GFMS (formally Gold Fields Mineral Services) [1] are research and consultancy company for the precious metal markets. Since 2011 they have been part of Thomson Reuters. As well as other commodities, they research gold, silver, platinum, palladium, and copper trading.

The consultancy’s core publication is the annual Gold Survey, which began in 1967. Consolidated Gold Fields, a mining conglomerate that was later taken over by Hanson plc in 1989, originally launched the Gold Survey. After the take over, a company was formed the same year to continue the survey. [2]

Between 1994 and 1998, the company was owned by Gold Fields of South Africa. [2] Between 1998 and 2003, the company was known as Gold Fields Mineral Services Limited. [3] In 1998, members of the research team completed a management buy out of GFMS from GFSA, and the consultancy gained full independence. In 2002, GFMS became an associate member of the London Bullion Market Association.[ citation needed ]

In August 2011, GFMS was purchased by Thomson Reuters. [2] [4] The execute chairperson Philip Klapwijk left the company.[ citation needed ]

GFMS analysts present at conferences and seminars on precious metals and commodities. They provide information to the news media.

Their reports include: [5]

In 2011, GFMS estimated 240 tonnes net sale of gold. [6] [7]

The company estimated that electronic waste recycling increase 14% between 2000 and 2014. [8] In 2016, they report a silver supply deficit. [9]

In March 2017, GFMS reported that India's gold imports had increased to 50 tonnes; 82% higher than 2016. [10]

Palladium is a chemical element; it has symbol Pd and atomic number 46. It is a rare and lustrous silvery-white metal discovered in 1802 by the English chemist William Hyde Wollaston. He named it after the asteroid Pallas, which was itself named after the epithet of the Greek goddess Athena, acquired by her when she slew Pallas. Palladium, platinum, rhodium, ruthenium, iridium and osmium form a group of elements referred to as the platinum group metals (PGMs). They have similar chemical properties, but palladium has the lowest melting point and is the least dense of them.

The Price Revolution, sometimes known as the Spanish Price Revolution, was a series of economic events that occurred between the second half of the 16th century and the first half of the 17th century, and most specifically linked to the high rate of inflation that occurred during this period across Western Europe. Prices rose on average roughly sixfold over 150 years. This level of inflation amounts to 1.2% per year compounded, a relatively low inflation rate for modern-day standards, but rather high given the monetary policy in place in the 16th century.

A commodity market is a market that trades in the primary economic sector rather than manufactured products, such as cocoa, fruit and sugar. Hard commodities are mined, such as gold and oil. Futures contracts are the oldest way of investing in commodities. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodity market for centuries for price risk management.

Precious metals are rare, naturally occurring metallic chemical elements of high economic value. Precious metals, particularly the noble metals, are more corrosion resistant and less chemically reactive than most elements. They are usually ductile and have a high lustre. Historically, precious metals were important as currency but are now regarded mainly as investment and industrial raw materials. Gold, silver, platinum, and palladium each have an ISO 4217 currency code.

Bullionism is an economic theory that defines wealth by the amount of precious metals owned. Bullionism is an early and perhaps more primitive form of mercantilism. It was derived, during the 16th century, from the observation that the Kingdom of England, because of its large trade surplus, possessed large amounts of gold and silver—bullion—despite the fact that there was not any mining of precious metals in England.

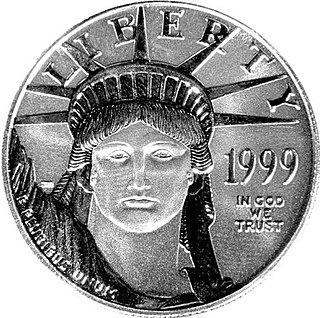

A bullion coin is a coin struck from highly refined precious metal (bullion) and kept as a store of value or an investment rather than used in day-to-day commerce. A bullion coin is distinguished by its weight and fineness on the coin. Unlike rounds, bullion coins are minted by government mints and have a legal tender face value. Bullion coins can have fineness ranging from 91.9% to 99.99% purity.

Of all the precious metals, gold is the most popular as an investment. Investors generally buy gold as a way of diversifying risk, especially through the use of futures contracts and derivatives. The gold market is subject to speculation and volatility as are other markets. Compared to other precious metals used for investment, gold has been the most effective safe haven across a number of countries.

Silver may be used as an investment like other precious metals. It has been regarded as a form of money and store of value for more than 4,000 years, although it lost its role as legal tender in developed countries when the use of the silver standard came to an end in 1935. Some countries mint bullion and collector coins, however, such as the American Silver Eagle with nominal face values. In 2009, the main demand for silver was for: industrial applications (40%), jewellery, bullion coins and exchange-traded products. In 2011, the global silver reserves amounted to 530,000 tonnes.

Electronic Broking Services (EBS) is a wholesale electronic trading platform used to trade on the foreign exchange market (FX) with market-making banks. It was originally created as a partnership by large banks and then became part of CME Group.

The London Bullion Market Association, established in 1987, is the international trade association representing the global Over The Counter (OTC) bullion market, and defines itself as "the global authority on precious metals". It has a membership of approximately 150 firms globally, including traders, refiners, producers, miners, fabricators, as well as those providing storage and secure carrier services.

The 2000s commodities boom or the commodities super cycle was the rise of many physical commodity prices during the early 21st century (2000–2014), following the Great Commodities Depression of the 1980s and 1990s. The boom was largely due to the rising demand from emerging markets such as the BRIC countries, particularly China during the period from 1992 to 2013, as well as the result of concerns over long-term supply availability. There was a sharp down-turn in prices during 2008 and early 2009 as a result of the credit crunch and European debt crisis, but prices began to rise as demand recovered from late 2009 to mid-2010.

Platinum as an investment is often compared in financial history to gold and silver, which were both known to be used as money in ancient civilizations. Experts posit that platinum is about 15–20 times scarcer than gold and approximately 60–100 times scarcer than silver, on the basis of annual mine production. Since 2014, platinum prices have fallen lower than gold. Approximately 75% of global platinum is mined in South Africa.

Philip Klapwijk is an economist in precious metals commodities markets.

MMTC Ltd. is one of the two highest earners of foreign exchange for India and India's largest public sector trading body. Not only handling the export and import of primary products such as coal, iron ore, agro and industrial products, MMTC also exports and imports important commodities such as ferrous and nonferrous metals for industry, and agricultural fertilizers. MMTC's diverse trade activities cover third country trade, joint ventures and link deals and all modern forms of international trading. The company has a vast international trade network, spanning almost in all countries in Asia, Europe, Africa, Oceania, and in the United States and also includes a wholly owned international subsidiary in Singapore, MTPL. It is one of the Miniratnas companies.

MKS (Switzerland) SA is a trader of precious metals. Based in Geneva, the group employs approximately 1,500 workers. MKS is an associate of the London Bullion Market Association (LBMA), and its subsidiary PAMP has been on the LBMA's Gold List, widely recognised in the financial services industry as the indicator of quality, since 1987.

The London bullion market is a wholesale over-the-counter market for the trading of gold, silver, platinum and palladium. Trading is conducted amongst members of the London Bullion Market Association (LBMA), tightly overseen by the Bank of England. Most of the members are major international banks or bullion dealers and refiners.

A gold IRA or precious metals IRA is an Individual Retirement Account in which physical gold or other approved precious metals are held in custody for the benefit of the IRA account owner. It functions the same as a regular IRA, only instead of holding paper assets, it holds physical bullion coins or bars. Precious metals IRAs are usually self-directed IRAs, a type of IRA where the custodian allows more diverse investments to be held in the account.

PAMP SA is an independent precious metals refining and fabricating company, and a member of the MKS Group. Established in 1977 in Ticino, Switzerland, the company originally started as a minting facility for bars weighing less than 100 grams and as an alloy specialist for the jewelry and luxury watch-making industries. It has since expanded to provide a full range of services, from collecting doré from mines to assaying, hedging, and delivering its bars and other products. PAMP produces bullion bars ranging from 1 gram to 12.5 kilograms.

The Great Bullion Famine was a shortage of precious metals that struck Europe in the 15th century, with the worst years of the famine lasting from 1457 to 1464. During the Middle Ages, gold and silver coins saw widespread use as currency in Europe, and facilitated trade with the Middle East and Asia; the shortage of these metals therefore became a problem for European economies. The main cause for the bullion famine was outflow of silver to the East unequaled by European mining output, although 15th century contemporaries believed the bullion famine to be caused by hoarding.

Valcambi is a precious metals refining company located in Balerna, Switzerland, and a subsidiary of Rajesh Exports Limited. Valcambi is owned by European Gold Refineries, which is owned by Global Gold Refineries AG, which in turn is 95% owned by REL Singapore PTE Ltd. and 5% by Rajesh Exports Limited India. Valcambi is thus 100% controlled by Rajesh Exports, the parent company of REL Singapore.

{{cite web}}: CS1 maint: bot: original URL status unknown (link)