the age of 28, Chetty became one of the youngest tenured faculty in the history of Harvard's economics department. He is a recipient of the John Bates Clark Medal and a 2012 MacArthur Fellow. Currently, he is also an advisory editor of the Journal of Public Economics. In 2020, he was awarded the Infosys Prize in Economics, the highest monetary award recognizing achievements in science and research, in India.

Stéfanie Stantcheva is a Bulgarian-born French economist who is the Nathaniel Ropes Professor of Political Economy at Harvard University. She is a member of the French Council of Economic Analysis. Her research focuses on public finance—in particular questions of optimal taxation. In 2018, she was selected by The Economist as one of the 8 best young economists of the decade. In 2020, she was awarded the Elaine Bennett Research Prize. In 2021, she received the Prix Maurice Allais.

Katherine Cuff is a Canadian economist who currently serves as Professor of Economics at McMaster University. She holds the Canada Research Chair in Public Economic Theory and has been recognized as a McMaster University Scholar. Cuff also serves as Managing Editor of the Canadian Journal of Economics and editor of the FinanzArchiv.

Henrik Jacobsen Kleven is a Danish economist who is currently a professor of economics and public affairs at Princeton University. He is also co-editor of the American Economic Review. His research lies inside the domain of public economics and inequality, in particular questions about tax policy and welfare programs. He combines economic theory and empirical evidence to show ways of designing more effective public policies. His work has had policy impact in both developed and developing countries.

Elizabeth Cascio is an applied economist and currently a Professor of Economics who holds the DeWalt H. 1921 and Marie H. Ankeny Professorship in Economic Policy at Dartmouth College. Her research interests are in labor economics and public economics, and focus on the economic impact of policies affecting education in the United States. She is also a research associate at the National Bureau of Economic Research, a research associate at the IZA Institute of Labor Economics, and Co-editor of the Journal of Human Resources.

Damon Jones is an American economist and associate professor at the Harris School of Public Policy in the University of Chicago. Alongside his academic research, Jones is a popular science communicator and regularly provides expert commentary on issues related to economics and public policy. During the COVID-19 pandemic he investigated the disproportionate impact of coronavirus disease on communities of color, and delivered evidence on his findings before the United States House Committee on the Budget.

References

- 1 2 3 4 5 "Bio - Frances Woolley". carleton.ca. Retrieved 2019-04-02.

- ↑ Woolley, Frances Ruth (1990). Economic models of family decision-making, with applications to intergenerational justice (PhD). London School of Economics and Political Science. Retrieved 5 May 2021.

- ↑ "Frances Woolley, Carleton University". Worthwhile Canadian Initiative. Retrieved 2019-04-02.

- ↑ "Frances Woolley, PhD". www.crrf-fcrr.ca. Retrieved 2019-04-02.

- ↑ "Frances Woolley (@franceswoolley) | Twitter". twitter.com. Retrieved 2019-04-02.

- 1 2 3 4 Woolley, Frances. Curriculum vitae. https://carleton.ca/fwoolley/wp-content/uploads/Woolley-CV-March-2019.pdf.

- ↑ "Frances Woolley - Google Scholar Citations". scholar.google.ca. Retrieved 2019-04-02.

- ↑ Chen, Zhiqi; Woolley, Frances (2001). "A Cournot-Nash Model of Family Decision Making". The Economic Journal. 111 (474): 722–748. doi: 10.1111/1468-0297.00657 . ISSN 0013-0133. JSTOR 798410.

- ↑ Woolley, Frances; Vermaeten, Arndt; Madill, Judith (1996). "Ending Universality: The Case of Child Benefits". Canadian Public Policy. 22 (1): 24–39. doi:10.2307/3551747. JSTOR 3551747.

- ↑ Vincent, Carole; Woolley, Frances (2000). Taxing Canadian families: what's fair, what's not. Choices / Institute for Research on Public Policy ; vol. 6, no. 5 ISSN 0711-0677. Institute for Research on Public Policy. Montreal: Institute for Research on Public Policy.