Related Research Articles

In finance, a bond is a type of security under which the issuer (debtor) owes the holder (creditor) a debt, and is obliged – depending on the terms – to provide cash flow to the creditor. The timing and the amount of cash flow provided varies, depending on the economic value that is emphasized upon, thus giving rise to different types of bonds. The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods. Thus, a bond is a form of loan or IOU. Bonds provide the borrower with external funds to finance long-term investments or, in the case of government bonds, to finance current expenditure.

A municipal bond, commonly known as a muni, is a bond issued by state or local governments, or entities they create such as authorities and special districts. In the United States, interest income received by holders of municipal bonds is often, but not always, exempt from federal and state income taxation. Typically, only investors in the highest tax brackets benefit from buying tax-exempt municipal bonds instead of taxable bonds. Taxable equivalent yield calculations are required to make fair comparisons between the two categories.

United States Treasury securities, also called Treasuries or Treasurys, are government debt instruments issued by the United States Department of the Treasury to finance government spending, in addition to taxation. Since 2012, the U.S. government debt has been managed by the Bureau of the Fiscal Service, succeeding the Bureau of the Public Debt.

Fixed income refers to any type of investment under which the borrower or issuer is obliged to make payments of a fixed amount on a fixed schedule. For example, the borrower may have to pay interest at a fixed rate once a year and repay the principal amount on maturity. Fixed-income securities can be contrasted with equity securities that create no obligation to pay dividends or any other form of income. Bonds carry a level of legal protections for investors that equity securities do not: in the event of a bankruptcy, bond holders would be repaid after liquidation of assets, whereas shareholders with stock often receive nothing.

In economics and accounting, the cost of capital is the cost of a company's funds, or from an investor's point of view is "the required rate of return on a portfolio company's existing securities". It is used to evaluate new projects of a company. It is the minimum return that investors expect for providing capital to the company, thus setting a benchmark that a new project has to meet.

A performance bond, also known as a contract bond, is a surety bond issued by an insurance company or a bank to guarantee satisfactory completion of a project by a contractor. The term is also used to denote a collateral deposit of good faith money, intended to secure a futures contract, commonly known as margin.

In finance, a surety, surety bond, or guaranty involves a promise by one party to assume responsibility for the debt obligation of a borrower if that borrower defaults. Usually, a surety bond or surety is a promise by a surety or guarantor to pay one party a certain amount if a second party fails to meet some obligation, such as fulfilling the terms of a contract. The surety bond protects the obligee against losses resulting from the principal's failure to meet the obligation. The person or company providing the promise is also known as a "surety" or as a "guarantor".

The bond market is a financial market in which participants can issue new debt, known as the primary market, or buy and sell debt securities, known as the secondary market. This is usually in the form of bonds, but it may include notes, bills, and so on for public and private expenditures. The bond market has largely been dominated by the United States, which accounts for about 39% of the market. As of 2021, the size of the bond market is estimated to be at $119 trillion worldwide and $46 trillion for the US market, according to the Securities Industry and Financial Markets Association (SIFMA).

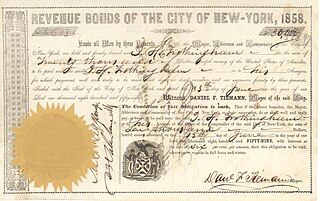

A revenue bond is a special type of municipal bond distinguished by its guarantee of repayment solely from revenues generated by a specified revenue-generating entity associated with the purpose of the bonds, rather than from a tax. Unlike general obligation bonds, only the revenues specified in the legal contract between the bond holder and bond issuer are required to be used for repayment of the principal and interest of the bonds; other revenues and the general credit of the issuing agency are not so encumbered. Because the pledge of security is not as great as that of general obligation bonds, revenue bonds may carry a slightly higher interest rate than G.O. bonds; however, they are usually considered the second-most secure type of municipal bonds.

The Bureau of the Public Debt was an agency within the Fiscal Service of the United States Department of the Treasury. United States Secretary of the Treasury Timothy Geithner issued a directive that the Bureau be combined with the Financial Management Service to form the Bureau of the Fiscal Service in 2012.

A bond fund or debt fund is a fund that invests in bonds, or other debt securities. Bond funds can be contrasted with stock funds and money funds. Bond funds typically pay periodic dividends that include interest payments on the fund's underlying securities plus periodic realized capital appreciation. Bond funds typically pay higher dividends than CDs and money market accounts. Most bond funds pay out dividends more frequently than individual bonds.

Credit enhancement is the improvement of the credit profile of a structured financial transaction or the methods used to improve the credit profiles of such products or transactions. It is a key part of the securitization transaction in structured finance, and is important for credit rating agencies when rating a securitization.

The 2007 Texas constitutional amendment election took place 6 November 2007.

Qualified Zone Academy Bonds (QZABs) are a U.S. government debt instrument created by Section 226 of the Taxpayer Relief Act of 1997. It was later revised and regulations may be found in Section 54(E) of the U.S. Code. The Tax Cuts and Jobs Act of 2017 eliminated QZABs as of January 30, 2018. QZABs allowed certain qualified public schools to borrow at nominal interest rates for public school renovation costs as well as for costs incurred in connection with the establishment of special programs in partnership with the private sector.

The Clean Water State Revolving Fund (CWSRF) is a self-perpetuating loan assistance authority for water quality improvement projects in the United States. The fund is administered by the Environmental Protection Agency and state agencies. The CWSRF, which replaced the Clean Water Act Construction Grants program, provides loans for the construction of municipal wastewater facilities and implementation of nonpoint source pollution control and estuary protection projects. Congress established the fund in the Water Quality Act of 1987. Since inception, cumulative assistance has surpassed 153.6 billion dollars as of 2021, and is continuing to grow through interest earnings, principal repayments, and leveraging.

PACE financing is a means used in the United States of America of financing energy efficiency upgrades, disaster resiliency improvements, water conservation measures, or renewable energy installations in existing or new construction of residential, commercial, and industrial property owners. Depending on state legislation, PACE financing can be used to finance water efficiency products, seismic retrofits, resiliency, and other measures with social benefits.

Securitization is the financial practice of pooling various types of contractual debt such as residential mortgages, commercial mortgages, auto loans or credit card debt obligations and selling their related cash flows to third party investors as securities, which may be described as bonds, pass-through securities, or collateralized debt obligations (CDOs). Investors are repaid from the principal and interest cash flows collected from the underlying debt and redistributed through the capital structure of the new financing. Securities backed by mortgage receivables are called mortgage-backed securities (MBS), while those backed by other types of receivables are asset-backed securities (ABS).

Non-profit housing developers build affordable housing for individuals under-served by the private market. The non-profit housing sector is composed of community development corporations (CDC) and national and regional non-profit housing organizations whose mission is to provide for the needy, the elderly, working households, and others that the private housing market does not adequately serve. Of the total 4.6 million units in the social housing sector, non-profit developers have produced approximately 1.547 million units, or roughly one-third of the total stock. Since non-profit developers seldom have the financial resources or access to capital that for-profit entities do, they often use multiple layers of financing, usually from a variety of sources for both development and operation of these affordable housing units.

Bonds issued by the government of Puerto Rico and its subdivisions are exempt from federal, state, and local taxes. However, unlike other triple tax exempt bonds, Puerto Rican bonds uphold such exemption regardless of where the bond holder resides. This has made Puerto Rican bonds extremely attractive to municipal investors as they may inure from holding a bond issued by a state or municipality different from the one where they reside. This advantage strives from the restriction typically imposed by municipal bonds enjoying triple tax exemption where such exemptions solely apply for bond holders that reside in the state or municipal subdivision that issues them.

A stable value fund is a type of investment available in 401(k) plans and other defined contribution plans as well as some 529 or tuition assistance plans. Stable value funds are often made available in these plans under a name that intends to describe the nature of the fund. They offer principal preservation, predictable returns, and a rate higher than similar options without proportionately increasing risk. The funds are structured in various ways, but in general they are composed of high quality, diversified fixed income portfolios that are protected against interest rate volatility by contracts from banks and insurance companies. For example, a stable value fund may hold highly rated government or corporate debt, asset-backed securities, residential and commercial mortgage-backed securities, and cash equivalents. Stable value funds are designed to preserve principal while providing steady, positive returns, and are considered one of the lowest risk investment options offered in 401(k) plans. Stable value funds have recently been returning an annualized average of 2.72% as of October 2014, higher than the 0.08% offered by money-market funds, and are offered in 165,000 retirement plans.

References

- 1 2 "Garvee Bond Guidance" (PDF). Federal Highway Administration. March 2004. Retrieved 2010-04-24.